Your Guide to Car Rental Insurance Options

- fantasma70

- Oct 24, 2025

- 17 min read

Standing at the rental car counter can feel like a pop quiz you didn't study for. The agent rattles off a confusing menu of car rental insurance options, and you have just a few seconds to make a choice. What they're really offering is different layers of protection—for the car, for other people, for yourself, and for your stuff.

The secret? You might already have some of this coverage and not even know it.

Your Guide to Navigating Rental Car Protection

Think of the insurance options at the counter like a protection buffet. You don’t need to pile your plate with everything. You just need to grab what fills the gaps in your existing coverage. The goal is simple: drive off the lot feeling protected, without paying for expensive policies you don't actually need.

Feeling pressured into buying extra insurance is a classic travel headache. But a little knowledge turns that anxiety into confidence. This is a big business, after all. The global car rental insurance industry was valued at around $17.5 billion in 2023 and is projected to hit $30.2 billion by 2032. Why the boom? More people are traveling, and it's easier than ever to book rentals and add coverage online. You can see more details on the growth of the car rental insurance market at dataintelo.com.

Understanding the Main Players

Before we get into the nitty-gritty, let's break down the alphabet soup of acronyms you'll see on that rental agreement. Each one is a different piece of the protection puzzle. Knowing what they mean is the first step to making a smart call at the counter.

CDW/LDW (Collision Damage Waiver/Loss Damage Waiver): This is for the rental car itself. It covers everything from a parking lot ding to the car being stolen.

SLI (Supplemental Liability Insurance): This kicks in if you cause an accident that damages someone else's car or, worse, injures them. It handles their bills, not yours.

PAI (Personal Accident Insurance): This covers medical bills for you and your passengers if you get hurt in an accident.

PEC (Personal Effects Coverage): This helps if someone breaks into the rental and steals your personal belongings, like a laptop or luggage.

The single most important thing you can do is actually read the rental agreement. Buried in the fine print, it will spell out exactly what's covered and what isn't. If anything is unclear, make the agent explain it to you in simple terms.

This basic knowledge is your best friend, whether you're grabbing a little sedan for a city trip or need a big SUV for a family adventure. Of course, your needs might change depending on the vehicle. It's always a good idea to match your insurance to the car, and you can explore the different car types available for rent to find the right fit.

To make it even simpler, here’s a quick rundown of the main insurance types you'll be offered.

Quick Overview of Common Car Rental Insurance Options

Insurance Type (Acronym) | Primary Coverage | What It Protects You From |

|---|---|---|

Collision Damage Waiver (CDW/LDW) | The rental car itself. | Costs from damage, vandalism, or theft of the vehicle you are renting. |

Supplemental Liability Insurance (SLI) | Other people and their property. | Lawsuits and bills if you cause an accident that damages another car or injures someone. |

Personal Accident Insurance (PAI) | You and your passengers. | Medical expenses for injuries sustained by you or anyone in your rental car. |

Personal Effects Coverage (PEC) | Your belongings inside the car. | The cost of replacing personal items that are stolen from the rental vehicle. |

Looking at this table, you might notice that some of these coverages sound familiar. That's because they often overlap with insurance you already have, which is exactly what we'll explore next.

Breaking Down the Main Types of Rental Coverage

Standing at the rental counter can feel like a pop quiz you didn't study for. The agent starts throwing around acronyms—LDW, SLI, PAI—and suddenly you’re nodding along, not entirely sure what you’re agreeing to. Don't worry, it's simpler than it sounds.

These are just different layers of protection, each designed to cover a specific risk. Getting a handle on what they do is the first step to driving off the lot with confidence. Let's break down the four main types you’ll almost always be offered.

The Collision Damage Waiver (CDW/LDW)

Think of the Collision Damage Waiver (CDW), or Loss Damage Waiver (LDW), as your financial shield for the rental car itself. It’s not technically insurance but rather an agreement from the rental company to waive their right to come after you for the cost of damage or theft.

So, if you scrape a pole in a parking garage or, worse, the car gets stolen, the CDW means you can walk away without a massive bill. Without it, you could be on the hook for everything from minor repairs to the car's entire value. It’s easily the most critical piece of the rental protection puzzle.

The CDW is all about protecting the rental company’s asset—the car you’re driving. From a small dent to a total wreck, this waiver is what stands between you and a bill for thousands of dollars.

But it’s not a get-out-of-jail-free card. You need to know what a CDW doesn't cover. Common exclusions include:

Tires and Windshields: Damage to glass and rubber often isn't part of the deal.

The Undercarriage: Hit a nasty pothole or take the car down a gravel road? Damage to the underbody is likely on you.

Reckless Driving: If an accident happens while you’re speeding or driving under the influence, the waiver is off the table.

Supplemental Liability Insurance (SLI)

While the CDW takes care of the rental car, Supplemental Liability Insurance (SLI) takes care of everyone else. This is your "I'm sorry" fund if you cause an accident that damages another person's car or injures them.

Let’s say you rear-end someone at a traffic light. SLI is what pays for the other driver's car repairs and medical bills. By law, rental agencies must provide some liability coverage, but the state-minimum limits are often shockingly low—sometimes just $10,000 to $20,000. That amount can disappear in a flash after a serious accident.

SLI dramatically boosts that protection, usually up to $1 million or more. It provides a vital safety net against lawsuits that could otherwise be financially devastating. To make an informed choice, it's worth understanding exactly what liability insurance covers, as it protects your personal assets from third-party claims.

Personal Accident Insurance (PAI)

With the car and other people covered, it's time to think about yourself and your passengers. Personal Accident Insurance (PAI) is basically medical coverage for anyone inside your rental car who gets hurt in a crash.

It helps pay for things like ambulance rides and medical care, no matter who was at fault for the accident. In a worst-case scenario, it also includes an accidental death benefit.

For many people, however, PAI is redundant. If you already have good health insurance or Personal Injury Protection (PIP) through your own auto policy, you're likely already covered for these kinds of injuries. A quick check of your existing policies before you travel can help you confidently say "no, thanks" to this one.

Personal Effects Coverage (PEC)

Finally, what about your stuff? Personal Effects Coverage (PEC) is all about protecting your belongings inside the rental car. Think of it as insurance for your luggage, laptop, camera, and anything else you’re traveling with.

If someone smashes a window and steals your bags, PEC is designed to reimburse you for that loss. It's often sold in a bundle with PAI and typically has a coverage limit, like $500 per person with a total cap around $1,500.

Just like PAI, you might already have this coverage from another source. Most homeowners or renters insurance policies include "off-premises" protection, meaning your stuff is insured even when it’s not at home. If that’s you, paying extra for PEC is probably a waste of money. A quick call to your insurance agent can confirm it.

Uncovering Your Existing Rental Car Coverage

Before you even think about the policies offered at the rental counter, you need to do a little homework. You might already be covered and not even know it.

Many of us have hidden rental car insurance tucked away in our personal auto policies, credit card benefits, or even travel insurance plans. A few minutes of checking can easily save you a hundred dollars or more by helping you avoid paying for coverage you don't need.

Your Personal Auto Insurance Policy

If you own a car, your first stop should be your own insurance policy. Most standard auto policies extend their coverage to rental cars, especially if you have collision and comprehensive coverage for your daily driver.

It’s not a given, though. Coverage details can get tricky and often vary between states and insurance companies. Before you assume you're covered, it's smart to:

Give your agent a quick call and ask if your policy covers rental vehicles.

Get clear on your deductible. Does it apply to the rental, too?

Ask about the sneaky fees, like "loss of use" or administrative charges, which rental companies love to tack on. Are those covered?

Your Credit Card’s Hidden Perks

That piece of plastic in your wallet might be your best friend at the rental counter. Many credit cards, especially travel-focused ones, offer rental car insurance as a built-in benefit. The catch? You usually have to pay for the entire rental with that specific card.

The most important thing to figure out is whether the coverage is primary or secondary. This distinction is a game-changer.

Primary coverage is the gold standard. It kicks in first, meaning you won’t have to involve your personal auto insurance at all. No claim, no deductible, no potential rate hike.

Secondary coverage, on the other hand, only pays out after your personal auto insurance has paid its share. You'd still be on the hook for your personal deductible and have to file a claim.

To make sure you use this benefit correctly:

Charge the full rental cost to the card offering the benefit.

You must decline the rental company’s Collision Damage Waiver (CDW/LDW). Accepting it usually voids the card's coverage.

Confirm which types of vehicles and how many rental days are covered. Exotic cars and long-term rentals are often excluded.

Travel Insurance Add-Ons

If you bought a travel insurance plan for your trip, check the fine print. Some policies bundle in rental car protection, while others offer it as an optional add-on for a small fee.

This coverage typically works on a reimbursement basis, meaning you’ll have to pay the rental company for any damages out of pocket and then file a claim with the travel insurer to get your money back.

Find out if rental protection is part of your base plan or a separate purchase.

Read the coverage limits and exclusions carefully.

Pay attention to any geographical restrictions—your policy might not cover you in certain countries.

Knowing these details ahead of time turns a stressful counter experience into a confident, informed decision. It's a massive market, with North America leading the way due to high demand from travelers and fierce competition between giants like Enterprise, Hertz, and Avis. You can Discover insights on Business Research Insights to see just how big the industry is.

Comparing Your Existing Insurance Sources

It can be a lot to keep track of, so here's a simple table to help you compare your options at a glance.

Coverage Source | Typical Coverage Provided | Key Considerations | Action Step |

|---|---|---|---|

Personal Auto Policy | Extends your existing liability and collision/comprehensive limits to the rental. | Your regular deductible applies. A claim could raise your personal insurance rates. | Call your insurance agent to confirm the specifics of your policy. |

Credit Card Benefits | Covers damage and theft. Can be primary (best) or secondary. | You must decline the rental company's CDW/LDW and pay with the card. Exclusions apply. | Read your card's guide to benefits or call the number on the back to verify. |

Travel Insurance | Often provides reimbursement for damage or theft up to a set limit. | Typically secondary coverage. You'll have to pay upfront and file a claim later. | Review your policy documents to understand the limits and claim process. |

Seeing it all laid out like this makes it easier to spot where your coverage is strong and where you might have gaps.

A Quick Real-World Example

Let's look at Sarah. She was heading out on a week-long road trip in an SUV. Before she left, she called her auto insurance agent and confirmed her policy's collision coverage fully extended to rentals. Feeling confident, she politely declined all the insurance options at the counter.

Halfway through her trip, a surprise hailstorm left the SUV with dozens of small dents. Because she'd done her homework, her personal insurance handled the entire repair claim. She just had to pay her regular deductible and didn't spend a dime on the rental company's expensive waiver.

Putting It All Together: Your Next Steps

Okay, you've reviewed your policies. Now what?

The goal is to identify any gaps in your existing coverage. You only want to buy insurance at the counter to fill those specific holes, not to pay for double coverage.

Liability Gap? If your personal policy has low liability limits or you don't own a car, buying the rental agency's Supplemental Liability Insurance (SLI) is a smart move.

Renting Abroad? Double-check that your credit card's benefits work in your destination country. Many cards exclude coverage in places like Ireland, Israel, or Jamaica.

No Collision Coverage? If your personal policy is liability-only or your credit card offers no protection, compare the cost of the rental company’s LDW to a standalone third-party insurance policy.

This targeted approach ensures you’re not just throwing money away on a bundle of policies you don't even need.

The Bottom Line

Taking 15 minutes to audit your existing coverage is one of the smartest things you can do before renting a car. It puts you in the driver's seat, both literally and financially.

By understanding what your auto policy, credit cards, and travel insurance already provide, you can confidently decline the upsell and walk away knowing you’re protected without overpaying. It’s a simple step that can save you a surprising amount of money and stress.

Navigating International Rental Insurance Rules

Renting a car in your home country can be a bit of a headache, but once you start planning a drive overseas, things get a whole lot more complicated. The insurance rules you're used to simply don't apply. That safety net you rely on at home? It pretty much vanishes the second you land in a foreign country.

The biggest mistake I see travelers make is assuming their personal U.S. auto insurance will cover them abroad. I can tell you from experience, it almost never does. Your policy is designed for the laws and regulations in the United States and Canada, leaving you high and dry in Europe, Asia, or anywhere else.

The same goes for most credit card rental insurance benefits. While they can be a lifesaver for domestic trips, their coverage often gets shaky—or disappears entirely—once you’re overseas. You absolutely have to read the fine print before you go.

Common International Exclusions and Requirements

Many of the best travel credit cards, the ones that offer primary rental coverage, have a specific list of countries they won’t cover. Dig into your card’s benefits guide, and you’ll likely find a list that includes places like Ireland, Israel, Jamaica, Italy, Australia, and New Zealand.

If you're heading to any of those spots, your credit card insurance is off the table. You'll need to figure out another plan.

Beyond country exclusions, you'll also run into mandatory insurance. In most countries, you’re legally required to have Third-Party Liability coverage. The good news is this is usually baked into your rental price. It covers damage you do to other people or their property, but it does absolutely nothing for the rental car itself. That’s where the Collision Damage Waiver (CDW) comes in.

Here's the catch with international rentals: the standard CDW often comes with an enormous deductible, sometimes thousands of dollars. The rental company will then offer you a "Super CDW" or "Excess Waiver" for an extra daily fee to knock that deductible down to zero.

Preparing for Your International Driving Adventure

A little prep work goes a long way in making sure your international rental is a smooth ride. This is a big business—the global rental car insurance market was valued at around $10.59 billion in 2025 and is expected to climb to $13.77 billion by 2029. That growth tells you just how essential and complex these products are for travelers. You can discover more insights about the rental car insurance market on researchandmarkets.com.

Before you even book a car, do some digging. A quick search for your destination’s driving insurance laws can save you a world of trouble at the rental counter. Knowing the local rules helps you confidently decide which options to accept or decline. Checking the requirements for different international car rental locations ahead of time will also give you a much better idea of what to expect.

Here’s a simple checklist to run through before you travel:

Call Your Credit Card Company: Don't just read the website. Call and ask point-blank if you're covered in your destination country. If you can, get it in writing or an email.

Research Local Laws: Find out if third-party liability is required and if it's already included in the rental price.

Ask About the Deductible: At the rental counter, have the agent show you exactly what the deductible (they might call it "excess") is on the standard CDW.

Document Everything: Before you leave the lot, take a slow walk-around video and plenty of photos of the car, paying close attention to any existing scratches or dings.

Having to handle a claim in a foreign country means dealing with different laws, language barriers, and currency conversions. Being properly insured from the start means a small fender-bender stays a small problem, instead of turning into a trip-ruining financial mess.

How to Choose the Right Coverage for Your Trip

Figuring out which car rental insurance to get can feel like a pop quiz at the rental counter. But it doesn't have to be so complicated. The trick is to match your coverage to your trip, making sure you’re protected without overpaying for policies you don't need.

Think of it like packing a suitcase. You wouldn't bring a parka to the Bahamas. In the same way, the insurance you need for a quick errand across town is completely different from what you'd want for a two-week road trip through the Alps. Let’s look at a few common scenarios to see how this works in the real world.

The Weekend Local Renter

Renting a car for a few days in your own city? If you already own and insure a car, you're probably in good shape. Your personal auto policy is your first line of defense, as most policies extend your existing collision and liability coverage to rental cars (for personal use, that is).

Here’s your game plan:

Confirm Your Coverage: Before you even book the rental, give your insurance agent a quick call. Ask them point-blank: "Does my policy cover rentals? What's my deductible? Does it cover 'loss of use' fees?"

Check Your Credit Card: Next, look at the credit card you plan to use. Many offer rental car insurance as a perk. A card with primary coverage is the gold standard because it steps in first, meaning you won't have to file a claim on your personal policy.

At the Counter: Armed with this info, you can confidently and politely decline the rental company's expensive waivers.

The Business Traveler

When you’re renting a car for work, the rules change. Your first move should always be to check with your employer. Many companies have a corporate insurance policy that covers employees for business-related travel. Don't just assume you're covered—ask your HR department or travel manager for the details.

If your company doesn't have a specific policy, the responsibility lands back on you. Your personal auto insurance probably won't cover you, since it's typically for personal use only. A corporate credit card might be your best bet, but again, you have to verify what it actually covers.

The International Vacationer

Taking your driving skills abroad adds a whole new layer of complexity. Your U.S. auto policy is almost certainly useless overseas, and many U.S. credit cards have coverage exclusions for certain countries like Ireland, Italy, or Jamaica. For international trips, a little homework is absolutely essential.

On international trips, the rental price often includes mandatory Third-Party Liability insurance, as required by local law. But heads up—this only covers damage you cause to other people or their property. It does nothing for the rental car itself. You'll almost always need to buy a Collision Damage Waiver (CDW) at the counter.

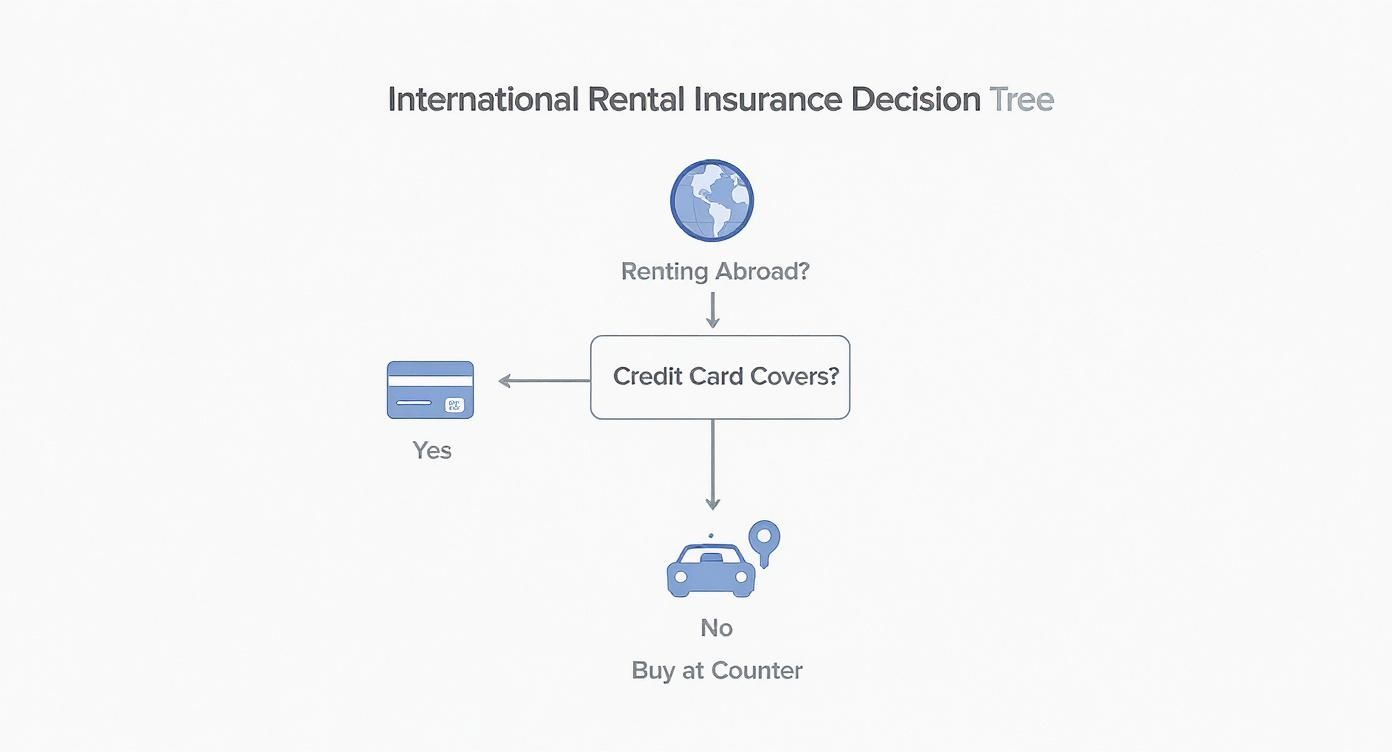

This decision tree gives you a simplified path for figuring out insurance when renting in another country.

The bottom line? You have to proactively confirm what your credit card covers before you leave home. If you can't get a clear "yes," the safest and simplest option is to buy the insurance directly from the rental agency when you arrive.

The Driver Without a Car

If you don't own a car, you don't have a personal auto policy to lean on. This makes you the most exposed type of renter, so you need a solid plan to build coverage from the ground up. Simply declining everything at the counter is a huge financial gamble.

For you, bundling a couple of car rental insurance options from the agency is usually the smartest move.

Supplemental Liability Insurance (SLI): This is non-negotiable. It protects you from the massive, potentially life-altering costs if you injure someone or damage their property.

Loss Damage Waiver (LDW): This takes care of the rental car itself. Without it, you’re on the hook for the car's full value if it gets stolen or damaged.

Credit Card Coverage: Have a credit card with primary rental insurance? This can be a fantastic alternative to the agency's LDW and can save you a good chunk of change.

By figuring out which of these traveler profiles you fit into, you can walk up to the rental counter with a clear plan. It turns a high-pressure sales pitch into a simple checklist, helping you find a great deal on a rental car without paying for coverage you already have.

Common Questions About Car Rental Insurance

Even after you've got the basics down, a few questions always seem to pop up. The world of rental agreements can feel like a maze of "what-ifs" and tricky scenarios. Let's clear the air and tackle some of the most common things people ask.

Getting straight answers to these practical concerns means you can walk up to that rental counter with confidence, knowing exactly what you need and why.

What Happens If I Decline All Insurance and Have an Accident?

This is a huge financial gamble. If you turn down all coverage and don't have a personal auto policy or credit card that steps in, you are on the hook for every single dollar of damage.

And it’s not just the repair bill. The rental company will also hit you with charges for:

Loss of Use: The money they lose every day the car is in the shop and can't be rented out.

Administrative Fees: Their cost for the time and paperwork to manage the whole claim process.

Diminished Value: The drop in the car's resale value now that it has an accident on its record.

These extras can easily tack on thousands of dollars to the final bill, turning a simple fender-bender into a serious financial problem. It's a risk you really don't want to take.

Is Insurance from Third-Party Sites a Good Deal?

You've probably seen those cheap insurance add-ons when booking on a travel site. They often look like a bargain compared to the prices at the rental counter, but you have to know what you're buying. This kind of insurance works on a reimbursement model.

What does that mean? If you have an accident, you have to pay the rental company for all damages out of your own pocket first. Then, you submit a mountain of paperwork to the third-party company and wait for them to pay you back.

While you might save some money upfront, you need to be ready to float a potentially large sum of cash and deal with the claims process. Always read the fine print for coverage limits before you click "buy."

Does the Collision Damage Waiver Have a Deductible?

This is a great question, and the answer completely depends on where you're renting the car.

Here in the United States and Canada, the Collision Damage Waiver (CDW) or Loss Damage Waiver (LDW) you get from the major rental companies almost always has no deductible. If something happens, you can hand back the keys and walk away without paying a dime for covered damages.

But internationally? It's a different story. In Europe, Australia, and most other places, the standard CDW that comes with the rental has a massive deductible (they often call it "excess"). This can be anywhere from $1,000 to over $3,000. To get that amount down to zero, you have to buy a second, more expensive policy called a "Super CDW" or "Excess Waiver."

Should I Take Photos of the Rental Car Before Driving?

Yes. One hundred percent, yes. It’s the easiest and best thing you can do to protect yourself. Before you even get in the car, do a slow walk-around and document every little thing with your phone.

Take Detailed Photos: Get close-ups of every scratch, dent, or scuff you can find. No ding is too small.

Record a Video: A slow, continuous video of the car's exterior and interior is even better.

Don't Forget the Inside: Look for any tears in the seats, stains, or damage to the dashboard.

Check the Glass and Tires: Note any chips in the windshield or scuffs on the wheels.

This gives you timestamped proof of the car’s condition when you picked it up. That way, they can't blame you for pre-existing damage when you bring it back. It’s a five-minute habit that can save you from a huge headache and a bogus charge. When making decisions about car rental insurance, it's also wise to be informed about your rights as a policyholder by learning about understanding bad faith insurance, to ensure fair treatment in case of a claim.

Ready to hit the road in Miami with confidence? At Cars4Go Rent A Car, we believe in transparent pricing and clear communication—no hidden fees, no high-pressure tactics. Book your next rental with us and enjoy the peace of mind that comes with a company that puts you first. https://www.cars4go.com

Comments