Navigate a rental car after car accident: Quick Guide to Insurance and a Loaner

- fantasma70

- Dec 24, 2025

- 13 min read

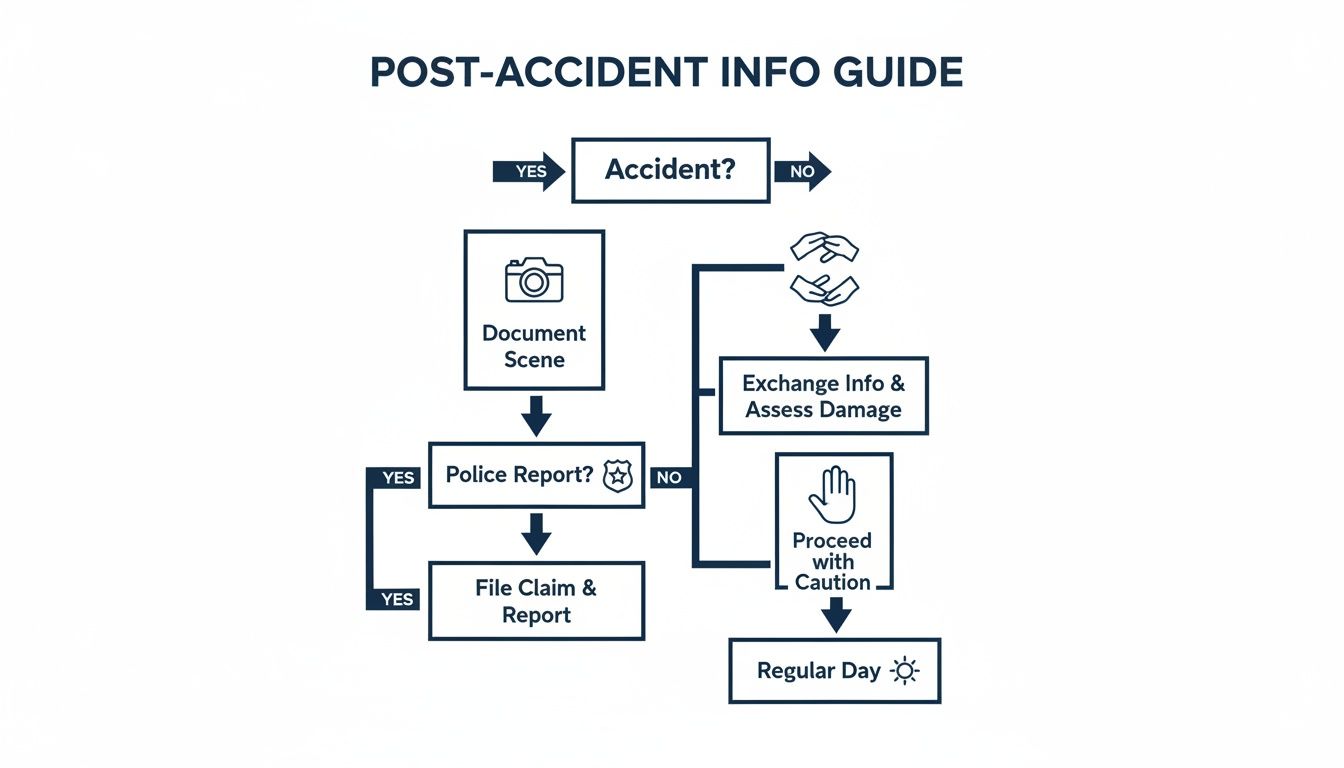

The moments right after a crash are a blur of adrenaline and confusion. But what you do on the scene has a direct impact on how smoothly—and quickly—you can get into a rental car after car accident. The goal is to gather solid, undeniable proof that will cut through the red tape and get your insurance claim moving.

What to Do Immediately After the Accident

It's easy to feel overwhelmed after a collision, but keeping a clear head is your biggest advantage. The information you collect right then and there isn't just for the overall insurance claim; it's the very foundation for getting your rental car approved without a hitch.

Miss a few key details, and your request could be stuck in administrative limbo for days.

First things first: safety. Make sure everyone is safe and has the medical attention they need. Once that's handled, your job shifts to documentation. This is where tiny mistakes can cause huge delays down the road.

Gather Essential Information

You need to think like an investigator building a case. Your insurance adjuster needs a complete, clear picture to authorize a rental car, whether it’s coming from your policy or the other driver’s.

Here’s the absolute must-have list of what to collect at the scene:

Other Driver's Details: Get their full name, address, and phone number. Crucially, you need their insurance company name and policy number. Don't just glance at their insurance card—snap a clear, readable photo of it.

Police Report Number: If the police are on the scene, make sure to get the officer's name, badge number, and the official report number. This report is often the single most important piece of evidence insurers use to assign fault and approve rental coverage.

Witness Contacts: Did anyone see what happened? Get their name and phone number. An unbiased account from a third party can be a game-changer if the other driver's story starts to change.

Following the right steps after a crash is vital for more than just getting a rental. For a more comprehensive checklist, this guide on what to do immediately after a car accident is a great resource.

Document the Scene with Photos

Your smartphone is your best friend in this situation. A picture really is worth a thousand words, and photos provide visual proof that can't be argued with.

My advice? Take way more pictures than you think you need. Get shots from every angle, showing where the cars ended up, nearby traffic signs, and even the weather or road conditions. This context helps the adjuster piece together exactly what happened.

Be sure to get detailed photos of the damage to both cars—wide shots to show the overall impact and close-ups of specific dents and scratches. A clear picture of the other driver's license plate is non-negotiable. This simple act of documenting everything is your best defense against delays, paving a much smoother path to getting the keys to your rental.

Making Sense of Your Insurance Coverage

After a crash, one of the biggest headaches is figuring out who's going to foot the bill for your rental car. It can feel like you need a law degree to understand your insurance policy, but a few key concepts can make all the difference.

Ultimately, who pays for the rental almost always comes down to one question: who was at fault? The answer determines whether you’ll be dealing with your insurance company or the other driver's.

The very first things you do at the accident scene can make this process much smoother. Having the right photos, notes, and a police report is the foundation for a hassle-free claim.

As you can see, getting the facts straight from the very beginning is crucial. This initial legwork directly impacts how quickly you can get your claim approved and get the keys to a rental.

When the Other Driver Is at Fault

If the accident wasn't your fault, the other driver's insurance company is on the hook for your rental. This is paid out under their property damage liability coverage, and you'll often hear adjusters call it a loss of use claim.

You're entitled to a "comparable" vehicle. So, if your family SUV is in the shop, don't let them push you into a tiny two-door compact. You have the right to a similar rental.

There can be a small snag, though. Some insurers will ask you to pay for the rental upfront and then submit the receipts for reimbursement. It's a frustrating but common practice. This is why you need to get on the phone with their adjuster right away to clarify the process.

When You Are at Fault or Fault Is Unclear

What happens if you caused the wreck or if both parties are pointing fingers? This is where your own insurance policy steps in. If you have rental reimbursement coverage, you’re in luck.

This is an optional add-on, so the first thing you need to do is pull up your policy and check. It will have two key numbers you need to know:

A daily limit, like $40 per day.

A total limit, such as $1,200 per accident.

If you rent a car that costs more than your daily limit, you’ll have to pay the difference yourself. It's a small detail that can add up quickly, so always confirm your limits before you book.

Pro Tip: Always ask the adjuster for your claim number and if they can set up direct billing with a rental company. This saves you from paying out-of-pocket and waiting for a check that feels like it’s never going to arrive.

This process is influenced by a massive global industry. The car rental market pulled in about $133 billion in 2023, with its insurance counterpart valued at $17.5 billion. Because of this, most major insurers have partnerships with rental agencies to make direct billing easier. You can learn more about these car rental statistics and market trends to see just how big the industry is.

To make things even clearer, here's a quick breakdown of the most common scenarios you might find yourself in.

Who Pays for the Rental Car: Your Insurance Coverage Scenarios

Scenario | Who Is at Fault | Which Insurance Policy Pays | Key Considerations |

|---|---|---|---|

Clear Fault | The other driver | The at-fault driver's property damage liability insurance | You're entitled to a "comparable" vehicle. You might have to pay upfront and wait for reimbursement. |

You Are At Fault | You | Your own policy, if you have rental reimbursement coverage | You're limited by your policy's daily and total caps (e.g., $40/day, $1,200 total). |

Fault Is Disputed | Unclear / under investigation | Your own policy (via rental reimbursement) is the fastest option | If the other driver is later found at fault, your insurer may seek reimbursement from their company. |

Hit-and-Run | The other driver (unidentified) | Your own policy, either under rental reimbursement or Uninsured Motorist Property Damage (UMPD) coverage, depending on your state and policy. | Filing a police report immediately is critical for using UMPD coverage. |

Comprehensive Claim | Not applicable (e.g., theft, fire, vandalism) | Your own policy, if you have rental reimbursement as part of your comprehensive coverage | Coverage typically starts 24-48 hours after the incident is reported, not immediately. |

This table should help you quickly pinpoint your situation and understand who to call first. Knowing where you stand is the first step toward getting back on the road without any surprise bills.

How Long You Can Keep the Rental Car

One of the biggest questions I hear from drivers after a wreck is, "What if my rental coverage runs out before my car is fixed?" It’s a totally valid concern. You might see a 30-day limit on your policy, but that doesn't mean you automatically get a rental for a month.

In reality, the rental period your insurer approves is tied directly to the estimated time it takes to repair your vehicle. They don’t just pull a number out of thin air. Insurance companies use standard labor time guides to figure out what a "reasonable" repair window looks like.

So, if the body shop tells them it’s 40 hours of labor, the insurer might approve a rental for just five to seven days, accounting for a weekend. This is where things can get tricky, and good communication becomes your best friend.

Keeping Your Repair Shop and Adjuster in Sync

Think of yourself as the project manager for your car's repair. You need to stay in constant communication with both the body shop and your insurance adjuster, because I can promise you, they aren't talking to each other every day. You're the one who makes sure everyone is on the same page.

A classic snag is a parts delay. Let's say your car needs a specific bumper that’s on backorder for two weeks. That initial five-day rental approval is now completely out the window. The second you hear about a delay from the shop, your very next call should be to your adjuster.

Give them the specifics. Don’t just say "it's delayed." Tell them:

Exactly what part is delayed (e.g., "the driver-side quarter panel").

The reason for the delay (e.g., "it's on a national backorder from the manufacturer").

The new estimated arrival date the shop gave you.

When you're proactive like this, it shows the insurer that the delay is legitimate and out of your hands. This makes it far more likely they’ll approve a rental extension without a fight. The worst thing you can do is wait until the day your rental is due back to sound the alarm.

Recent industry data from early 2025 showed the average Length of Rental (LOR) after an accident was 16.7 days. If the vehicle couldn't be driven, that number shot up to 22.8 days. For a moderate collision, you should probably plan on being in a rental for at least two to three weeks.

What Happens When Your Car Is a Total Loss?

The game changes completely if your car is declared a total loss. In this situation, your rental coverage doesn't last until you find and buy a new car. Instead, the coverage usually ends just a few days after the insurance company makes you a settlement offer.

The clock starts ticking the moment they present you with the settlement value. Insurers usually give you about three to five days to return the rental, which can create a serious time crunch.

This short window is really just designed to give you enough time to accept their offer and handle the title transfer. It's critical to move quickly. If you know you'll need more time to shop for a new vehicle, ask your adjuster about your options, but be prepared to start paying for the rental yourself if you go past their cutoff date.

To soften the blow, it’s a good idea to check out current rental car deals ahead of time to find a budget-friendly option for that transition period.

Choosing Your Vehicle and Avoiding Hidden Fees

That moment you finally get the keys to a rental is a huge relief after a crash. But be careful—the rental counter is exactly where that relief can turn into frustration if you're not prepared for unexpected costs and misunderstandings.

First thing to get straight is the "comparable vehicle" rule. The insurance company—yours or the other driver's—is only required to pay for a rental that's similar to your damaged car. Got a compact sedan? They’re going to approve another compact sedan.

If you decide you want to upgrade to a big SUV for the week, that extra cost is on you. Always, always confirm the approved vehicle class with your adjuster before you sign anything. This one step can save you from a nasty surprise bill later on. You can get a feel for what’s considered a comparable match by exploring different rental car types and classes.

Watch Out for Uncovered Extras

Rental agents are pros at upselling you on optional add-ons. While some might sound tempting, your insurance almost certainly won't cover them. Just be ready to politely say "no, thanks."

Here are the most common ones to watch out for:

Supplemental Damage Waivers: Your own auto insurance policy usually covers you in a rental, making this extra coverage redundant. It’s worth a quick call to your agent to be sure, but this is typically an unnecessary expense.

Prepaid Fuel Options: This is rarely a good deal. They charge a premium for the convenience of returning the car with an empty tank. You’ll save money every time by just filling it up yourself before you drop it off.

GPS and Toll Passes: Insurers see these as luxury items, not necessities, so they won't foot the bill. Your smartphone's navigation app works just as well and costs nothing.

Timing is also a factor. Rental demand spikes during holidays and certain seasons, which can affect availability and pricing. One study found that over 1 in 10 renters had their reservations canceled during the holidays, with daily rental budgets averaging around $86. Booking as soon as you get approval is a smart move.

Your Pre-Rental Inspection Checklist

Before you even think about driving off the lot, take five minutes to do a thorough walk-around. This is non-negotiable and protects you from being on the hook for damage you didn't cause.

The best thing you can do is pull out your smartphone and take a slow, detailed video of the entire car. Walk around the outside, zooming in on every single scratch, dent, and scuff. Do the same for the interior, noting any stains or tears. Narrating what you see adds another layer of proof.

Don’t forget to check the inside. Make sure the mileage and fuel level on the dashboard match what’s printed on your rental agreement. This quick check is your best defense against getting hit with unfair damage claims when you return the car.

How Specialized Services Make Getting a Rental Car a Breeze

Let's be honest. After a car crash, you're already juggling adjusters, repair shops, and just trying to get through your day. The last thing you want to deal with is a complicated process for picking up a rental car. Traditional rental agencies just weren't designed for the unique stress and urgency of an accident.

Luckily, a new breed of rental service has stepped up to fill this gap. These companies are built from the ground up to handle post-accident situations, focusing on one thing: removing the logistical headaches so you can get on with your life.

The Game-Changer: Direct Delivery and Billing

One of the biggest hurdles is just getting to the rental counter, especially when your car is out of commission. Specialized services solve this by bringing the car directly to you.

Instead of trying to find a ride or shelling out for a taxi, you can get a rental car after car accident delivered right where you need it. This isn't just a small perk; it’s a massive weight off your shoulders.

To Your Home: The car shows up in your driveway, letting you get back to your routine without missing a beat.

To the Body Shop: They can meet you right at the repair center when you drop off your damaged vehicle. You hand over your keys and get into your rental, with zero downtime.

To the Airport: If the accident happened while traveling, they can have the car waiting when you land.

This kind of flexibility is a lifesaver when your entire schedule has been upended. Finding a company with a wide network of car rental locations and delivery zones makes all the difference in how smoothly things go.

Here's the best part: these services often bill the insurance company directly. That means you can avoid putting a hefty hold on your credit card or paying out-of-pocket and then chasing a reimbursement check for weeks. The rental provider works directly with your insurer to handle the payments.

A Process Designed for Your Reality

It’s about more than just delivery. These companies have fine-tuned their entire operation for people in your exact situation. They get that you need simplicity and a helping hand, not a mountain of paperwork and a confusing list of add-ons.

Their whole goal is to take the transportation problem off your plate so you can focus on getting your car fixed and yourself back to normal.

This modern approach isn't just about giving you a set of wheels; it's about providing a complete, stress-free solution. By working with a service that specializes in insurance rentals, you sidestep all the usual frustrations. What was once a major source of post-accident anxiety becomes a simple, managed task, helping you get your life back on track that much faster.

Got Questions? Here Are Some Real-World Answers

Even with a clear plan, the "what-ifs" always creep in when you're trying to sort out a rental car after a crash. It can feel like you're putting together a puzzle with missing pieces. Let's tackle some of the most common questions and concerns that pop up in this situation.

What if I Don't Have Rental Coverage?

It’s a tough spot to be in, but don't panic. You still have a path forward.

If the other driver was clearly at fault, your best move is to file a claim directly against their insurance policy. Their property damage liability coverage should cover your "loss of use"—which is just insurance-speak for a comparable rental vehicle while yours is out of commission.

But what if you were at fault, or it's a he-said-she-said situation? In that case, you'll likely be paying out of pocket. Your first call should be to your repair shop to see if they offer any courtesy cars or loaners. If that's a no-go, shop around for rental agencies that offer weekly discounts or special rates. It can make a huge difference in managing the cost.

Can I Get a Bigger Car Than Mine?

Absolutely, you can rent a bigger vehicle or an SUV—you’ll just have to pay the difference yourself.

Insurance companies stick to a "like-for-like" policy. They'll only cover the cost of a vehicle similar in size and class to your own damaged car. So, if you drive a Toyota Corolla, they'll approve and pay for a similar compact sedan.

Here's how it works if you decide to upgrade:

The rental company bills your insurer for the approved daily rate of the compact car.

You'll be on the hook for the daily upgrade fee, which you pay directly to the rental agency.

Pro Tip: Before you book anything, call your adjuster and confirm the exact vehicle class and daily rate they've approved. A quick five-minute call can save you from a nasty surprise on your credit card bill down the line.

What Happens if Repairs Take Longer Than Planned?

This happens all the time, especially with the parts shortages we've been seeing lately. The key is to be proactive.

The second you hear about a delay from the body shop, get on the phone with your insurance adjuster. Give them the details: what specific part is on backorder, the new ETA, and any other info the shop provides. When an adjuster sees a legitimate, documented delay, they can usually authorize a rental extension.

This is especially true if the at-fault driver's insurance is paying. If you're using your own policy, keep an eye on your limits. Once you hit your maximum (like 30 days or $1,200), the daily rental cost becomes your responsibility.

Will the Insurance Company Pay the Rental Agency Directly?

Often, yes. Most big insurance carriers have direct billing agreements set up with the major rental companies. This is the smoothest way to go because it keeps your credit card out of it. You aren't fronting a huge sum and then waiting for a reimbursement check.

However, don't assume this is always the case. Some smaller insurance companies or local, independent rental agencies might require you to pay first and get reimbursed later. You'd pay with your own card, then submit the final receipt to your adjuster. Always, always clarify the payment process with your adjuster before you make a reservation to avoid a financial headache.

Dealing with an accident is stressful enough. Your rental car shouldn't add to it. Cars4Go Rent A Car gets that, which is why we focus on making it simple with direct delivery, flexible payment options, and clear pricing. Explore our fleet and book your hassle-free rental today!

Comments