Your Guide to an Insurance Claim Rental Car

- fantasma70

- Sep 5, 2025

- 13 min read

The moments after a car accident are always a blur. It's chaotic, confusing, and stressful. But what you do in those first few minutes is absolutely critical, especially when you're in a rental car. Taking the right steps from the get-go will not only keep you safe but also pave the way for a much smoother insurance claim rental car process with Cars4Go.

What To Do Right After A Rental Car Accident

Your first priority is safety, but your second is communication. You'll need to get in touch with Cars4Go as soon as possible, and having their contact info handy makes a huge difference.

I always recommend snapping a quick photo of the rental company's contact page or saving the number in your phone before you even drive off the lot. As you can see here, Cars4Go offers multiple ways to get in touch, which is a lifesaver when you're shaken up after an accident.

Your First Move: Safety Above All

Before you even think about insurance or paperwork, stop and check on yourself and anyone else in the car. Are you okay? Is everyone else? If there are any injuries, even minor ones, call 911 right away. Don't hesitate.

If the cars are still drivable and it’s safe, carefully move them to the shoulder or a nearby side street. The last thing you want is to cause another accident. Flip on your hazard lights to warn oncoming traffic.

Whether you're in a rental or your own car, remembering the essential steps to take immediately after a car accident can make a world of difference for your well-being and any future claims.

Channel Your Inner Detective: Document the Scene

Once everyone is safe, it's time to switch gears. Your smartphone is your most important tool right now. The documentation you gather here will be the bedrock of your insurance claim.

Go Photo-Crazy: Seriously, you can't take too many pictures. Get shots of the accident scene from every conceivable angle. Capture the damage on all the vehicles involved, not just yours. Make sure you get clear photos of license plates, nearby street signs, and even things like skid marks or weather conditions.

Swap the Essentials: You'll need to exchange information with the other driver. Get their full name, phone number, address, driver's license number, and their insurance policy details. Be polite and give them your information as well.

Find an Eyewitness: Did anyone see what happened? If there are bystanders, politely ask for their names and phone numbers. An objective third-party account can be incredibly valuable if there's a dispute about who was at fault.

I've seen so many claims get complicated because the driver only took a few close-ups of the dent. An insurance adjuster needs to see the whole story. Photos showing the final resting positions of the cars, the traffic signals, and the general layout of the intersection are just as crucial for piecing together what happened.

Make the Important Calls: Police and Cars4Go

With the immediate scene documented, it's time to make two very important calls. First, call the police to file a report. This creates an official, unbiased record of the incident, and insurance companies almost always require it.

Next, you need to call Cars4Go immediately. Your rental agreement spells this out clearly—you have to report any accident right away. Have your rental agreement number handy and give them a straightforward, factual account of what happened. Delaying this call can create major headaches and could even jeopardize your coverage.

Remember, rental cars are packed with sophisticated tech these days, and that means repairs are more expensive than ever. The average repair cost now tops $1,100. Prompt reporting isn't just a rule; it's your best move to protect yourself financially.

Starting Your Rental Car Insurance Claim

Once you’re away from the immediate chaos of the accident scene, it's time to shift gears and focus on getting your claim started. It can feel a bit overwhelming trying to figure out who to call first, but a calm, methodical approach is your best friend here. The order in which you contact everyone actually makes a difference.

Your very first call should be to your personal auto insurance company. It doesn’t matter if you’re certain the other driver was at fault—getting your own insurer in the loop right away gets the ball rolling. Think of them as your primary advocate in this whole process.

Making That First Call To Your Insurer

When you get your agent on the phone, clarity is everything. Just stick to the facts you gathered at the scene. This isn't the time to guess who was at fault or admit to anything. Your only goal is to give them a clean, simple report so they can open your claim without a hitch.

Here are a few simple phrases to guide that initial conversation:

"Hi, I was just in an accident while driving a Cars4Go rental car."

"I have the police report number and the other driver's contact and insurance details."

"I need to open a claim and find out what the next steps are for my insurance claim rental car coverage."

A straightforward script like this gives them exactly what they need, cutting through the noise that can sometimes slow things down.

The person on the other end of the phone is there to help, but remember, they're probably juggling dozens of claims. A direct, factual account helps them get your file set up quickly and accurately, which is what you both want.

Who Needs What: Your Document Checklist

As you move forward, different people will need specific documents to do their part. Your insurer, your credit card company, and Cars4Go will all be looking to you for information. Getting organized now will save you a ton of frustration later on.

While every situation is a little different, the general roadmap is usually the same. If you're looking for a good overview of the whole process, this step-by-step guide on filing a car insurance claim is a fantastic resource that covers the basics for any type of vehicle.

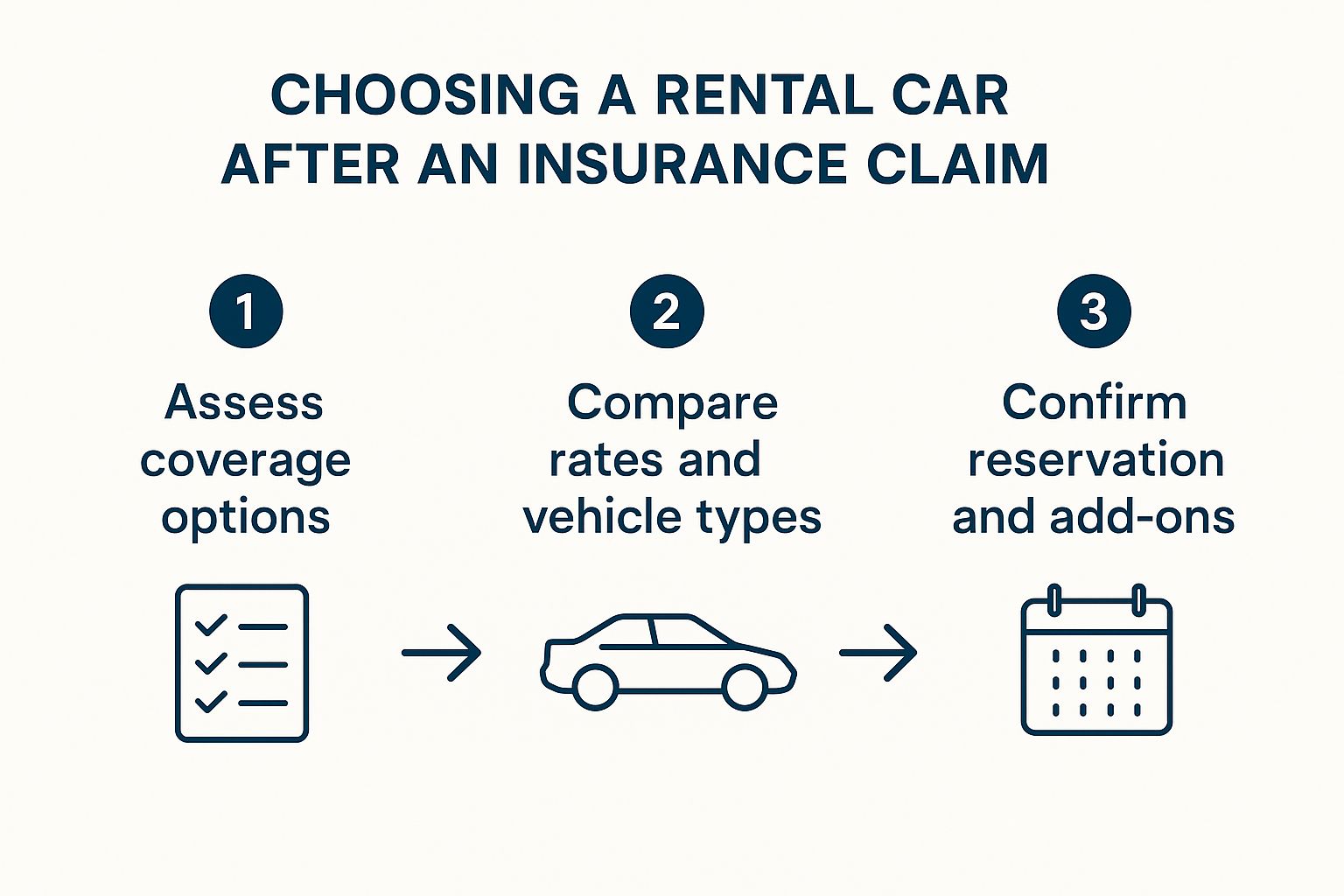

The image below breaks down the key decisions you'll make after filing your claim, especially when it comes to getting a replacement rental.

As you can see, it all starts with knowing your coverage. That knowledge directly influences which car you can get and how you book it, making the whole experience much smoother.

To keep you organized, I’ve put together a table outlining the essential paperwork you'll need.

Essential Documents for Your Rental Car Claim

Use this checklist to gather the key documents needed by your insurer, credit card company, and rental agency to process your claim smoothly.

Document Type | Who Needs It | Why It's Critical |

|---|---|---|

Police Report | All Parties | This is the official, unbiased story of what happened. |

Rental Agreement | Your Insurer, Credit Card Co. | It confirms rental terms and any insurance you accepted or declined. |

Photos/Videos | Your Insurer, Cars4Go | Visual proof of the damage is powerful and hard to dispute. |

Other Driver's Info | Your Insurer | Your insurance company needs this to pursue the at-fault party. |

Credit Card Statement | Your Credit Card Co. | This proves you used their card for the rental, activating coverage. |

A great pro tip is to scan these documents and save them in a dedicated folder on your computer or in the cloud. Having everything ready to email shows everyone you're on top of things and helps them do their jobs much more efficiently. It’s a small step that makes a huge difference.

Getting to Grips With Your Rental Car Coverage

Trying to figure out rental car insurance can sometimes feel like a bit of a guessing game. Before you can even think about managing an insurance claim rental car scenario, you have to know what protections you already have in your back pocket. You might be surprised to find you're better covered than you think.

Your first stop should always be your personal auto insurance policy. For most people, the liability and comprehensive coverage you carry for your own car will extend to a rental. This is your primary safety net if something goes wrong.

But it’s not a perfect one-to-one match. It's really important to understand where the gaps are. For example, your personal policy probably won't cover things like administrative fees or "loss of use" charges, which a rental company like Cars4Go could bill you for while their car is in the shop.

Your Credit Card: The Unsung Hero

This is where your credit card can really save the day. A lot of major credit cards offer secondary rental car insurance just for being a cardholder. This coverage is designed to kick in right after your main auto insurance pays its share, often filling the exact gaps your personal policy leaves behind.

What might your credit card cover? Things like:

Your deductible: If your personal policy has a $1,000 deductible, your credit card benefits could pay that for you.

Loss of Use: Those annoying fees for the rental car's downtime? Many premium cards have you covered.

Towing Costs: The tow bill after an accident is often included in these perks.

A word of caution: don't assume every credit card is the same. A basic, no-frills card might offer minimal protection, but a premium travel card often comes with much more substantial benefits. I always tell people to call the number on the back of their card before they get to the rental counter to confirm exactly what's covered.

This isn't just a niche benefit anymore. The global car rental insurance market is on a trajectory to grow from $17.5 billion to over $30.2 billion by 2032. That's a huge jump, and it shows that travelers are getting savvier about these risks. You can actually explore the full market analysis on dataintelo.com to see the trend for yourself.

The Options at the Rental Counter

Last but not least, let's talk about the insurance options Cars4Go will offer you right at the counter. The main one you'll encounter is the Loss Damage Waiver (LDW), sometimes called a Collision Damage Waiver (CDW). This isn't really "insurance" in the traditional sense. It's more of an agreement where Cars4Go promises not to come after you for repair or replacement costs if the car is damaged or stolen.

Taking the LDW can make life a lot simpler if something happens, letting you walk away without a long, drawn-out claims process. Whether you should take it really depends on how good your other two layers of coverage are.

If you’re treating yourself to one of the premium vehicle types available from Cars4Go that's much pricier than your car at home, your personal policy might not cover its full value. In that case, the LDW is probably a smart move. Understanding how your personal policy, credit card benefits, and the rental counter options work together is what will keep you protected.

Talking to Insurers and Rental Agencies

Dealing with an insurance claim rental car can feel like you’ve taken on a second job. The secret to getting what you need—without losing your mind—is mastering the art of communication. You'll be talking to your insurance adjuster and the team at Cars4Go, and the goal is to be clear, organized, and persistent. Think of yourself as the project manager for your own claim.

You want to be a friendly squeaky wheel. Insurance adjusters are juggling dozens, sometimes hundreds, of cases at once. If you’re polite, prepared, and consistent, your file naturally gets more attention. A simple pro tip: always lead with your claim number. It helps them find your file instantly and shows you mean business.

Keep a Running Log of Everything

This is non-negotiable. From the very first call, start a communication log. It doesn’t need to be fancy; a simple notebook or a running Google Doc is perfect.

Every time you get off the phone, immediately write down:

The date and time you spoke.

The full name and job title of the person on the other end.

A quick summary of the conversation, especially any commitments or timelines they gave you.

This log is your proof. It’s your single source of truth. When a new adjuster tells you something that completely contradicts what you were told before, you can calmly reference your notes. "Actually, when I spoke with David in claims on Monday at 10:15 AM, he confirmed that the direct billing was approved." This instantly adds weight to your words and keeps everyone honest.

A detailed log is the single most powerful tool in your arsenal. It turns a frustrating "he said, she said" situation into a simple, fact-based conversation.

What to Ask and How to Follow Up

Knowing the right questions to ask is half the battle. Your conversations with the adjuster should always end with a clear understanding of the next steps. For a deep dive into handling these conversations, it's worth learning how to negotiate insurance settlements successfully.

Don't ever feel awkward about following up. If someone says they’ll call you back in 24 hours and they don't, send a brief, polite email. Something like, "Hi [Adjuster's Name], just wanted to circle back on our conversation from yesterday regarding my rental coverage." It’s professional, not pushy.

And don't forget to keep your local Cars4Go branch in the loop. Give them your claim number and the adjuster's contact info. This lets them talk directly to the insurer, which can solve a lot of problems before they even reach you. You can easily find the right contact information for all our Cars4Go rental locations on our website. Good communication all around is what gets you back on the road with minimal hassle.

Tackling Common Problems and Delays

Even when you've done everything right, an insurance claim for a rental car can hit a snag. I've seen it happen time and again. Knowing what these common roadblocks look like ahead of time can help you navigate them with a lot less stress. Usually, the problems boil down to simple miscommunications or disagreements that can stall everything if you're not prepared.

A classic issue is a dispute over who was at fault. One day, you’re told the other driver’s insurance is accepting 100% liability; the next, you hear they're contesting it. This back-and-forth can leave you stuck in the middle, especially when it comes to figuring out who's footing the bill for your Cars4Go rental.

Disagreements over repair costs can also throw a wrench in the works. An adjuster might question a specific labor charge or the price of a part, freezing the entire repair process. And when the repairs stop, your rental coverage can get stuck right along with it.

What About "Loss of Use" and Other Charges?

One of the most confusing and frustrating charges you might see on your final bill is for "loss of use." This is a fee Cars4Go charges to make up for the income we lose while one of our vehicles is in the shop and can't be rented out. It’s a standard practice in the industry, but it catches a lot of people by surprise.

Whether your insurance will pay for this depends entirely on your specific policy.

Personal Auto Policies: Honestly, most standard auto insurance policies do not cover loss of use charges. It's often listed as an exclusion.

Credit Card Benefits: This is where you might get lucky. Premium travel credit cards often do cover loss of use as part of their rental car protection benefits.

LDW from Cars4Go: If you purchased our Loss Damage Waiver (LDW), you're typically in the clear. It's designed to cover these kinds of fees, which simplifies things immensely.

It's so important to clarify this with your insurance provider early on. Ask them directly, "Does my policy cover loss of use fees from the rental company?" Getting a straight 'yes' or 'no' upfront will save you from a major headache later.

Another tricky situation can pop up from unpredictable events, like a freak hailstorm. These "act of God" claims are less common but can be complex. In fact, weather-related incidents account for about 0.97% of all reported rental car damage, with an average repair bill of $743 because of all the dents and potential glass damage.

Knowing When to Escalate an Issue

So, what do you do if you feel your claim is stalling or you’re just not getting straight answers? It's time to take it to the next level.

Start by politely but firmly asking to speak with a claims supervisor. If that doesn't get things moving, you have the right to file a formal complaint with your state's Department of Insurance.

Make sure you have your communication log handy, be ready to present the facts calmly, and stay persistent. And if you're ever in doubt about your rental options during a long, drawn-out claim, take a look at our latest Cars4Go rental car deals for a budget-friendly way to stay on the road while things get sorted out.

Answering Your Top Rental Car Claim Questions

Navigating an insurance claim can feel like a maze, and when it’s for a rental car, the confusion can double. Let's walk through some of the biggest questions that pop up when dealing with an insurance claim for a rental car, so you can have clear, straightforward answers.

Will a Rental Car Claim Increase My Personal Insurance?

This is the million-dollar question, and the honest answer is: it might. If you’re at fault for an accident in the rental and you file the claim through your own auto insurance, your provider will likely see it as no different from an accident in your personal car. This could definitely lead to a higher premium when it's time to renew.

But it doesn't always have to go that way. If the damage is fully covered by another source, your personal insurance rates should stay put.

Loss Damage Waiver (LDW): This is exactly what the LDW you buy from Cars4Go is for. It's designed to step in and handle the costs directly, so you never have to get your personal insurer involved.

Credit Card Coverage: In the same vein, if your credit card’s rental benefit is robust enough to cover the entire cost of the damage, you can sidestep your personal policy altogether.

"The smartest move you can make is to figure out your layers of coverage before you even turn the key. A quick call to your insurance agent and your credit card company can save you a world of headache and potentially a big rate hike."

What Exactly Is Loss Of Use and Am I Responsible?

Ever heard of "loss of use"? It’s a fee rental companies like Cars4Go charge to make up for the money they lose while a damaged car is stuck in the repair shop instead of being out on the road. And yes, you are responsible for paying it.

The tricky part is that many standard auto insurance policies do not cover loss of use fees. It's a common blind spot that catches a lot of renters by surprise. On the flip side, a lot of premium credit cards that offer rental car protection specifically list loss of use as a covered benefit. Your best bet is to dig into your policy documents or cardholder benefits guide to know for sure.

The Rental Company Already Charged My Card. What Now?

Seeing a surprise charge hit your credit card from the rental company after an incident is definitely jarring. Don't panic. The first thing you need to do is get your insurance claim number and your adjuster's direct contact info over to Cars4Go right away.

Then, give your insurance company or credit card benefits administrator a heads-up about the charge. This lets them start talking directly with Cars4Go to sort out the reimbursement. If the charge looks way out of line, you can also start a dispute with your credit card company while the claim gets sorted out.

How Long Does A Rental Car Claim Usually Take?

The timeline for settling an insurance claim on a rental car is all over the map. A simple claim with minor damage where fault is crystal clear might be wrapped up in just a few weeks.

However, more complicated situations can easily drag on for months. Things that can slow everything down include:

Arguments over who was at fault

Multiple insurance companies pointing fingers at each other

Serious injuries that need time for medical evaluation

Supply chain issues causing delays in getting parts for the repair

Your best strategy to speed things up is to stay on top of it. When your adjuster asks for something, get it to them immediately. Providing complete, organized documents from day one makes a huge difference.

Ready to hit the road without the worry? With a diverse fleet and transparent pricing, Cars4Go Rent A Car makes your Miami adventure easy and affordable. Book your perfect rental today at Cars4Go.

Comments