What Is Supplemental Liability Insurance? Protect Your Finances

- fantasma70

- Sep 16, 2025

- 12 min read

Supplemental liability insurance is essentially an extra layer of financial armor. It kicks in only after a major claim has completely maxed out the limits of your primary insurance policy.

Think of it as a financial safety net for those truly catastrophic, "worst-case scenario" events. It’s designed to protect your assets and future earnings from being wiped out by a single, devastating incident.

Understanding Your Financial Safety Net

Let’s use an analogy. Imagine your standard renters or auto insurance is a sturdy bucket. It’s great for handling everyday spills—minor accidents or small claims. That bucket holds a specific amount, which is your policy limit, maybe $100,000. It does its job perfectly well within that capacity.

But what happens when a financial "downpour" hits? I’m talking about a major lawsuit or a severe accident where the costs skyrocket far beyond that $100,000 limit. This is exactly where supplemental liability insurance proves its worth.

This powerful coverage acts like a giant umbrella that only opens up when your primary "bucket" overflows. It doesn't replace your standard policy. Instead, it works right on top of it, providing a much, much higher limit of protection—often starting at $1 million or more. This ensures one terrible event doesn't lead to your financial ruin.

The Core Purpose of Supplemental Coverage

The main job of this insurance isn't to deal with frequent, small-scale problems. Its real purpose is to shield you from those high-cost, low-probability events that have the power to drain your savings, seize your assets, and even garnish your future wages.

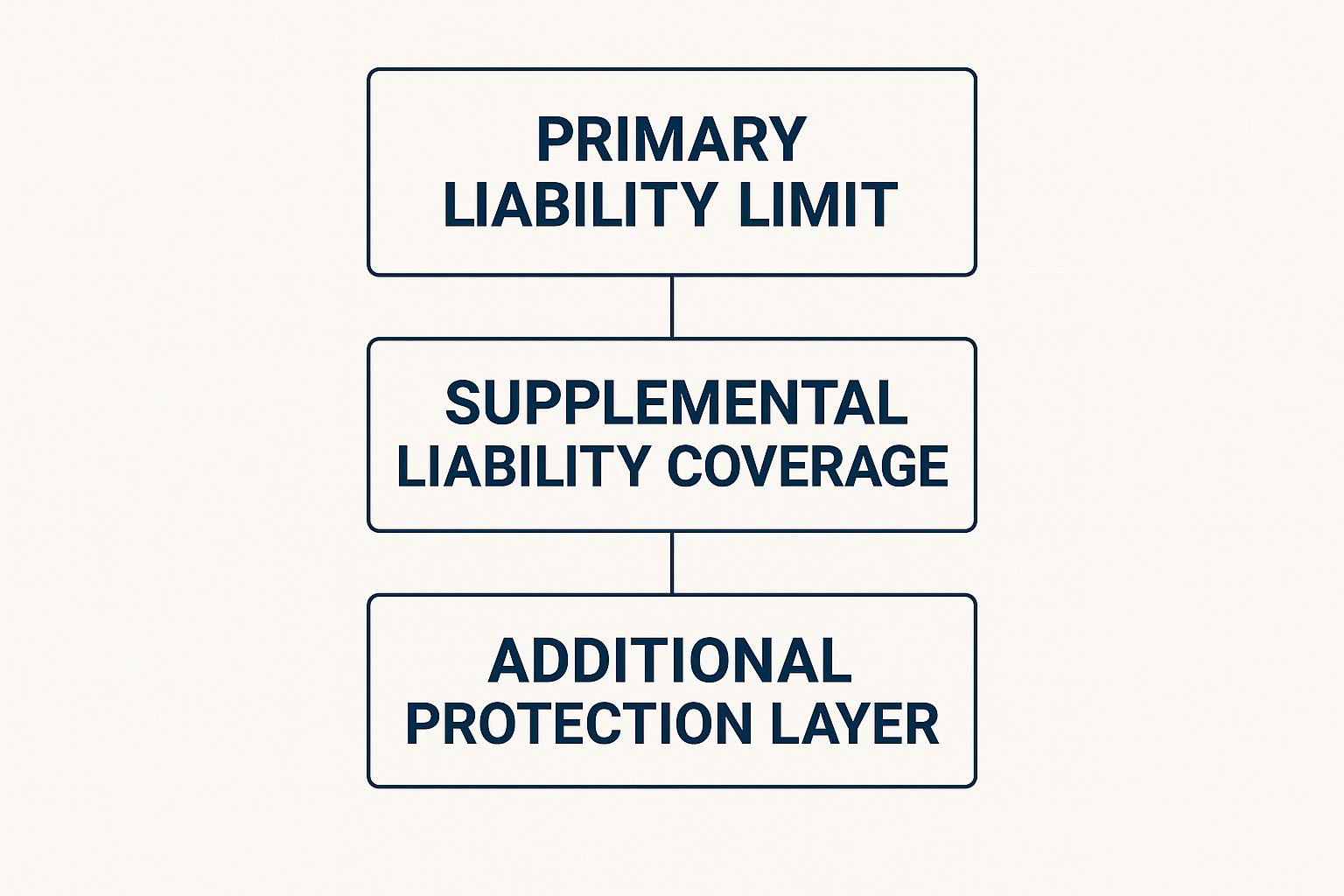

This diagram shows how supplemental liability sits on top of your primary policies, adding that crucial extra layer of protection.

As you can see, the supplemental coverage only activates after your primary liability limit has been completely used up.

This kind of strategic layering is a key piece of any solid financial defense. Understanding broader concepts like risk management planning helps you see exactly where supplemental liability fits into your overall protection strategy. It’s all about building a comprehensive shield for your financial future.

Key Takeaway: Supplemental liability isn't for minor fender-benders. It's a high-limit safeguard specifically for worst-case scenarios that could overwhelm a standard insurance policy and threaten your entire financial stability.

Standard Liability vs. Supplemental Liability at a Glance

To make it even clearer, let's break down the fundamental differences between a standard liability policy and supplemental liability insurance. This table highlights their distinct roles in your financial protection plan.

Feature | Standard Liability Insurance | Supplemental Liability Insurance |

|---|---|---|

Primary Role | Covers initial, everyday liability claims. | Provides extra coverage for catastrophic claims. |

When It Activates | From the first dollar of a covered claim. | Only after the standard policy limit is exhausted. |

Typical Coverage Limits | Usually $100,000 to $500,000. | Typically starts at $1 million and can go much higher. |

Common Use Case | A guest slips and falls in your apartment. | A multi-vehicle accident with severe injuries and a major lawsuit. |

As you can see, they aren't competing products; they're designed to work together as a team to give you a much more robust financial defense.

The Hidden Gaps in Your Standard Insurance

It’s easy to think of your standard insurance policy as a complete financial shield. While it’s absolutely your first line of defense, relying on it alone can be a risky bet. The reality is that these policies have hard limits, and the costs from a single serious accident can blow past them faster than you’d think.

This creates a serious "coverage gap," leaving you on the hook for what could be a mountain of debt.

Picture this: you're hosting a dinner party, and a friend accidentally trips over a rug in your apartment. It’s a bad fall, leading to a severe injury that requires surgery, physical therapy, and time off work.

Your standard renters insurance might have $100,000 in liability coverage. That sounds like a big number, but you’d be shocked at how quickly it can evaporate in a real-world scenario.

When Standard Limits Just Aren't Enough

Let's do some quick math to see how that $100,000 disappears. The initial hospital visit and surgery alone could easily hit $50,000. Then come the follow-up costs: months of physical therapy, appointments with specialists, and, if they sue, your legal defense fees. Suddenly, you’ve burned through that limit.

Standard policies often have limits that are no match for the true cost of significant personal injury claims. And once that $100,000 is gone, every dollar that comes after is your personal responsibility.

This is the hidden gap that puts your savings, your home, and even your future earnings on the line. It's the very reason understanding what is supplemental liability insurance is so important—it’s designed to fill that dangerous financial void.

A single unforeseen accident can create a lifetime of debt. Supplemental liability insurance is designed to protect your assets and future earnings from being consumed by a claim that exceeds your primary policy's limits.

The Reality of Liability Claims

You might be thinking this all sounds a bit far-fetched, but these situations are more common than people realize. For a bit of perspective, consider the business world: data shows 4 out of 10 small businesses are likely to face a liability claim over a decade. The average cost for settlement and defense often exceeds $75,000.

While that’s a business stat, it paints a clear picture of just how high the financial stakes can be.

Without that extra layer of protection, you are personally exposed to these massive costs. Supplemental coverage is what kicks in when your primary policy has been maxed out, preventing one bad day from turning into a personal financial disaster.

How Supplemental Liability Works in Real Life

You’ve probably seen an offer like this one from a major rental car company at the rental counter. They always ask if you want the extra insurance, and it's easy to dismiss. But that little box highlights protection against third-party injury and property damage claims—exactly where your financial risk skyrockets in a serious accident.

It’s one thing to talk about insurance in theory, but seeing how it plays out in a real-world mess is what really drives the point home. Let's walk through a couple of scenarios to see why understanding supplemental liability insurance can be the one thing that separates you from financial disaster.

The Rental Car Catastrophe

Picture this: you’re on a dream vacation and just picked up your rental car. To save a few bucks, you decline the extra insurance offered at the desk, figuring your own auto policy is good enough. But then, a moment of distraction causes a serious multi-car pile-up, and you’re found to be at fault.

The aftermath is grim. Other drivers and their passengers have serious injuries, and their cars are mangled. When all the bills are tallied up—medical expenses, lost income, vehicle repairs—the grand total comes to a whopping $750,000.

Your personal auto policy has a liability limit of $300,000. That sounds like a lot, but in this case, it leaves a jaw-dropping $450,000 gap. Without supplemental coverage, you are on the hook for that entire amount. We’re talking about garnished wages, seized assets, and a mountain of debt that could haunt you for years.

Now, let’s rewind. What if you had opted for the Supplemental Liability Insurance (SLI)? The outcome would be completely different.

Your Policy Pays First: Your personal auto insurance would pay out its maximum of $300,000.

SLI Covers the Rest: The supplemental policy would then kick in to cover the remaining $450,000.

With SLI, you walk away with your finances and future intact. The policy did its job perfectly by bridging that massive gap. It's a critical thing to consider when picking up a car from any of the available car rental locations.

The Apartment Fire Scenario

Let's switch gears and look at a rental property. Imagine you're cooking dinner in your apartment when a small kitchen fire gets out of hand. It quickly spreads to neighboring units, causing immense smoke and water damage that displaces several families and harms the building's structure.

The final bill for repairs and compensating your neighbors for their destroyed belongings and temporary housing is $400,000. Your standard renters insurance policy has $100,000 in personal liability coverage.

The Financial Fallout: Your policy pays its $100,000 limit, but you're not in the clear. The landlord's insurance company then sues you personally to get back the remaining $300,000. For most people, that's a financially crippling lawsuit.

This is the exact moment a supplemental policy—often sold as a personal umbrella policy for renters—proves its worth. It would step in and cover the $300,000 that your primary renters insurance couldn't handle, protecting you from a legal and financial nightmare.

In the rental car world, this is often called Excess Automobile Liability Insurance and can boost your coverage up to $500,000 or even more for third-party damages, giving you crucial peace of mind on the road.

Calculating Your Ideal Coverage Amount

So, how much supplemental liability coverage do you actually need? This isn't a random number you pull out of a hat. The right amount is a personalized financial shield built to protect everything you've worked so hard for—and everything you'll earn in the future.

The best way to start is with a quick personal risk assessment. This just means taking a realistic look at your assets, your lifestyle, and your potential future earnings. The more you have to protect, the more coverage you’ll want to consider. It makes sense, right? Someone with hefty savings and a stock portfolio has a lot more on the line in a lawsuit than someone who’s just starting out.

Assess Your Current Net Worth

Your net worth is the bedrock of this whole calculation. Think of it as a simple snapshot of your financial health right now. To figure it out, you just add up everything you own (your assets) and subtract everything you owe (your debts).

First, tally up your assets:

Savings and Checking Accounts: All the cash you can access easily.

Investments: Think stocks, bonds, and retirement funds like a 401(k) or IRA.

Property: The current market value of your home, car, or any other valuable possessions.

Got that total? Now, subtract your liabilities—things like student loans, credit card balances, or a car payment. The number you're left with is your current net worth. This figure is the absolute bare minimum your total liability coverage (that's your primary policy plus supplemental) should protect.

A Critical Insight: Your supplemental liability coverage shouldn't just protect what you have today. It needs to shield what you could earn tomorrow. A big lawsuit can result in wage garnishment, putting your future income on the chopping block for years.

Consider Your Lifestyle and Future Earnings

Your day-to-day life is a big piece of the puzzle. Do you have a swimming pool or a trampoline? Do you own a big dog? Do you love hosting parties? These things, while fun, can naturally increase your personal liability risk.

Your profession matters, too. People in high-earning fields or those with a public profile can sometimes be seen as bigger targets for lawsuits. If that's you, higher coverage limits are a smart move.

Insurance companies typically offer supplemental liability policies in tiers, usually starting at $1 million and going up to $5 million or even more. Let's say your net worth is $500,000. A $1 million policy gives you a fantastic buffer, protecting your current assets and giving you a cushion for future earnings. But if your net worth is climbing or your lifestyle carries more risk, bumping that up to a $2 million or $3 million policy might be the right call for genuine peace of mind.

How to Get Coverage and Understand the Cost

So, how do you actually get supplemental liability insurance? And what’s it going to cost? The good news is that it's usually simpler and more affordable than most people assume. The easiest place to start is with the company that already handles your main auto or renters insurance.

The price tag for this kind of powerful protection isn't fixed. Instead, your premium is calculated based on a few key things that give the insurance company a snapshot of your personal risk.

What Determines the Cost?

Think of your premium as a reflection of how likely it is you’ll need to file a huge claim. Here’s what insurers look at:

How Much Coverage You Want: This one’s pretty straightforward. A $2 million policy will cost more than a $1 million policy. But you might be surprised at how small the price jump is for doubling your protection.

Your Primary Policy Limits: Insurers want to see that you have a solid foundation of coverage already. In fact, having higher limits on your primary auto and renters policies can sometimes earn you a lower rate on your supplemental plan.

Your Personal Details: Things like your driving history, the kind of car you own, and even whether you have a dog or a swimming pool can nudge your rate up or down.

The Steps to Getting Covered

Getting this extra layer of protection is typically a quick and easy process. Your first move should be to call your current insurance agent. They have all your information on file and can usually give you a quote right on the spot.

Before they can sell you a policy, though, they’ll need to make sure you meet a key requirement. Insurers insist that you have a certain minimum amount of liability coverage on your existing policies, like your car insurance. For example, they might require you to carry at least $250,000 in auto liability before they’ll add on a supplemental policy.

Why do they have this rule? Insurance companies see supplemental liability as a safety net for true financial disasters. By making sure you have strong primary coverage, they keep the supplemental policy for what it's meant for—those rare, life-altering events, not smaller fender-benders.

This idea of building a complete financial shield is becoming more common. Some states are even starting to mandate certain types of supplemental coverage. In New York, for example, a new law now requires insurers to offer supplemental spousal liability insurance, showing a real push toward ensuring people are fully protected. You can read more about that specific rule in this detailed legal explanation.

This is especially important to think about when you’re renting a car. Before signing the rental agreement, it's smart to check what your own policies cover. You’ll want to know if a great car rental deal means you'll need to purchase extra liability coverage at the counter.

Common Questions About Supplemental Liability

Even with a good grasp of the basics, it's totally normal to have a few more questions rattling around. Supplemental liability insurance has its quirks, so let's walk through some of the most common things people ask. Getting these last few details straight is key to feeling confident you've got the right protection.

Does It Cover My Own Injuries or Property?

This is probably the biggest point of confusion, and the answer is a firm no. It’s crucial to remember that liability insurance is all about protecting you from claims made by *other people*.

Think of it this way: if you cause an accident, this coverage pays for the other driver's medical bills and car repairs. It also steps in to cover your legal fees if they decide to sue.

So, who covers your own damages? That’s where your other policies come into play:

Your Health Insurance: Takes care of your own medical bills.

Collision Coverage: This is the part of your auto policy that pays to fix your car.

Renters Insurance: Covers your personal belongings if they’re damaged or destroyed.

Supplemental liability is purely there to boost the financial protection you offer to others, not to yourself.

Is It the Same as an Umbrella Policy?

You’ll often hear "supplemental liability" and "umbrella policy" used interchangeably, and for the most part, they do the same job. Both give you a hefty layer of extra liability coverage that only kicks in after your main policies have been exhausted.

But there are some subtle differences.

A personal umbrella policy is a specific type of insurance that sits "over" multiple policies at once—like your auto and renters insurance—giving you very broad protection.

The term Supplemental Liability Insurance (SLI) is most famous in the world of car rentals. The SLI you buy at the rental counter is a form of supplemental liability, but it’s temporary and only applies to that one rental car for that specific period. A personal umbrella policy, on the other hand, is a much bigger, year-round safety net.

In short, a personal umbrella policy is a comprehensive form of supplemental liability coverage. However, not all supplemental liability products (like the one for a rental car) are full-blown umbrella policies.

Do I Really Need It If I Have Few Assets?

It’s easy to think this insurance is only for the wealthy, but that's a dangerous misconception. Even if you have modest savings, this coverage provides critical protection. Why? Because a major lawsuit doesn’t just come after what you have in the bank today; it can also target what you earn tomorrow.

If a court judgment against you is higher than your insurance limits, you could be facing wage garnishment for years. That means a chunk of every single paycheck could be legally taken from you to pay off the debt, completely derailing your financial future.

Supplemental liability insurance doesn't just protect your current net worth. It also acts as a shield for your future earning potential. For what it costs, it’s an incredibly powerful tool for safeguarding your long-term financial security. Building a strong financial plan involves understanding topics like these, and you can explore more helpful articles on our official blog.

What Are the Requirements to Get This Insurance?

Insurance companies won't just sell you a million-dollar supplemental policy out of the blue. They need to see that you’ve already done your part by having a solid foundation of primary coverage.

This means you’ll have to meet their minimum liability limits on your existing auto and renters (or homeowners) policies first. For example, an insurer might require you to have at least:

$250,000/$500,000 in bodily injury liability on your car insurance.

$300,000 in personal liability on your renters policy.

Once you have that baseline protection in place, they’ll be willing to sell you a $1 million umbrella or supplemental policy on top of it. This ensures the extra coverage is used for its intended purpose: protecting you from those rare, catastrophic events that go way beyond an everyday claim.

Comments