Your Guide to Car Rental Insurance USA

- fantasma70

- Jan 29

- 16 min read

Deciding whether to buy car rental insurance in the USA can feel like a pop quiz you didn't study for. But here’s the good news: you might already have all the answers. While rental companies will always pitch their own policies at the counter, your personal auto insurance or even your credit card often provides the protection you need.

Do You Really Need Extra Car Rental Insurance?

You’ve just gotten off a long flight, you're tired, and all you want are the keys to your car. The last thing you feel like doing is making a rushed, expensive decision about insurance while standing at the rental desk. But that's exactly the moment the agent will present you with several options, and the pressure to just say "yes" can be surprisingly intense.

The real question is whether paying an extra $30 to $60 per day for their coverage is actually necessary. Is it smart protection, or just a pricey upsell?

Think of it like a travel adapter. It's crucial for your trip, but you don't need to buy a brand-new one every single time you fly if the one you packed works perfectly well. Your existing insurance policies and credit cards are like that adapter—they might already have you fully covered for your American road trip. This guide will walk you through how to check what you have, so you can confidently say "no, thanks" to the extras and keep that money in your pocket.

How to Check Your Existing Coverage

The trick is to do a little homework before you leave for your trip. Your two main sources of potential coverage are your personal car insurance policy and the credit card you plan to use for the rental. A few minutes of prep here is the single best way to avoid overspending at the counter.

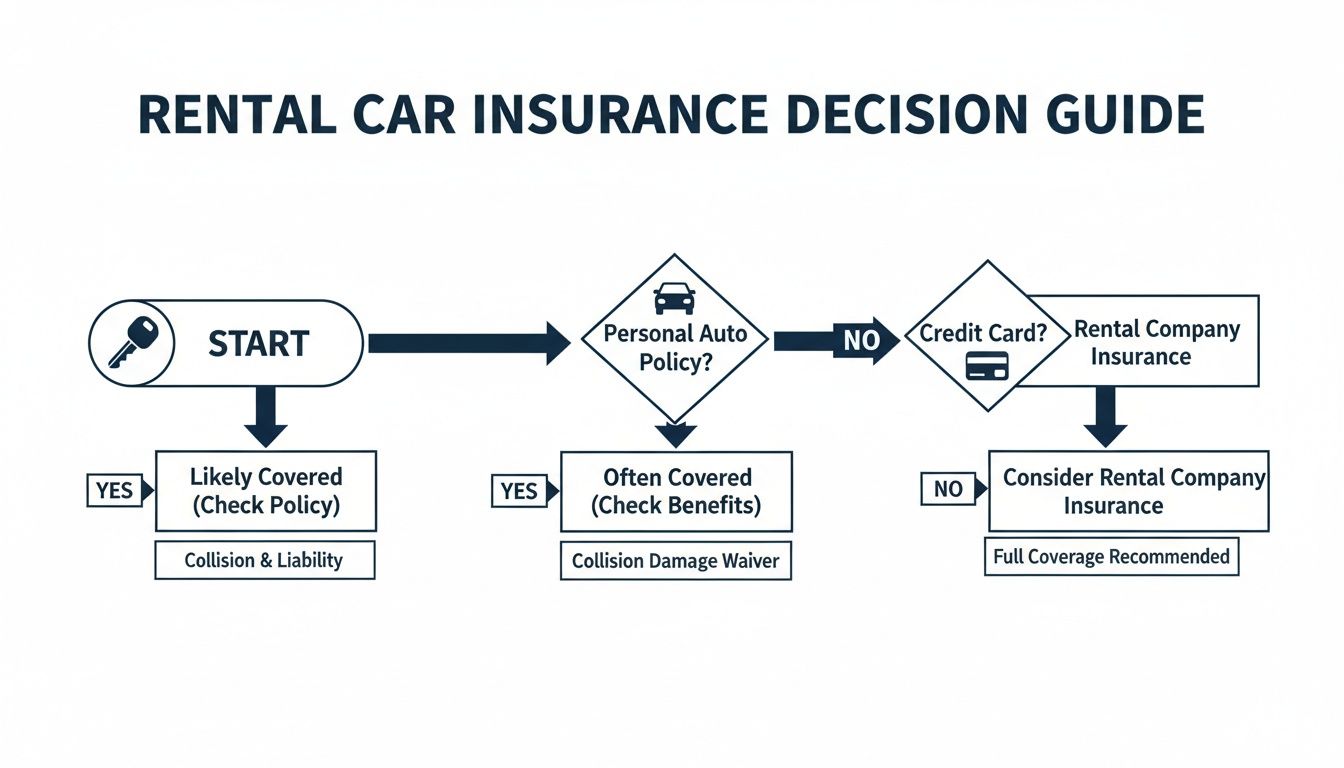

This decision guide helps visualize the process, making it easy to see where you stand before you even get to the airport.

By simply checking your auto policy and calling your credit card company, you can pinpoint any potential gaps and make a truly informed choice.

The aggressive push for these add-ons makes sense from a business perspective. The global car rental insurance market was valued at an incredible USD 52.45 billion and is projected to hit USD 270.83 billion by 2033. That explosive growth shows just how often travelers, especially in North America, opt-in for these policies.

Never assume you need to buy insurance from the rental company. A quick call to your own auto insurer and credit card provider can easily save you hundreds of dollars on a week-long trip.

A little bit of preparation goes a long way. It can make your entire trip smoother, cheaper, and far less stressful. And when you're ready to book, finding the right vehicle is just as important. Take a look at the latest rental deals from Cars4Go to find a car that fits your travel plans. By being prepared, you can just grab the keys and enjoy the open road with total peace of mind.

Quick Coverage Check: Do You Need Extra Insurance?

Use this checklist to quickly assess if you need to purchase insurance at the rental counter. Answer 'Yes' or 'No' to see where you stand.

Coverage Checkpoint | Where to Look | Potential Coverage |

|---|---|---|

Do you own a car with comprehensive and collision coverage? | Your personal auto insurance policy declaration page. | Your policy might extend to rental cars. |

Does your credit card offer primary rental car insurance? | Your credit card's "Guide to Benefits" or customer service. | Could cover theft and damage to the rental vehicle. |

Are you traveling for business? | Your personal auto policy exclusions; your employer's insurance. | Personal policies often exclude business use. |

Are you renting a specialty vehicle (luxury car, large van)? | Your personal auto policy and credit card terms. | Many policies exclude certain types of vehicles. |

Is your rental longer than 15-30 days? | Your credit card's rental benefit terms. | Most credit cards have a maximum rental period for coverage. |

After running through these questions, you’ll have a much clearer picture of whether you need to tick that extra insurance box or if you're already good to go.

Understanding The Main Types Of Rental Car Insurance

Walking up to the rental car counter can feel like a pop quiz. The agent starts rattling off acronyms—CDW, SLI, PAI, PEC—and you're suddenly pressured to make a quick decision that could cost you a lot of money.

Let's break down exactly what they're offering. Think of the rental company’s insurance options as four different shields, each designed to protect you from a specific type of problem. You might already have some of these through your personal insurance, but knowing what each one does is the key to not overpaying.

Collision Damage Waiver (CDW/LDW) - The 'Oops, I Dented It' Coverage

First up is the Collision Damage Waiver (CDW), which you might also hear called a Loss Damage Waiver (LDW). Funnily enough, this isn't technically insurance. It’s a waiver from the rental company. If you accept it, they're agreeing not to come after you for the cost of damage to their car or if it gets stolen.

Imagine you misjudge a parking spot and scrape the car against a concrete pillar. Without a CDW, you'd be on the hook for the repair bill and possibly "loss of use" fees while the car is in the shop. With the waiver, you can just hand back the keys and walk away.

This is the most common coverage people think about, and it typically costs between $10 to $30 per day. It's also the protection most often included as a perk with premium travel credit cards.

Supplemental Liability Insurance (SLI) - The 'My Bad, Let Me Cover That' Coverage

Next is Supplemental Liability Insurance (SLI). Honestly, this is the most critical piece of the puzzle, especially if you’re visiting from another country or don't own a car. It protects you financially if you cause an accident that hurts someone or damages their property.

Let's say you rear-end someone, damaging their car and injuring the driver. Your SLI would cover their repair costs and medical bills up to your policy limit, shielding your personal savings from a lawsuit.

In the USA, all drivers are legally required to have a minimum amount of liability coverage. Your personal auto policy usually covers this when you rent. But if you don't have a car, or your policy doesn't extend, buying SLI at the counter is absolutely essential for your financial protection.

Personal Accident Insurance (PAI) - The 'Ambulance Ride' Coverage

Personal Accident Insurance (PAI) covers medical bills for you and your passengers if you're injured in an accident with the rental car, no matter who was at fault. It's like a temporary health insurance policy that only works while you're in that specific vehicle.

It can help pay for things like ambulance transport and immediate hospital care. PAI usually provides a specific dollar amount for medical expenses and, in the worst-case scenario, an accidental death benefit.

That said, if you already have a good health insurance plan, PAI is often redundant. Your personal health policy will likely provide far better coverage than the limited plan offered at the rental counter.

Personal Effects Coverage (PEC) - The 'Someone Stole My Laptop' Coverage

Finally, there’s Personal Effects Coverage (PEC). This one is simple: it protects your stuff. If someone breaks into your rental car and steals your laptop, luggage, or camera, PEC helps reimburse you for the value of those stolen items.

It’s almost always bundled together with Personal Accident Insurance (PAI) into a single package deal.

Before you add this, give your homeowners or renters insurance policy a quick look. Many policies have "off-premises" coverage, meaning your belongings are protected even when they're not at home. If that’s the case, buying PEC is just spending money you don’t need to.

Rental Insurance Options At A Glance

To make it even clearer, here's a quick rundown of the four main insurance types you'll encounter at the rental desk.

Insurance Type | What It Covers | Protects You From... | Typical Daily Cost (USD) |

|---|---|---|---|

Collision Damage Waiver (CDW/LDW) | Damage to or theft of the rental car itself. | Paying for the rental car's repair or replacement costs out-of-pocket. | $10 - $30 |

Supplemental Liability Insurance (SLI) | Damage to other people's property and their medical bills if you cause an accident. | Lawsuits and major financial liability from at-fault accidents. | $8 - $15 |

Personal Accident Insurance (PAI) | Medical expenses for you and your passengers after an accident. | Paying for ambulance rides and hospital bills if you lack health insurance. | $2 - $8 |

Personal Effects Coverage (PEC) | Theft or damage of your personal belongings inside the rental car. | The cost of replacing stolen items like laptops, luggage, or phones. | $1 - $5 |

Understanding these four distinct types of car rental insurance in the USA is the first step. Now you can confidently decide which shields you need and which ones you can safely leave behind.

How to Find Out If You're Already Covered

Before you ever set foot on the rental car lot, a little homework can save you a surprising amount of money and a whole lot of stress. Many of us already have the coverage we need, tucked away in policies we use every day.

The two most common places to find existing car rental insurance in the USA are your personal auto insurance policy and the perks that come with your credit card. Finding this coverage is like discovering a forgotten gift card—it’s money you can put toward your trip instead of an expensive, and possibly redundant, insurance add-on at the counter.

And with more people hitting the road, this pre-trip check is more important than ever. In a recent year, a staggering 48 million Americans rented cars, with a massive 74% of those rentals for leisure travel. This trend really shines a light on how crucial it is for travelers to understand their insurance options before grabbing the keys. You can discover more insights about the U.S. car rental market growth and its connection to insurance needs.

Checking Your Personal Auto Insurance Policy

If you own a car, your personal auto insurance is the first place you should look. For most drivers in the U.S., the liability, comprehensive, and collision coverages you already pay for extend to rental cars driven within the country. Your policy often treats the rental as a temporary substitute for your own vehicle.

To be sure, find your policy's declaration page. It’s usually a one-page summary of your coverages and limits. You’ll want to look for phrases like "non-owned" or "temporary substitute" vehicles.

If the fine print is confusing, the best move is to simply call your insurance agent. Don't be shy about asking direct questions to get the clarity you need.

Pro Tip: When you call your insurer, don't just ask, "Am I covered?" Get specific. Ask them to confirm that your policy covers rental cars in the state you're visiting and whether your normal deductible applies. A single five-minute call can give you complete peace of mind.

Questions to Ask Your Insurance Agent

When you get your agent on the line, you want to be efficient and cover all your bases. Here’s a quick script to get straight to the point:

Does my collision and comprehensive coverage extend to rental cars in the USA?

Does my liability coverage apply when I’m driving a rental? What are my limits?

Are there any types of vehicles that are excluded from my policy, like trucks, luxury cars, or large passenger vans?

Is my coverage valid for the entire length of my rental? (Some have limits, like 30 days).

Does my policy cover extra charges from the rental company, like administrative fees or "loss of use"?

Getting clear, straight answers to these questions will tell you exactly where you stand with your personal policy.

Investigating Your Credit Card Benefits

Many travel-oriented credit cards offer rental car insurance as a built-in perk, but you have to pay attention to the details. This benefit almost always covers collision damage and theft (what the rental counter calls a CDW/LDW), but it almost never includes liability insurance.

The most important detail to nail down is whether the coverage is primary or secondary.

Primary Coverage: This is the gold standard. It means your credit card company steps up first to pay a claim, so you don't have to involve your personal auto insurer at all. This is a huge benefit, as it helps you avoid filing a claim that could jack up your personal insurance rates.

Secondary Coverage: This is more common. It acts as a safety net, kicking in only after your personal auto insurance has paid out. It typically covers what's left over, like your deductible.

To activate this benefit, you absolutely must decline the rental company's CDW and pay for the entire rental with that specific card. Call the number on the back of your card and ask for a "Guide to Benefits" document to see the exact terms, limits, and exclusions for yourself.

State Minimum Liability Rules: What You Need to Know

Liability coverage is probably one of the most confusing—and most important—parts of renting a car in the U.S. I like to call it the "I'm sorry" insurance. If you cause an accident, liability coverage is what pays for the other person's car repairs and medical bills.

It doesn’t cover damage to your rental car, but it protects you from the kind of lawsuits that can be financially devastating.

Every single state legally requires drivers to have a minimum amount of liability insurance. The whole point is to make sure there’s a financial safety net to cover damages for innocent victims if someone causes a wreck. Without it, you could be on the hook personally for tens or even hundreds of thousands of dollars.

For most U.S. residents who already own a car, the good news is that your personal auto policy's liability coverage usually extends to rental cars. But if you’re visiting from another country or you don't own a car, this is a massive gap you have to fill. You legally cannot drive off the rental lot without it.

Why You Can't Ignore This

Not having the state-required liability coverage isn't just risky—it's illegal. The consequences can be severe, turning a great trip into a complete disaster.

Driving without adequate liability insurance is like walking a tightrope without a net. A single misstep can lead to catastrophic financial consequences, including having your assets seized to pay for damages. It's a risk that is never worth taking.

The rental company will offer you something called Supplemental Liability Insurance (SLI) at the counter. This usually provides up to $1 million in coverage. If you don't have your own auto insurance, saying "yes" to this is an absolute must.

A Closer Look at Florida's Rules

Florida is a huge travel destination, so it's worth taking a minute to understand its specific laws, which often catch people by surprise. The state requires drivers to carry:

$10,000 for Personal Injury Protection (PIP), which covers your own medical costs no matter who was at fault.

$10,000 for Property Damage Liability (PDL), which pays for damage you cause to someone else's property.

Those numbers might look small, and that's because they are—they're just the bare legal minimum. A fender-bender with a newer car or a minor injury can blow past those limits in a heartbeat. This is exactly why the much higher coverage from the rental company’s SLI gives you real protection and peace of mind.

Before you pick up your keys from one of the Cars4Go rental locations in Florida, make sure you have this sorted out.

This is especially critical for international drivers who aren't covered by a U.S. auto policy. For them, buying SLI isn’t just a smart move; it’s a necessary one to be legal and financially safe on American roads. Don't leave it to chance.

Your Smart Traveler's Rental Car Checklist

Alright, you've figured out your car rental insurance usa plan. That's a huge step, but the job isn't done yet. Now comes the moment of truth: picking up and dropping off the car. This is where small oversights can turn into surprisingly large bills.

Think of it like the final walk-through before buying a house. You wouldn’t just sign the papers without checking for cracks in the foundation or a leaky roof, right? The same principle applies here. Never, ever drive a rental car off the lot without giving it a thorough once-over.

This checklist is your game plan for a seamless rental, from the second you get the keys to the moment you hand them back. Follow these steps, and you'll sidestep the common traps that lead to disputes and extra fees. For an even deeper dive, this Smart Traveler's Guide to Insurance When Renting a Car is a fantastic resource to have in your back pocket.

Before You Drive Away

The first 10 minutes at the rental counter and in the parking lot are your most critical. This is your one chance to document the car's condition and get all your questions answered before you're responsible for it.

Inspect Like a Detective: Do a slow walk around the entire car. Look for every single scratch, ding, and dent, no matter how tiny. Check the bumpers for scuffs, the windshield for chips, and the wheels for curb rash. Pop open the doors and check the interior for any stains, tears, or burn marks.

Your Phone is Your Best Friend: Pull out your smartphone and take a video of your entire walk-around. Get up close on any damage you find. Photos are good, but a timestamped video is irrefutable proof that the dings and scratches were there before you drove away.

Get it in Writing: March back to the rental agent and point out every imperfection you found. Make sure they note all of it on the rental agreement paperwork. Don't leave until you have a copy of that signed damage report in your hand. This piece of paper is your shield against bogus damage claims.

Your smartphone is the most valuable tool you have at the rental lot. Spending a few minutes recording a video can literally save you hundreds, if not thousands, of dollars. Don't be shy—document everything.

Understanding the Fine Print

The rental agreement is full of details that can cost you money if you're not paying attention. A few quick questions upfront can save you a lot of grief later.

Fuel Policy: Ask the agent to clearly explain the fuel policy. The best deal is usually "Full-to-Full," where you bring it back with a full tank. If you don't, the rental company will happily refill it for you at a ridiculously inflated price per gallon.

Return Time and Location: Confirm the exact date, time, and location for the return. Bringing the car back even an hour late can sometimes trigger a charge for an entire extra day. Also, ask if there are fees for after-hours drop-offs.

Mileage Limits: Most rentals in the USA come with unlimited mileage, but never assume. Always confirm. If there's a mileage cap, know what it is and what the per-mile penalty costs. This is especially vital if you're planning an epic road trip. You can explore our fleet's features and policies by checking out the different car types available at Cars4Go.

At Drop-Off

You're not finished just because you've parked the car. A few final steps are essential to close out your rental properly. Don't just toss the keys and run!

Do One Last Inspection: When you return, do another quick walk-around. If an agent is available, have them do it with you. Snap a few final photos or a quick video to document the car's condition upon return.

Get a Final Receipt: This is non-negotiable. Always wait for a final, itemized receipt that shows you have a zero balance (or shows the final, correct charges). This is your official proof that the contract is closed and the car has been accepted back.

Keep Your Paperwork: Don't throw anything away just yet. Hold onto your rental agreement, the damage report from pickup, and your final receipt for at least a month. If a mysterious charge shows up on your credit card statement weeks later, you'll have all the evidence you need to fight it.

Your Car Rental Insurance Questions Answered

Even after you've done all your homework, those nagging "what if" questions can pop into your head right before you book. This section is all about tackling those common, real-world scenarios travelers face with car rental insurance in the USA. Think of it as your quick-reference guide for handling last-minute doubts with total confidence.

Let's dive into some of the most frequent questions we hear and get you clear, direct answers so you can make the smartest decision for your trip.

What If I Decline All Insurance and Damage the Car?

This is the big one. If you say no to all the insurance at the counter and don't have a personal auto policy or credit card to fall back on, you are on the hook for everything. And it’s a lot more than just the repair bill.

The rental company will come after you for several other costs you might not expect. These typically include:

Loss of Use: They'll charge you for every single day the car is in the shop and can't be rented to someone else.

Diminished Value: This is the difference in the car's resale value now that it has an accident on its record. Yes, they can charge you for that.

Admin Fees: You'll also get a bill for the paperwork and staff time spent managing the whole claim process.

These extras can easily balloon a simple repair cost by thousands of dollars. The rental company will likely hit the credit card you have on file for the full amount, leaving you in a very expensive and stressful spot. This is exactly why you need to be 100% sure of your coverage before you even walk up to the counter.

Does My Credit Card's Rental Insurance Cover Everything?

It's a fantastic perk, but credit card rental insurance is not a magic wand. It's crucial to understand what it doesn't do, because the exclusions are significant.

First off, most credit cards offer secondary coverage. This just means it kicks in after your personal auto insurance has paid out, covering things like your deductible. Only a handful of premium travel cards offer primary coverage, which is much better because it acts as your first line of defense.

The most important thing to remember is this: credit card benefits almost always cover damage to the rental car itself (the CDW part). They almost never provide liability insurance for damage you cause to other people or their property. Relying only on a credit card for your car rental insurance in the USA is a huge gamble.

On top of that, these policies are notorious for their fine print. Coverage often won't apply to:

Certain Cars: Forget about that luxury convertible or oversized van; they're usually excluded.

Long Rentals: Most policies cap coverage at 15 or 30 consecutive days.

Certain Places: Some cards have geographic restrictions, so they might not work for rentals in specific countries.

Before you travel, call the number on the back of your card and ask them to send you the full guide to benefits. It's the only way to know for sure what you're actually covered for.

As an International Traveler, What Is the Most Important Insurance?

For any visitor from another country renting a car in the U.S., the single most critical piece of insurance you can buy is Supplemental Liability Insurance (SLI). This isn't just a good idea—it's a financial lifesaver.

In many parts of the world, a good amount of liability coverage is baked into the daily rental rate. That’s not how it works here. In the U.S., it's almost always sold separately as an optional extra. Driving without it is playing with fire.

If you cause an accident that injures someone or damages property, you could be sued for staggering amounts of money. Without liability protection, your personal assets back home are at risk. While the Collision Damage Waiver (CDW) is important for protecting the car, SLI is what protects you from a life-altering financial disaster.

Can I Use a Debit Card and Still Get Insurance?

Yes, you can often rent a car with a debit card, but be prepared for some major headaches. It complicates the process and strips away one of your best insurance options.

Rental agencies are much warier of debit card users. They’ll likely ask for more proof, like a return flight itinerary, and may even run a credit check on the spot. Even worse, they'll place a massive security deposit hold on your account—often hundreds of dollars—that can tie up your travel money for weeks after you return the car.

The biggest downside, though, is that you lose out on all the potential rental car insurance benefits that come with credit cards. Since debit cards offer no such perk, you're left with two choices: rely on your own personal car insurance (if you have it) or buy the Collision Damage Waiver (CDW) and liability coverage directly from the rental desk.

If you don't own a car and plan to use a debit card, your safest bet is simply to buy the insurance offered by the rental company. It's the most straightforward way to know you're fully protected.

Ready to hit the road with confidence? At Cars4Go Rent A Car, we believe in transparent pricing and clear policies so you can enjoy your trip without any surprises. Book your next Miami adventure today and experience the convenience of door-to-door service and no hidden fees. Explore our fleet and book your car now.

Comments