What Is Third Party Liability Insurance for Rental Cars?

- fantasma70

- Dec 11, 2025

- 13 min read

Think of third-party liability insurance as your financial shield. If you cause an accident, it’s there to cover the costs for the other person. It won't pay for your own injuries or damage to your rental car, but it takes care of the other driver's medical bills and vehicle repairs.

Unpacking the Basics of Liability Coverage

When you get into the world of insurance, you'll hear the term "parties" thrown around a lot. It's actually pretty simple.

First Party: That's you, the person who holds the insurance policy.

Second Party: This is your insurance company.

Third Party: This is everyone else involved in an accident you cause—the other driver, their passengers, or even the owner of a mailbox you hit.

That's where the name comes from. This insurance is all about covering your financial responsibility to that third party. It’s not just a good idea; it's the foundation of responsible driving and a legal requirement in almost every state.

The Two Pillars of Liability Protection

Liability coverage is really made up of two distinct parts that work together:

Bodily Injury Liability (BI): This is the part that helps pay for the other person’s medical bills, lost income if they can't work, and even their pain and suffering.

Property Damage Liability (PD): This piece covers the cost to fix or replace what you damaged. Most often it’s the other person's car, but it could also be a fence, a storefront, or a telephone pole.

The real job of third-party liability is to protect you. Without it, you could be on the hook personally for a lawsuit that could drain your savings, threaten your home, and impact your financial future for years.

State Requirements and Legal Foundations

Every state has its own rules for the minimum amount of liability coverage you must carry. To get a good sense of how these laws are structured, it's helpful to look at something like the Texas car insurance requirements, which lay out the legal reasons this coverage is so critical.

Keep in mind, these state minimums are just that—minimums. In a serious accident, they often aren't nearly enough to cover all the costs.

To make it crystal clear, this table breaks down exactly who is and isn't covered by your liability insurance when you're the at-fault driver.

Who Is Covered in an At-Fault Accident with Liability Insurance

Type of Damage | Who Is Covered by Your Liability Insurance? | Who Is NOT Covered? |

|---|---|---|

Other Driver's Injuries | Yes, up to your policy's Bodily Injury limits. | Your own injuries. |

Other Driver's Car Repairs | Yes, up to your policy's Property Damage limit. | Repairs to your rental car. |

Your Passengers' Injuries | Yes, this is often covered under your Bodily Injury limit. | Your own medical bills (covered by PIP or health insurance). |

Damage to Public Property | Yes, such as a damaged guardrail or sign. | Fines or legal penalties you incur. |

As you can see, liability insurance is focused outward. It protects everyone else from you, which in turn, protects your own assets for you.

Understanding Your Coverage Scope and Limits

It’s one thing to know that third-party liability insurance protects you. It's another thing entirely to know exactly what it pays for and, more importantly, how much. Your coverage isn’t a blank check; it has very specific components and clearly defined financial caps.

This protection is broken down into two main categories, each tackling a different kind of damage you might cause if you’re at fault in an accident.

Bodily Injury (BI) Liability: This is the part that covers costs when you injure someone else. It helps pay for their hospital bills, ongoing medical treatments, lost wages if they can't work, and even your legal defense if you get sued.

Property Damage (PD) Liability: This piece of the puzzle pays to repair or replace someone else’s property that you’ve damaged. Most of the time, this means the other driver’s car, but it also covers things like a mailbox, a fence, or even a storefront you might have hit.

The scale of these risks is huge. The global liability insurance market hit about $290.5 billion in 2024, and for good reason. Car accidents are responsible for nearly half of all liability payouts in the U.S., which shows just how crucial this coverage is. You can dig into more liability insurance statistics on feather-insurance.com to see the full picture.

Decoding Your Policy Limits

The most important part of your policy to understand is its limits. These numbers represent the absolute maximum amount your insurance company will pay out for a single claim. You’ll often see these limits written as a series of three numbers, like 50/100/25.

It might look like confusing code at first, but it's really just a simple shorthand that explains how your coverage is split.

Policy Limits Explained: Think of these numbers as separate buckets of money set aside for specific types of damage. If a claim costs more than what's in a bucket, you’re on the hook for the rest.

Let’s break down what a 50/100/25 policy actually gives you:

$50,000: The maximum amount your insurer will pay for injuries to a single person in an accident you cause.

$100,000: The maximum total amount your insurer will pay for injuries to everyone involved in that one accident.

$25,000: The maximum amount your insurer will pay for all the property damage you cause in that accident.

Picking the right limits is a balancing act between what you can afford and how much protection you need. State-required minimums are often dangerously low and might not come close to covering the costs of a serious crash, especially if you hit an expensive car or multiple people are hurt.

Getting this right is key, whether you're insuring your own car or looking at the various Cars4Go vehicle rental options. If you exceed your limits, your personal assets—like your savings or your home—could be at risk.

How Liability Differs From Other Car Insurance

The world of car insurance can feel like an alphabet soup of policies, and it’s easy to get confused. But understanding how third-party liability insurance works is much simpler when you see how it fits alongside the other common types of coverage you’ll encounter, especially when renting a car.

Here’s the main thing to remember: third-party liability insurance pays for the other person’s damages. Most other policies are designed to protect you or your rental car directly. Think of it as a financial shield that faces outward, protecting others from harm you might cause—and by doing so, protecting your own assets from a lawsuit.

This distinction becomes crystal clear when you compare it directly with collision and comprehensive coverage, which are often bundled together and called "full coverage."

Liability vs. Collision vs. Comprehensive Coverage

Let's break down the big three types of auto insurance side-by-side. This table makes it easy to see exactly what each one does and where third-party liability fits in the grand scheme of things.

Coverage Type | What It Covers | Example Scenario |

|---|---|---|

Liability Insurance | Damage and injuries you cause to other people and their property. | You run a red light and hit another car. Liability pays for the other driver's medical bills and the repairs to their vehicle. |

Collision Coverage | Damage to your own rental car resulting from a crash with another object, regardless of who is at fault. | You back your rental car into a pole in a parking garage. Collision coverage helps pay for the repairs to your rental. |

Comprehensive Coverage | Damage to your own rental car from non-collision events that are out of your control. | A tree branch falls on your parked rental car during a storm, or the vehicle is stolen. Comprehensive helps cover the loss. |

As you can see, each policy has a very specific job. Relying on just one type can leave you exposed in ways you might not expect.

Filling The Gaps Liability Doesn't Cover

While liability is the absolute foundation of any car insurance policy, it leaves some big gaps in your protection. It does nothing for your own medical bills or the damage to your rental if you're hit by a driver with little or no insurance of their own.

This is where other specialized coverages come into play:

Personal Injury Protection (PIP): This is a big one in "no-fault" states like Florida. PIP covers your own medical expenses and lost wages after an accident, no matter who was at fault.

Uninsured/Underinsured Motorist (UM/UIM): This is a lifesaver. It steps in to pay for your injuries and damages if you're hit by a driver who has no insurance or not enough to cover your costs.

These policies are focused inward, making sure you and your passengers are taken care of. And as cars and claims get more complex, other specialized policies have popped up too. For instance, while liability handles damage to other cars, you can now get specific coverage for smaller (but still expensive) mishaps, like losing a high-tech key fob with car key insurance.

The takeaway is that a complete insurance strategy involves multiple types of coverage working together. Liability protects your assets from claims you cause, while collision, comprehensive, and other policies protect you and your property from harm.

Modern vehicle technology is also raising the financial stakes. The number of electric vehicles is soaring—they may account for 25% of all cars globally by 2030. Their specialized components can be up to 70% more expensive to repair than those in traditional cars, which directly increases the potential cost of a property damage claim your liability insurance has to cover. You can find more insights on how technology impacts insurance costs in this McKinsey report. This trend makes understanding your coverage limits more critical than ever before.

Your Liability Insurance Options for a Rental Car

You’re at the rental counter, ready to grab the keys and go. The last thing you want is to get bogged down by confusing insurance options. Now that you understand what third-party liability is, let’s talk about how to make sure you’re actually covered when you rent a car.

You basically have three paths to take. Each has its own pros and cons, so figuring out which one is right for you before you drive off the lot is a smart move.

Using Your Personal Auto Insurance

Your first and often best option might be the insurance policy you already have for your own car. A lot of personal auto policies extend your existing liability coverage to rental cars. This means if you cause an accident in the rental, you're protected up to the same limits you have for your personal vehicle.

But here's the crucial part: never assume this is true. It’s not a universal rule. Before your trip, make a quick call to your insurance agent. Ask them two very direct questions: "Does my liability coverage extend to rental cars?" and "Are there any restrictions, like for certain types of vehicles or how long I can rent?" That five-minute phone call can save you from a massive financial nightmare.

Buying Coverage from the Rental Company

What if your personal policy doesn't cover rentals, or you feel the limits are too low for comfort? Your next choice is right there at the rental desk. Car rental companies offer something called Supplemental Liability Insurance (SLI), sometimes called a Liability Insurance Supplement (LIS).

Think of this as a temporary, high-powered liability policy that only lasts for your rental period. It usually provides very high coverage limits, often up to $1 million, which is a serious safety net. Yes, it adds to your daily rental cost, but it also buys you significant peace of mind. This is especially true if you don't own a car or your personal liability limits are on the lower side. Taking a moment to review these protection plans is a great way to secure one of our Cars4Go rental deals.

Relying on Credit Card Benefits

A lot of people think their credit card has them covered. While many travel-focused credit cards do offer rental car insurance as a perk, there's a huge catch you need to know about. This benefit almost always covers collision damage—that is, damage to the rental car itself—not your liability to others.

Key Takeaway: Your credit card is a fantastic tool for covering dings and dents on the rental car, but it's not a reliable source for liability protection. It is extremely rare for a credit card to cover medical bills or property damage for other people, so you absolutely should not count on it for that.

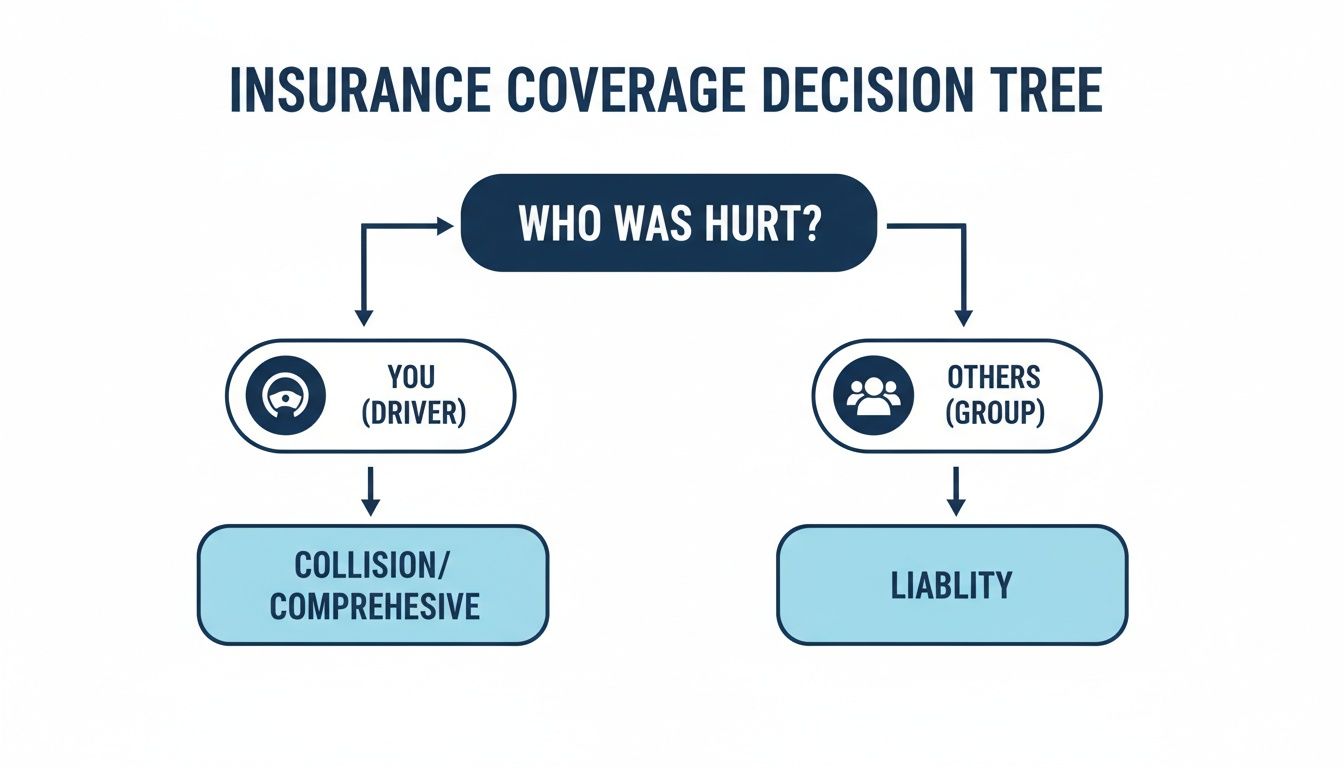

This simple chart can help you see which insurance kicks in and when.

As the flowchart shows, if you’re responsible for injuring someone or damaging their property, liability insurance is what steps in to handle the costs. Keep in mind that while rental companies are required to include the state-minimum liability coverage, these amounts can be shockingly low and often aren't nearly enough for a serious accident. This is why adding supplemental coverage is so often a wise decision.

A Special Note on Florida Insurance Rules

Renting a car in the Sunshine State comes with its own unique insurance quirks. Florida is a "no-fault" state, a term that often causes confusion and can lead to a dangerous misunderstanding about liability coverage.

The "no-fault" rule is all about Personal Injury Protection, or PIP. In Florida, every driver is required to carry PIP. Its job is to cover your own initial medical bills and lost wages after an accident, no matter who was at fault. This helps people get medical payments quickly without having to fight over who caused the crash first.

But here’s the critical part: PIP only covers your own injuries. It does absolutely nothing for the damage you might cause to someone else’s car or property.

Why Liability Insurance Is Still a Must-Have

Even with the no-fault system, Florida law still requires every driver to carry Property Damage Liability (PDL) insurance. This is your classic third-party liability coverage, and it pays for the repairs to the other person's vehicle or property when you’re the one who caused the accident. Without it, you'd be paying for those damages right out of your own pocket.

More importantly, Florida's no-fault system has its limits. When an accident involves serious injuries, the no-fault protections can disappear entirely.

If you cause a crash that results in significant or permanent injury to someone else, that person can step outside the no-fault system and sue you directly for everything from medical bills to pain and suffering. This is the moment when Bodily Injury (BI) liability coverage becomes your financial lifeline.

The Real-World Risk of Being Underinsured

While not always mandatory for every driver in the state, carrying strong Bodily Injury (BI) liability limits is one of the smartest financial decisions you can make. The legal landscape in the U.S. has seen a rise in massive jury awards for personal injury cases, sometimes called "nuclear verdicts." This trend is pushing claim costs higher, which you can read more about in the global insurance market trends on marsh.com.

At the end of the day, just meeting Florida's minimum insurance requirements leaves you dangerously exposed. A single serious accident could trigger a lawsuit with costs that dwarf a basic policy, putting your savings, your home, and your future earnings at risk.

This is exactly why understanding what third party liability insurance is—and making sure you have enough of it—is non-negotiable, even in a no-fault state.

Frequently Asked Questions About Liability Insurance

Sorting through rental car insurance can feel like a maze. To help you find your way, we've answered a few of the most common questions renters have about third-party liability coverage. Getting these concepts straight will help you feel much more confident when you step up to the rental counter.

It’s all about understanding the key differences. While we cover some big ones here, you can find even more practical advice on the Cars4Go rental car information blog.

Do I Need Liability Insurance if I Have Health Insurance?

This is a great question, and we hear it all the time. The short answer is a definite yes. You absolutely need both because they do completely different jobs. Think of them as two different players on your financial protection team.

Your health insurance is all about you. If you get hurt in a car crash, it steps in to help pay for your doctor visits, hospital bills, and other medical care, based on your plan. Its focus is entirely on your personal well-being.

Third-party liability insurance, on the other hand, looks outward. It has nothing to do with your own injuries. Its one and only job is to cover the costs for the other person—the "third party"—if an accident is your fault. That includes their:

Medical and hospital bills

Lost wages if they can't work

Pain and suffering damages

Lawsuits they might file against you

Without liability coverage, you'd be on the hook for all those costs yourself. A serious accident could easily run up a bill of tens, or even hundreds, of thousands of dollars.

Your health insurance protects your body, while liability insurance protects your wallet from claims made by others. They are two separate, essential shields that give you complete protection.

Trying to make one do the job of the other leaves a massive, risky gap in your coverage and puts everything you own on the line.

What Happens if Damages Exceed My Liability Limits?

This scenario is precisely why having enough liability coverage is so critical. Your policy's limit is the absolute maximum amount your insurance company will pay out for a claim. If you cause an accident where the damages cost more than that limit, the situation can get serious—fast.

Once your insurer pays up to the policy limit, you are personally responsible for the rest. We're not talking about a minor bill; we're talking about a potentially life-altering debt. The other party can, and likely will, come after your personal assets to cover what's left.

This means everything you've worked for could be at risk:

Your Savings & Investments: They could go after your bank accounts, retirement funds, and stocks.

Your Property: A lien could be placed on your house, or they could seize other assets like a second car.

Your Future Income: A court could garnish your wages, taking a chunk of your paycheck every month until the debt is paid off.

Let's say your property damage limit is $25,000, but you hit a brand-new luxury SUV, causing $70,000 worth of damage. Your insurance pays its $25,000, but now you owe the remaining $45,000. That's a debt you’d have to pay out of pocket, which is why simply carrying the state minimum coverage is often a huge gamble.

Does Liability Insurance Cover My Legal Fees if I Am Sued?

Yes, and this is one of the most valuable and overlooked perks of a good liability policy. If you're at fault in an accident and the other person decides to sue you, your liability insurance typically steps in to handle your legal defense.

That means your insurance company will hire and pay for a lawyer to represent you. It also covers related court costs and other defense expenses. This protection is a core part of what your premiums are paying for.

Of course, this benefit isn't unlimited. The insurance company's duty to defend you usually ends once they’ve paid out the maximum liability limit through a settlement or a court judgment.

Still, having your legal defense paid for is a massive relief. The cost of a lawsuit can spiral into thousands of dollars before you even see a courtroom. Liability insurance isn't just a safety net for damages; it's a legal shield for the entire messy process that can follow an accident.

Ready to hit the road in Miami with confidence? Cars4Go Rent A Car offers transparent pricing and a wide selection of vehicles to make your trip easy and enjoyable. Book your rental car today and experience the convenience of our customer-first service. https://www.cars4go.com

Comments