What Is Supplemental Liability Insurance for Rental Cars?

- fantasma70

- Dec 20, 2025

- 13 min read

When you're at the rental counter, you'll likely be offered something called Supplemental Liability Insurance. It's designed to give you extra financial protection, often up to $1 million, if you cause a serious accident in your rental car.

Think of it as a powerful financial safety net. It's the kind of coverage that steps in only after your own insurance has paid out its maximum, shielding your personal assets from the kind of lawsuits that can be financially devastating.

What Is Supplemental Liability Insurance in Simple Terms

Let's use an analogy. Imagine your personal auto insurance is a bucket of water you have on hand to put out a fire. For a small fire, like a minor fender-bender, that bucket is probably plenty. But what happens if the fire is a massive blaze—say, a multi-car pile-up that causes serious injuries? Your bucket will be empty in seconds, but the fire will still be raging.

Supplemental Liability Insurance (SLI) is like having a fire truck on standby. It only shows up after your initial bucket is completely used up, but it arrives with enough water to handle even a catastrophe. This coverage isn't for fixing your rental car; its one and only job is to cover the massive costs of injuring other people or damaging their property when you're the one at fault.

Understanding Your Financial Responsibility

The whole idea behind SLI boils down to one word: liability. In the eyes of the law, liability means you are financially on the hook for any harm you cause. If an accident is your fault, you could be sued for:

Medical Bills: The cost of treating injuries for drivers and passengers in other vehicles.

Property Damage: The bill for repairing or replacing other cars, or even things like fences and buildings.

Legal Fees: The staggering expense of defending yourself in a lawsuit.

Lost Wages: Compensation for others if their injuries keep them from working.

These costs can easily skyrocket into hundreds of thousands, or even millions, of dollars—far more than a standard auto policy covers. SLI was created to fill that exact financial gap. The need for this coverage has been growing, especially in North America, which makes up 38.5% of the nearly $291 billion global liability insurance market. Given the strict regulations in the U.S. and the potential for huge claim payouts, supplemental policies have become a crucial consideration for many drivers.

What SLI Covers and What It Excludes

Let's get crystal clear on what SLI does—and doesn't—do. It's really important to know that this isn't an all-in-one policy. It has a very specific, and very important, role. For more smart travel tips, you can always find great articles over on our blog.

Key Takeaway: SLI is not for your rental car or your own injuries. It is exclusively for protecting you against claims made by third parties—other people involved in an accident you caused.

To make it even clearer, this table breaks down what supplemental liability insurance typically handles versus what it leaves out.

Supplemental Liability Insurance At a Glance

Coverage Area | What SLI Covers (Examples) | What SLI Does NOT Cover (Examples) |

|---|---|---|

Injuries to Others | Medical bills, ambulance costs, and long-term care for other drivers or pedestrians. | Your own medical bills or injuries to passengers in your rental car. |

Damage to Property | Repair costs for other vehicles or damage to public or private property. | Damage, theft, or vandalism to your Cars4Go rental vehicle. |

Legal Expenses | Attorney fees and court costs if you are sued by another party after an accident. | Traffic fines, personal legal fees unrelated to the liability claim. |

Essentially, SLI is your backup plan for worst-case scenarios involving other people. For damage to the rental car itself or your own well-being, you’d need different types of coverage.

How SLI Works With Your Existing Insurance Policies

It's a common assumption: your personal car insurance or that fancy credit card in your wallet has you totally covered when you rent a car. But the reality is a bit more complicated. Insurance works in layers, and if you don't understand how they stack up, you could be leaving yourself wide open to financial risk.

Think of it like a stack of building blocks. Each block is a different policy, and they get used in a very specific order. Supplemental Liability Insurance is meant to be the very top block—a final, massive layer of protection that only comes into play after your other coverage has been completely drained.

The First Layer: Your Personal Auto Policy

If you own a car, your personal auto insurance policy is almost always your first line of defense. The good news is that this liability coverage often extends to your rental car, which is usually enough for a minor fender-bender.

The problem? The limits on many personal policies are lower than you might think. A typical policy might cover $50,000 per person and $100,000 per accident. In a serious pile-up with major injuries, medical bills and lawsuits can burn through that amount in a heartbeat, leaving you on the hook for the rest.

Even smaller incidents can have financial ripple effects. For instance, consider the potential increase in your insurance rates after a speeding ticket in Florida. It’s a reminder that driving always carries risk, which is why having strong liability coverage is so important.

The Role of Credit Card Benefits

So, what about the insurance from your credit card? This is where a lot of people get tripped up. While premium credit cards often advertise rental car benefits, they almost always provide something called a Collision Damage Waiver (CDW) or Loss Damage Waiver (LDW).

This is a crucial distinction. It means the card will help pay for damage to or theft of the rental car itself. It offers absolutely zero liability protection if you injure someone or damage their property. Relying only on your credit card for insurance creates a huge, dangerous gap in your protection.

Key Insight: Credit card benefits protect the car you're driving, not the people or property you might hit. Supplemental liability insurance is designed to fill this exact gap.

How SLI Fills the Gaps

This is precisely where Supplemental Liability Insurance steps in to act as your financial safety net. It sits on top of your primary insurance and only kicks in after those initial limits have been maxed out.

Let’s go back to our stacking block analogy:

Block 1 (The Base): Your personal auto policy or the state-minimum liability included with the rental. This gets used up first.

Block 2 (The Top Layer): Supplemental Liability Insurance. This activates after Block 1 is gone, providing up to $1 million or more in additional coverage.

This layered protection is more critical than ever. With the rising costs of accidents and lawsuits, many primary insurers are hesitant to offer massive liability limits. SLI bridges the gap between what your personal policy covers and what a catastrophic accident could actually cost.

By understanding how these pieces fit together, you can make a smart, informed decision at the rental counter. If your personal policy has high limits, you might be fine. But if it doesn’t, adding SLI gives you a powerful financial shield, protecting your savings and assets from a worst-case scenario.

As you plan your next trip, take a moment to review all your options. And when you're ready, check out our latest car rental deals to find the perfect vehicle for your journey.

Why Florida's Liability Laws Make SLI a Smart Choice

Renting a car in Florida? It's crucial to understand the state's unique insurance rules before you get behind the wheel. Many people hear that Florida is a "no-fault" state and figure they're protected from lawsuits after a crash. That assumption can be a very expensive mistake.

The no-fault system is really just about your own initial medical bills. It means your own insurance handles your injuries up to a certain limit, no matter who caused the accident. But here's the key part: it does not stop someone from suing you for serious injuries or major property damage you cause.

This is where the financial risk for rental car drivers gets very real.

Florida's Bare-Bones Minimums

Florida law does require rental companies to have liability insurance, but the required minimums are shockingly low. They're often just enough to handle a fender bender, not the kind of serious, multi-car pile-up you might see on I-95 or the Turnpike.

This basic, state-mandated coverage is dangerously thin when it comes to protecting your personal assets. When accident costs blow past those low limits, the at-fault driver—that's you—is on the hook for the rest.

Crucial Point: Florida's "no-fault" law won't shield you from a lawsuit if you seriously injure someone. The state's low mandatory liability limits for rentals create a huge financial gap that you could be forced to pay out of your own pocket.

Let's walk through a realistic scenario. You're driving your rental on a rainy afternoon, you hydroplane, and cause a three-car pile-up. One driver ends up with a broken leg that needs surgery, and another person has chronic back injuries. The cars are a mess.

Let's look at what the costs could be:

Medical Bills: For two injured people, the hospital stays, surgery, and physical therapy could easily top $250,000.

Property Damage: Getting two other cars fixed could run another $60,000.

Legal Fees: If you get sued, your legal defense alone could cost tens of thousands more.

The total financial damage is suddenly pushing $350,000 or more. The tiny state-minimum liability that came with the rental would be wiped out almost instantly, leaving a massive bill with your name on it.

How SLI Protects You in the Sunshine State

This is exactly why supplemental liability insurance can be a financial lifesaver. Think of it as a massive shield that steps in after the basic coverage runs out. It's there to pay for the hundreds of thousands of dollars in remaining claims. Without it, your savings, your home, and even your future wages are on the line.

With millions of tourists driving on crowded roads, the chance of an accident is higher than most people think. Before you travel, it's smart to look at your options. You can check out our various car rental locations in Florida to find a convenient pickup spot and start your trip with real peace of mind.

Choosing SLI in Florida isn't just an upsell; it's a sound financial move. It takes a dangerously low level of protection and turns it into a strong safety net, making sure one bad moment on the road doesn't turn into a personal financial disaster.

Deciding If You Need Supplemental Liability Insurance

We’ve all been there: standing at the rental car counter, pen in hand, being asked about extra insurance. It’s a moment where a quick decision can have huge financial consequences. But figuring out if you need Supplemental Liability Insurance (SLI) doesn't have to be a stressful, last-minute guess.

The right answer really just boils down to your personal situation and the coverage you already have. Let's walk through how to figure this out before you even get to the counter.

Your Personal Decision Checklist

Thinking through these four key questions will give you a clear answer on whether SLI is a smart move for you.

Do you own a car? If you don’t own a car, you almost certainly don’t have a personal auto policy. This means you have no liability coverage to fall back on, making SLI an essential purchase.

What are your personal auto policy's liability limits? Pull out your insurance card or check your policy online. If your limits are on the low side—like the state minimums—they can be wiped out in a flash after a serious accident. On the other hand, robust limits like $100,000/$300,000 or higher offer a much stronger safety net.

Do you have an umbrella policy? This is a separate policy that kicks in when your regular auto or home insurance limits are maxed out. If you have an umbrella policy, it often provides $1 million or more in extra liability protection, meaning you're likely already well-covered.

What’s your personal risk tolerance? Take a quick inventory of your assets. Do you own a home, have a healthy savings account, or other significant investments? The more you have to protect, the more critical it is to have iron-clad liability coverage.

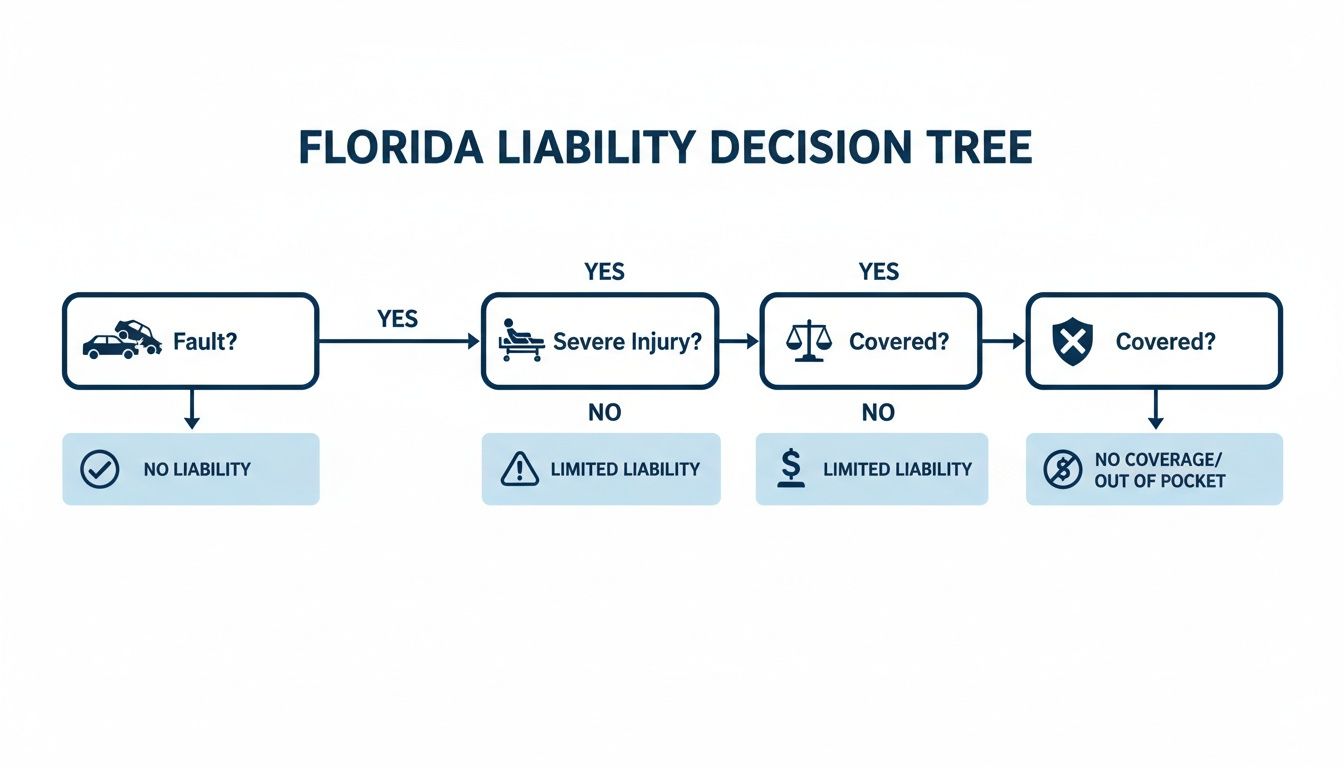

This flowchart is a great way to see how these factors play out, especially in a state like Florida where liability rules can be complex.

As you can see, even if you’re found at fault for a serious accident, having enough insurance is the final line of defense for your financial future.

Clear Scenarios: When to Say Yes or No

To make it even simpler, here’s a breakdown of the most common situations people find themselves in. See which one sounds most like you.

Key Insight: Choosing SLI has nothing to do with how well you drive. It's a purely financial decision based on the insurance you already have in place to protect your assets.

A great personal auto policy is always your first and best defense. If you're looking to strengthen that foundation, it's worth exploring how to lower auto insurance premiums to get the best possible coverage for your budget.

Decision Checklist When Renting a Car

To simplify things even further, here's a side-by-side look at when it makes sense to accept SLI and when you can probably pass.

Consider ACCEPTING SLI If... | Consider DECLINING SLI If... |

|---|---|

You don't own a car and have no personal auto insurance to cover the rental. | You have a high-limit personal auto policy (like $250k/$500k) and have confirmed it covers rentals. |

Your personal auto liability limits are low or just meet the state minimum, leaving you exposed. | You have a personal umbrella policy providing at least $1 million in additional liability coverage. |

You are renting for business, and your personal policy specifically excludes business use. | Your credit card offers primary rental liability coverage (this is extremely rare, so verify it carefully). |

You want complete peace of mind and prefer to eliminate any potential gap in coverage, no matter what. | Your personal assets are limited, and after reviewing your policies, you're comfortable with your existing coverage level. |

Ultimately, the small daily fee for SLI is an investment in your financial security. By taking a few minutes to think through your own situation, you can leave the rental lot feeling confident you’ve made the right call for your trip.

Real-World Scenarios Where SLI Saves the Day

Insurance can feel a bit abstract until you see it in action. So, let's move past the definitions and look at some real-world situations where supplemental liability insurance can be an absolute financial lifesaver. These aren't just wild "what-if" stories; they're the kinds of things that can happen to anyone on any given day.

There's a reason the global market for liability protection is expected to jump from USD 252.34 billion to over USD 432 billion. Lawsuits are getting more common and a lot more expensive. You can dig into the data on these trends yourself, but the takeaway is clear: having enough coverage has never been more important.

These next two examples show you exactly why that extra layer of protection is worth its weight in gold.

Scenario One: The Multi-Car Pile-Up

Picture this: you’re cruising in your rental on the interstate when a sudden storm unleashes a downpour. Visibility is near zero. Before you can react, you rear-end the car ahead, triggering a chain reaction that ends up involving three other vehicles. It's a mess, and unfortunately, you're at fault.

The aftermath is serious. One driver has a severe back injury that needs surgery, while a passenger in another car has a broken arm. The cars themselves are badly damaged.

Here’s a quick look at how the bills stack up:

Medical Costs: Between surgeries, hospital stays, and long-term rehab for the two injured people, the total skyrockets past $300,000.

Property Damage: Getting three cars fixed, including a luxury SUV, tacks on another $85,000.

Lost Wages & Legal Fees: The driver with the back injury is a self-employed contractor who can't work. They sue for lost income, adding $150,000 plus legal fees to the tally.

The grand total comes to a staggering $535,000. Your personal auto policy has a decent $100,000 liability limit, but that's wiped out in an instant. Without SLI, you are on the hook for the remaining $435,000. This is where supplemental liability insurance becomes your hero, stepping in to pay that massive outstanding balance and saving you from financial ruin.

Scenario Two: The Costly Parking Lot Mistake

Not every disaster happens at 70 mph. Imagine you're carefully backing out of a tight spot at a fancy shopping mall and you accidentally tap a pedestrian you just didn't see.

They fall, breaking their wrist. It seems minor at first, but you soon find out the pedestrian is a surgeon. The injury not only requires surgery but also months of physical therapy, making it impossible for them to perform their job.

Key Takeaway: The severity of an accident doesn't always line up with the final cost. A "minor" injury to a high-earning professional can trigger a lawsuit for lost wages that dwarfs the actual medical bills.

The surgeon sues for medical expenses and—more importantly—for the massive income they lost while recovering. The total claim hits $750,000. Your own insurance pays its $100,000 limit, leaving you staring at a $650,000 gap.

This is another classic case where SLI saves the day. It covers the entire remaining balance, protecting your house, your savings, and your future from being liquidated to satisfy the court judgment. In moments like these, the value of that extra coverage becomes crystal clear.

Answering Your Top Questions About SLI

When you're trying to figure out rental car insurance, the same questions tend to come up again and again. Getting a straight answer can be the difference between feeling confident and feeling confused at the rental counter. Let's clear up the most common points of confusion right now.

Think of this as your go-to cheat sheet. We'll cut through the jargon so you know exactly what you're paying for.

Is SLI Just Another Name for a Collision Damage Waiver?

This is probably the number one question we hear, and the answer is a hard no. They're two completely different products covering entirely separate things. Mixing them up can leave you with a huge financial blind spot.

Supplemental Liability Insurance (SLI): This covers damage you cause to other people and their property. It’s there to protect your own money and assets from lawsuits if you’re at fault in an accident.

Collision Damage Waiver (CDW): This covers the rental car itself. If the car you're driving gets damaged or stolen, a CDW (sometimes called a Loss Damage Waiver) reduces or even eliminates the amount you owe the rental company.

Simply put, SLI protects you from having to pay others, while a CDW protects you from having to pay for the rental car. They address two very different risks.

Does My Credit Card's Rental Insurance Cover Liability?

This is another huge point of confusion. While it's true that many premium credit cards offer rental car protection, that coverage almost always acts like a Collision Damage Waiver, not liability insurance.

So, your credit card might pay for a dent in the rental car's door. But it won't cover the medical bills for someone you injure in a crash. If you're only relying on your credit card, you have a massive gap in your liability coverage.

Key Takeaway: Credit card perks are there to cover the rental vehicle, not to shield your life savings from a lawsuit. You should never assume your card includes supplemental liability.

How Much Coverage Does SLI Typically Provide?

The exact figures can shift a bit depending on the rental company, but the industry standard for SLI is thankfully quite high.

Most SLI policies offer $1 million in coverage, and some go up to $2 million. There’s a good reason for that. This massive safety net is built for those worst-case-scenario accidents where medical bills, property damage, and legal defenses can skyrocket into the six or seven figures. It’s a financial backstop that goes way beyond what most personal auto policies or state-mandated minimums provide.

Once you get these key distinctions, the whole process becomes much clearer. You can walk up to any rental counter knowing exactly what each product does, allowing you to make a smart choice that protects you and your finances on the road.

Ready to hit the road with complete peace of mind? At Cars4Go Rent A Car, we believe in making your rental experience simple and transparent. Book your vehicle today and add the right protection for a worry-free Florida adventure.

Comments