What Is Collision Damage Waiver Coverage? Find Out Now

- fantasma70

- Oct 11, 2025

- 14 min read

You're standing at the car rental counter, ready to start your trip, and the agent asks, "Would you like to add our Collision Damage Waiver?" It’s a common question, and one that can be a bit confusing. Let’s clear it up.

A Collision Damage Waiver (CDW) is an optional service offered by rental car companies that essentially gets you off the hook for damage to the rental vehicle. Think of it less like traditional insurance and more like a financial shield. By paying a daily fee for it, you're telling the rental company, "If something happens to this car while I have it, you agree not to charge me for the damages." The company takes on the risk instead of you.

What a Collision Damage Waiver Really Is

It's easy to mistake a CDW for an actual insurance policy, but they aren't the same thing. Insurance is a contract where an insurer agrees to pay for specific losses. A CDW, on the other hand, is a simple agreement between you and the rental agency.

When you buy the waiver, the company promises not to come after you for the cost of repairs—or even the full value of the car—if it's damaged or stolen. This means you won’t have to file a claim with your own auto insurer or pay thousands of dollars out of your own pocket.

Understanding the Scope of CDW

This kind of protection is a big deal in the rental world. In fact, the global market for car rental insurance is expected to grow from $17.5 billion in 2023 to a whopping $30.2 billion by 2032. This huge jump shows just how much renters value peace of mind on the road. You can dive deeper into the car rental insurance market trends to see the full picture.

While a CDW is a fantastic safety net, it's not a free-for-all. You need to know exactly what it covers and, more importantly, what it doesn't. The fine print can vary a bit from one company to the next, but there are some common ground rules.

To make it simple, we've put together a quick comparison of what you can generally expect a CDW to cover versus what it usually leaves out.

CDW Coverage at a Glance

Typically Covered by CDW | Typically Excluded by CDW |

|---|---|

Damage to the rental car's body from a collision (dents, scratches, major accident damage) | Damage to specific parts like tires, windshields, mirrors, or the undercarriage |

Total loss of the vehicle due to an accident | Damage caused by risky behavior (e.g., driving under the influence, speeding, off-roading on unpaved roads) |

Theft of the entire rental car | Personal items stolen from inside the car (this would fall under your homeowner's or renter's insurance) |

"Loss of use" fees charged by the rental company while the car is being repaired | Any liability for injuries or property damage to others (this is covered by separate liability insurance) |

Towing and administrative fees related to the damage | Damage that happens when an unauthorized person is driving the car |

This table is just a general guide. It's always a good idea to quickly read the rental agreement so you know precisely what you're signing up for before you drive off the lot.

How a Collision Damage Waiver Really Works

When you’re standing at the rental counter and you say "yes" to the Collision Damage Waiver, you’re basically making a deal with the rental company. You’re paying them to take on the financial headache if the car gets damaged on your watch.

Think of it this way: you pay a daily fee, and in exchange, they agree not to come after you for repair bills if the car gets scratched, dented, or seriously damaged. This is the core of what collision damage waiver coverage is—it simplifies things tremendously if a mishap occurs.

A Tale of Two Renters

Let's paint a picture to see how this plays out in real life. Imagine you’re trying to squeeze into a tight parking spot and... scrape. That horrible sound. You get out and see a long, nasty scratch down the side of the car. What happens next is completely different depending on your CDW decision.

Renter A (With CDW): You see the scratch, your heart sinks for a second, but then you remember the waiver. You snap a quick photo and drive on. When you return the car, you point out the damage to the agent. They'll make a note of it, but that's it. You sign the final paperwork and walk away without owing a dime for that scratch.

Renter B (Without CDW): You see that same scratch, and that sinking feeling in your stomach doesn't go away. Now, you’re on the hook for the entire repair cost. The rental company will send you a bill that includes not just the repair itself, but often extra administrative fees and even a "loss of use" charge for the time the car is out of service. You have to pay up front and then start the bureaucratic tango of filing a claim with your personal car insurance or credit card company.

This simple scenario shows the immediate peace of mind a CDW provides. It takes the financial stress and guesswork out of an already unpleasant situation.

It Is a Waiver, Not Insurance

Here’s a really important point people often miss: a CDW is not an insurance policy. That might sound like splitting hairs, but it makes a huge difference in what's actually covered.

A waiver is a promise from the rental company not to hold you responsible for damage to their car. It does nothing for other people or their property.

In other words, the CDW covers the dent you put in the rental car's bumper, but it won't cover the other car you backed into. For that, you need liability coverage. Most rentals include a basic, state-required level of liability, but you can usually purchase supplemental coverage for more protection.

Finding Out If You Are Already Covered

Before you get to the rental counter and feel the pressure to add a Collision Damage Waiver, it's a good idea to see if you're already covered. You might be surprised to find you already have protection, and nobody wants to pay twice for the same thing.

You could already be shielded from hefty repair bills through a few common sources: your personal car insurance, your credit card, or even a travel insurance policy. A little bit of digging before your trip can save you a decent chunk of money and give you confidence when that rental agent asks, "Would you like to add our coverage?"

Check Your Personal Auto Insurance Policy

The first place you should always look is your own car insurance policy. If you have comprehensive and collision coverage for your personal vehicle, that protection often extends to rental cars, especially when you're traveling within the country.

It's a pretty common feature. In the U.S., for instance, about 77% of insured drivers have collision coverage on their own cars. This tells us that people generally understand the value of being protected against damage—a principle that applies just as much to a rental.

But don't just assume you're covered. You need to confirm the specifics. Give your insurance agent a quick call and ask some direct questions:

Does my policy’s collision coverage carry over to rental cars?

Are there any restrictions on the type of car I can rent or where I can rent it?

Will my policy cover extra fees the rental company might charge, like "loss of use" or administrative costs?

That one phone call can clear up any gray areas and tell you for sure if your personal policy is a solid alternative to the rental company's CDW.

Uncover Your Credit Card Benefits

Many credit cards, especially those geared toward travel, come with rental car coverage as a handy perk. It's one of the most overlooked benefits of travel credit cards for rental car insurance. To make it work, you usually have to decline the rental company's CDW and use that specific card to pay for the entire rental.

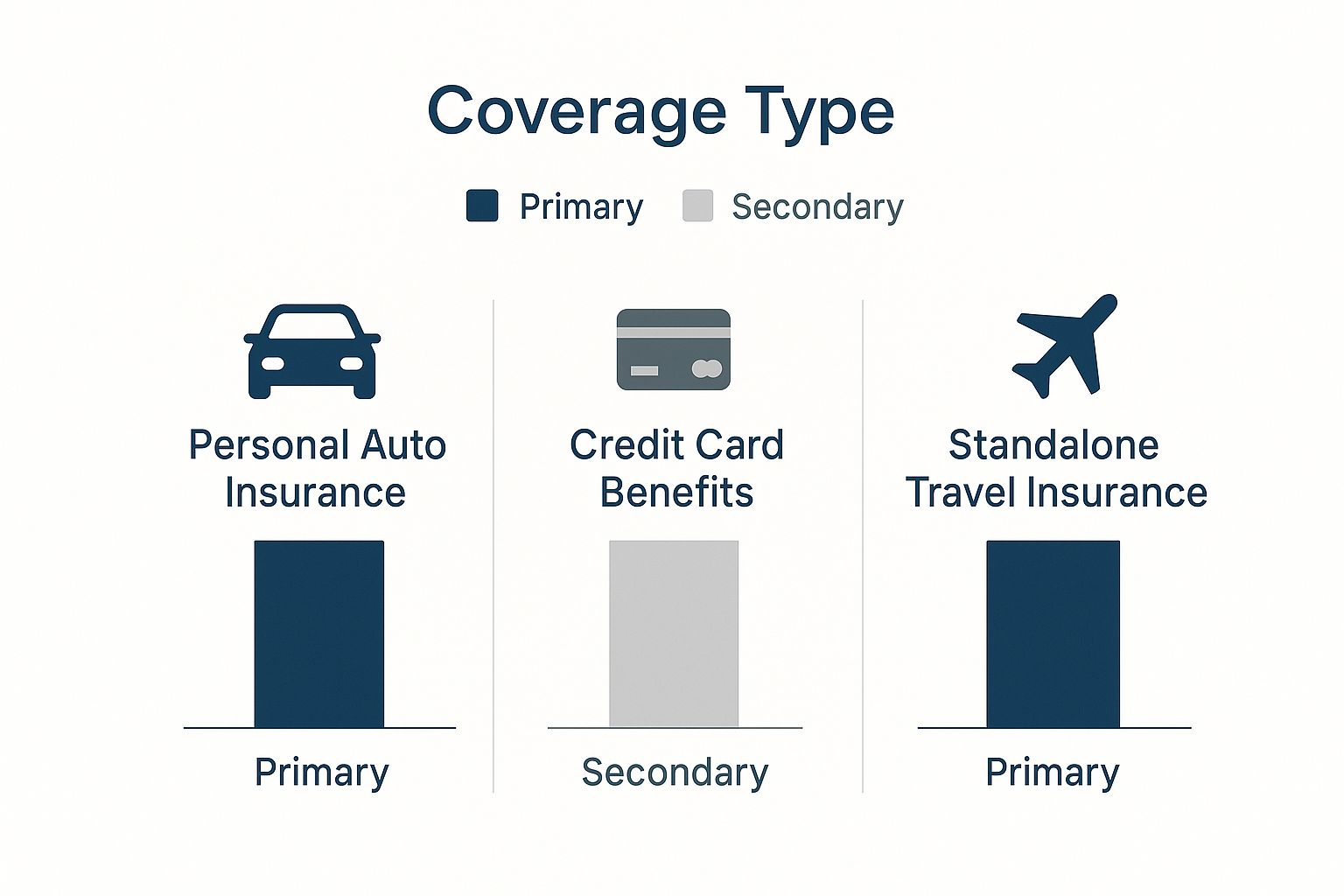

The most important thing to figure out is whether your card offers primary or secondary coverage. This distinction is a big deal.

Primary Coverage: This is the gold standard. If something happens, the credit card's insurance pays first. You won't even have to get your personal auto insurer involved, which means no claim on your record and no potential rate hike.

Secondary Coverage: This is more typical. It acts as a backup, stepping in to cover what your personal auto insurance doesn't—like your deductible or other leftover costs. It's still helpful, but it means you have to file a claim with your own insurer first.

This infographic breaks down where you typically find each type of coverage.

As you can see, knowing whether your card offers primary or secondary coverage is essential.

Key Takeaway: Don't leave it to chance. Call the number on the back of your credit card and ask a representative to explain their rental car coverage. Finding out if it's primary or secondary before you rent will save you a massive headache if you end up needing to file a claim.

To help you weigh your options, let's compare these different sources side-by-side.

Comparing Your Coverage Options

Coverage Source | Pros | Cons | Best For |

|---|---|---|---|

Rental Company CDW | Simple to purchase at the counter. No deductible. No claims on personal insurance. | Can be very expensive ($15-$30+ per day). May have exclusions. | Travelers who want maximum convenience, have no other coverage, or want to avoid any possibility of a claim on their personal policy. |

Personal Auto Insurance | You're already paying for it. Familiar claims process. | You must pay your deductible. A claim could raise your future premiums. May not cover all rental company fees. | Domestic travel where your policy provides clear, comprehensive coverage for rentals and you're comfortable with your deductible. |

Credit Card Benefits | Often included at no extra cost. Primary coverage avoids claims on your personal policy. | Coverage limits and vehicle exclusions apply. Requires declining the CDW and paying with the card. Secondary coverage still requires a personal claim. | Savvy travelers with a premium card offering primary coverage, who have verified the terms and are renting an eligible vehicle. |

Each option has its place. The rental company’s waiver offers peace of mind for a price, while your own insurance and credit card benefits reward a bit of prep work with significant savings. Understanding the differences is the key to making the smartest choice for your trip.

Is the Extra Cost for a CDW Really Worth It?

So, you're standing at the rental counter, and they ask if you want the Collision Damage Waiver. It's a classic moment where you have to decide: is this extra charge a smart move or just an unnecessary expense?

Let's be real, the peace of mind is nice, but the daily cost of a CDW can seriously pump up your final bill. We're not talking about a small, flat fee here. The price can swing quite a bit depending on a few things.

You can expect to see prices ranging anywhere from $15 to over $30 a day. Think about that for a second. On a week-long trip, you could be adding an extra $105 to $210 to your rental cost. That’s a pretty big chunk of change, so you’ve got to weigh that expense against how much risk you’re comfortable taking on.

What Makes the Price of a CDW Go Up or Down?

That daily rate you're quoted isn't just a number pulled out of thin air. Rental companies are constantly calculating their risk, and that calculation directly impacts the price they offer you for collision damage waiver coverage.

Here are the main things that move the needle on cost:

The Car You Choose: It makes sense, right? A fancy luxury sedan or a big SUV is going to cost more to repair or replace than a basic economy car. So, the CDW for a higher-end vehicle will almost always be more expensive.

Where You're Renting: Picking up a car in a busy city or a popular tourist spot? Expect a higher CDW rate. The risk of accidents, dings, and theft is just greater in those high-traffic areas compared to a quiet, rural town.

The Rental Company Itself: Every company has its own way of pricing things. It's always a good idea to shop around and explore different Miami car rental deals to see how those costs compare.

Knowing these factors ahead of time helps you get a better feel for the potential cost and decide if it fits your travel budget.

When Paying for the CDW Is a No-Brainer

It’s tempting to just say "no, thanks" to the waiver every time to keep costs down. But honestly, there are times when buying it is absolutely the smartest—and safest—call you can make.

The real beauty of a CDW is the simplicity it offers. If something happens, you can often just hand back the keys and walk away, skipping the headache of a long, drawn-out claims process with your own insurance company.

You should seriously consider buying the CDW if:

You don’t have other coverage. If you don't own a car and don’t have a personal auto policy, or if your credit card doesn’t offer any rental car protection, the CDW is your main safety net.

You’re traveling internationally. Big one here. Your personal car insurance from home almost certainly won't cover you in another country. Trust me, trying to handle a claim in a foreign language and legal system is a nightmare you want no part of.

Your personal insurance has a high deductible. If your policy has a $1,000 deductible (or more), paying for the CDW might actually be cheaper than paying that out-of-pocket if you get into a fender-bender.

You just want total convenience. For a lot of people, especially those on vacation, the extra daily cost is worth it just to avoid the potential stress, phone calls, and paperwork of filing a claim.

Handling a Claim With and Without CDW

Getting into an accident is stressful enough, but what happens next with your rental car can go one of two very different ways. It all comes down to a single decision you made at the counter: did you get the Collision Damage Waiver (CDW)?

The experience is night and day. One path is a quick, straightforward conversation with us. The other involves a lot more phone calls, paperwork, and dealing with outside companies.

What Happens When You Have CDW Coverage

If you opted for our collision damage waiver coverage, dealing with a claim is about as simple as it gets. Think of it as the easy button for rental car damage. Your only real job is to let us know what happened as soon as you can.

Here’s how it usually plays out:

Report the Damage: When you bring the car back, just show the damage to our agent.

Fill Out a Form: We’ll have you fill out a quick incident report. It’s usually just a page or two explaining what happened.

You’re Done: And that's it. Seriously. Because you have the waiver, we handle all the repairs and costs on our end. You won't have to pay a deductible or get your personal insurance involved.

The biggest perk here is pure convenience. No endless phone calls with insurance adjusters and no worries about your personal insurance rates going up.

What Happens When You Don’t Have CDW Coverage

If you decide to decline the CDW, you’re on the hook for any damage. This makes the claims process a lot more hands-on, as you'll have to manage things between our rental agency and your own insurance provider or credit card company.

Keep in mind: Without a waiver, you are responsible for the entire cost of repairs. On top of that, you could be charged for "loss of use" while the car is in the shop, plus administrative fees.

The process is definitely more involved:

Document Everything: The first thing you should do is take plenty of photos and videos of the damage from every angle.

File Reports: You’ll need to file a report with us and, depending on the situation, with the local police.

Start a Claim: It's on you to call your personal auto insurer or credit card benefits administrator to get the claims process rolling.

Pay Your Deductible: You'll have to pay your own insurance deductible first, which is often $500 to $1,000 or even more.

Play the Middleman: You become the main point of contact, shuffling documents and information between us and your insurance company.

Going this route takes a lot more of your time and energy. To see what our customers have to say about their experiences, you can read a Cars4Go customer review of our service.

Taking Advantage of Modern Tools for Your Rental Coverage

Long gone are the days when your only option for rental car coverage was the one pushed on you at the rental counter. Thanks to technology, you now have the power to shop around and lock in your protection well before you even see the car.

This change is all about the rise of digital platforms and apps. These tools let you easily compare different third-party coverage options, where you'll often find plans with equal—or even better—protection than a standard CDW, but for a fraction of the daily cost.

Say Goodbye to Counter Pressure

Imagine buying your coverage from the comfort of your own home, days before your trip. You can walk up to that rental desk with your policy already sorted, confidently saying "no, thank you" to those pricey last-minute add-ons.

This digital-first approach finally brings some much-needed transparency to the rental insurance game. You get the time to actually read the fine print, understand what's covered (and what's not), and pick a plan that fits your trip and budget—all without a salesperson breathing down your neck.

Technology is genuinely changing how we handle rental insurance. Big players in the insurance world are rolling out slick digital platforms and apps that make buying and managing a policy incredibly simple. It's a smoother, more user-friendly experience from start to finish. You can dive deeper into how digital solutions are transforming the car rental insurance market to see just how big this shift is.

At the end of the day, these modern tools put you back in the driver's seat. They don't just save you money; they cut out the stress and confusion that used to be a regular part of renting a car.

Questions We Hear All the Time About CDWs

Even after you get the hang of what a collision damage waiver is, a few specific questions always seem to pop up. Let's tackle the most common ones we hear from our renters so you can feel completely confident in your decision.

Is a Collision Damage Waiver Just Another Name for Insurance?

This is a big one, and the answer is no. It’s a really important distinction to make. A CDW isn't an insurance policy at all; it's a waiver.

Think of it this way: when you accept the CDW, the rental company is essentially agreeing ahead of time not to come after you for the cost if their car gets damaged. It's an agreement that waives your financial responsibility for that specific vehicle.

It doesn’t cover liability at all, though. That means it won’t pay for injuries to other people or damage to their property if you cause an accident. Liability coverage is a completely separate thing, often required by law, and handled differently.

What’s the Worst That Can Happen If I Say No to the CDW?

If you decide to decline the waiver and the car ends up with a dent or worse, you're on the hook for the full cost of the repairs. And it doesn't always stop there—you could also be hit with administrative fees and "loss of use" charges to cover the income the company loses while their car is stuck in the shop.

You’d have to go through the process of filing a claim with your personal car insurance or the provider on your credit card. This usually means paying a deductible out of your own pocket first and dealing with a lot more paperwork and hassle than you would with a simple waiver.

The Bottom Line: Saying "no" to the CDW means you're personally accepting all the financial risk. The rental company will charge you directly, and then it's up to you to chase down the reimbursement from your insurance.

Does a CDW Also Cover Me If the Rental Car Gets Stolen?

Usually, yes. Most rental companies roll collision and theft protection together into something called a Loss Damage Waiver (LDW). This combined waiver typically covers you for both accident damage and the complete theft of the vehicle.

But you have to pay attention to the fine print, as policies can differ between rental locations and companies. Always read your rental agreement to see exactly what's included. For example, if the car is stolen because you were negligent—like leaving the keys in an unlocked car—you can bet that won't be covered.

For more tips on making smart rental decisions, check out the other guides and articles on our Cars4Go rental car blog.

At Cars4Go Rent A Car, we're all about making your rental experience straightforward and worry-free. Book your next Miami trip with us and get transparent pricing with absolutely no hidden fees. Reserve your car today!

Comments