Do Rental Cars Come With Insurance? Your Miami Guide

- fantasma70

- Jan 30

- 10 min read

The short answer is yes, rental cars almost always come with some insurance. But here's the catch: it's usually just the bare-minimum coverage required by state law.

Think of it like buying a house—it meets the basic building code, but it doesn't come furnished. This base-level insurance typically covers damage you might cause to other people's cars or property, but it does absolutely nothing to cover the car you're actually driving.

What Insurance Do You Really Get With a Rental Car?

So, when you ask if your rental comes with insurance, the real answer is a bit more complicated than a simple "yes." What's included is state-mandated liability insurance—a safety net for everyone else on the road, not for you or the several-thousand-dollar asset you're responsible for.

This creates a pretty significant gap. If the rental car gets a tiny door ding in a parking lot, is involved in an accident, or is stolen, you could be on the hook for the entire repair bill. And it doesn't stop there; rental companies often add on administrative fees and "loss of use" charges for the time the car is in the shop.

Understanding What's on the Table

This isn't a bait-and-switch; it's just how the industry works. In major markets like North America, which made up around 35% of the global car rental insurance market in 2023, offering basic liability is standard practice. The real money for rental companies comes from the optional add-ons, like a Collision Damage Waiver (CDW) or theft protection. For a deeper dive into these industry trends, you can check out the global car rental insurance market report.

To help you see the difference clearly, here’s a quick breakdown of what’s usually included versus what costs extra at the rental counter.

Rental Car Insurance at a Glance

Coverage Type | Usually Included? | What It Covers |

|---|---|---|

State Minimum Liability | Yes | Damage you cause to other people's vehicles and property. |

Collision Damage Waiver (CDW/LDW) | No (Optional Extra) | Damage to the rental car itself, from accidents to dings. |

Supplemental Liability Insurance (SLI) | No (Optional Extra) | Extra liability protection above the state minimum. |

Personal Accident Insurance (PAI) | No (Optional Extra) | Medical costs for you and your passengers after an accident. |

Personal Effects Coverage (PEC) | No (Optional Extra) | Theft of personal belongings from the rental car. |

Knowing what these options mean before you get to the counter is the key. It's the difference between driving with genuine peace of mind and unknowingly risking a massive, vacation-ruining bill.

Understanding the Alphabet Soup of Rental Coverage

Stepping up to the rental counter can feel like a pop quiz. The agent starts throwing around acronyms—CDW, LDW, SLI—and suddenly, you're nodding along, hoping you're making the right call. It’s confusing, but it doesn’t have to be.

Let's break down exactly what they're offering. Think of these as individual layers of protection. Each one covers a specific risk, and knowing what's what is the first step to driving off the lot with confidence, not confusion.

Protecting the Rental Car Itself

The first thing you'll almost always hear about is the Collision Damage Waiver (CDW), sometimes called a Loss Damage Waiver (LDW). Fun fact: it's not technically "insurance." It's an agreement.

Simply put, when you buy the CDW, the rental company is waiving its right to come after you for the cost of damage or theft. It’s your get-out-of-jail-free card for dents, dings, or even if the car is stolen.

Without it, you could be on the hook for the car's full value, plus a bunch of administrative and "loss of use" fees you never saw coming. This is the big one to think about for protecting the actual vehicle you're driving.

Protecting Others and Your Own Finances

Next up is Supplemental Liability Insurance (SLI). Your rental already comes with the bare-minimum liability coverage required by the state, but "minimum" is the key word here. In a serious accident, that's often not nearly enough.

SLI acts as a safety net on top of that basic coverage. If you’re at fault in an accident, the costs for injuries or property damage can skyrocket past those minimum limits. SLI steps in to cover the difference, protecting your savings and personal assets from getting drained by a lawsuit.

Protecting You and Your Stuff

Finally, there's a bundle of coverage designed to protect you and your passengers directly. This usually comes in a package with two parts:

Personal Accident Insurance (PAI): This helps pay for medical bills for you and anyone in the rental car if there’s an accident, no matter who was at fault. It works a bit like health insurance but is tied specifically to your time in that vehicle.

Personal Effects Coverage (PEC): This one is for your belongings. If someone breaks into the rental and steals your laptop or luggage, PEC will help you recover the value of what was lost, up to a certain limit.

Once you understand what each of these does, you can start asking the real money-saving question: "Do I already have this coverage somewhere else?" Your personal auto policy or even a credit card might already have you covered, which we'll get into next.

Will Your Personal Auto Insurance Cover the Rental Car?

This is probably the biggest question travelers have at the rental counter. The short answer is yes, for most U.S. drivers, your personal auto insurance policy often extends to the car you're renting. But it’s not always a perfect one-to-one match, and that's where people can get into trouble.

Think of it like this: your personal insurance policy generally follows you as a driver, not just your specific car. So, the same liability, collision, and comprehensive coverages you carry on your own vehicle usually apply when you get behind the wheel of a rental.

The Devil Is in the Details

Relying entirely on your personal policy can leave you with some surprising and costly gaps. For starters, most policies will only cover a rental car up to the value of your own vehicle. If you drive a 10-year-old sedan at home but decide to rent a brand-new luxury SUV for your trip, you could be seriously underinsured if something happens.

On top of that, your personal insurance almost never covers the extra fees rental companies tack on after an accident. These charges can add up fast.

Loss of Use: The rental company can charge you for every day the car is in the shop, since they can't rent it out and are losing income.

Diminished Value: This covers the permanent drop in the car's resale value after it's been in an accident, even if it’s perfectly repaired.

Administrative Fees: These are charges for all the internal paperwork and time they spend handling the claim.

Before you just assume you're covered, it pays to make a quick call to your insurance agent. Asking a simple question like, "Will my policy cover loss of use and administrative fees on a rental?" can save you from a massive financial headache down the road.

Taking five minutes to confirm these details gives you peace of mind before you even step up to the rental desk. For more practical travel advice, check out the other guides on our Cars4Go blog. A little bit of prep work goes a long way.

2. Your Credit Card Might Be Your Best Friend

You might be holding a secret weapon against high rental car insurance fees right in your wallet. Many credit cards, especially travel and premium cards, offer rental car coverage as a standard perk. This can be a fantastic way to sidestep the pricey Collision Damage Waiver (CDW) at the rental counter.

But here's the catch: not all credit card coverage is created equal. It's crucial to understand the details before you rely on it. The biggest difference comes down to one key distinction.

Primary vs. Secondary Coverage: What's the Deal?

Think of it like this: primary coverage is your first line of defense. If you have an accident, your credit card company steps up to handle the claim directly. You don't even have to call your personal auto insurer, which means no claim on your record and no risk of your premiums going up. It’s clean and simple.

Secondary coverage, on the other hand, is more like a backup player. It only kicks in after your personal auto insurance has paid out. It will typically cover your deductible and other costs your main policy doesn't, but you still have to file a claim with your own insurance company first.

The Bottom Line: Primary coverage is the gold standard. It keeps your personal insurance out of the picture, saving you a potential headache and a rate hike. Always find out which type your card has.

Always, Always Read the Fine Print

Before you confidently wave off the rental company’s insurance, you have to do a little homework. Credit card benefits are packed with exclusions, and what they don't cover can be a real surprise.

Common exclusions often include:

Luxury, exotic, and antique cars (that cool BMW might not be covered).

Trucks, large passenger vans, and RVs.

Rentals that last longer than 15 or 31 consecutive days.

Rentals in certain countries (Ireland, Israel, and Jamaica are common exclusions).

These perks are a big deal in the travel world, and with demand growing among travelers like the diverse clientele at Cars4Go Rent A Car in Miami, understanding what you're getting is key. Taking a moment to verify can save you a world of trouble. You can get a sense of how the rental car insurance market is evolving and why these benefits matter.

The easiest way to get the facts? Just call the number on the back of your credit card. Ask the representative to explain the "auto rental collision damage waiver" benefits. That five-minute phone call can give you all the peace of mind you need.

Hit the Miami Roads with Total Peace of Mind

Renting a car in Miami should be the start of a great adventure, not a source of stress. At Cars4Go Rent A Car, we think the whole process should be simple and clear, without any high-pressure sales tactics or confusing surprise fees when you get to the counter. We want you to feel supported right from the get-go.

Whether you're visiting from another country and trying to figure out U.S. insurance, or you're a local family taking advantage of perks like our free car seats, we believe clarity is everything. That’s why our team is always ready to chat by phone or WhatsApp to answer all your questions before you commit.

A Rental Experience Built Around You

We've designed our process to be hassle-free, a welcome escape from the typical airport rental chaos. Our customers, from tourists soaking up the sun to locals needing a weekend ride, get a flexible experience that includes GPS, loyalty points, and unlimited miles within Florida.

With travel booming, more and more people are seeing the wisdom in making sure their trip is protected. In fact, a recent rental car insurance market report highlights this growing trend. Taking a moment to double-check your coverage is the final, crucial step to avoiding unexpected costs on your journey.

Our promise is simple: a straightforward rental experience so you can feel confident and excited to explore everything Miami has to offer, from the sands of South Beach to the vibrant art districts.

This no-nonsense approach lets you focus on the fun part—planning your trip. By giving you clear answers and helpful extras, we make sure you drive away with nothing but peace of mind.

Ready to start? Check out our convenient Miami car rental locations and let’s get your adventure rolling.

Your Pre-Rental Insurance Checklist

Before you hop in the driver's seat and head for the Miami sun, a quick final check can save you a ton of headaches later. Think of it as a last-minute pit stop to make sure you’ve got the right coverage without paying for extras you don't actually need.

Final Checks Before You Drive

A few minutes of prep can make all the difference. Here’s a simple but effective checklist to run through:

Call Your Auto Insurer: Get on the phone with your insurance agent. The big question is whether your personal policy’s collision and liability coverage carries over to rental cars. Be specific—ask them directly about “loss of use” and administrative fees, as these are sneaky little gaps many standard policies don’t cover.

Verify Credit Card Benefits: Don’t just assume your card has you covered. Call the number on the back of the credit card you plan to use. You need to know if their rental car insurance is primary or secondary. Also, ask about any exclusions, like certain types of vehicles (trucks, luxury cars) or long-term rental periods.

Inspect the Car: This one is huge. Before you even think about leaving the lot, do a slow walk-around of the vehicle. Use your phone to take pictures or a quick video of every single scratch, ding, or dent you see, no matter how tiny. Point them out to the rental agent and ensure they’re all noted on your rental agreement.

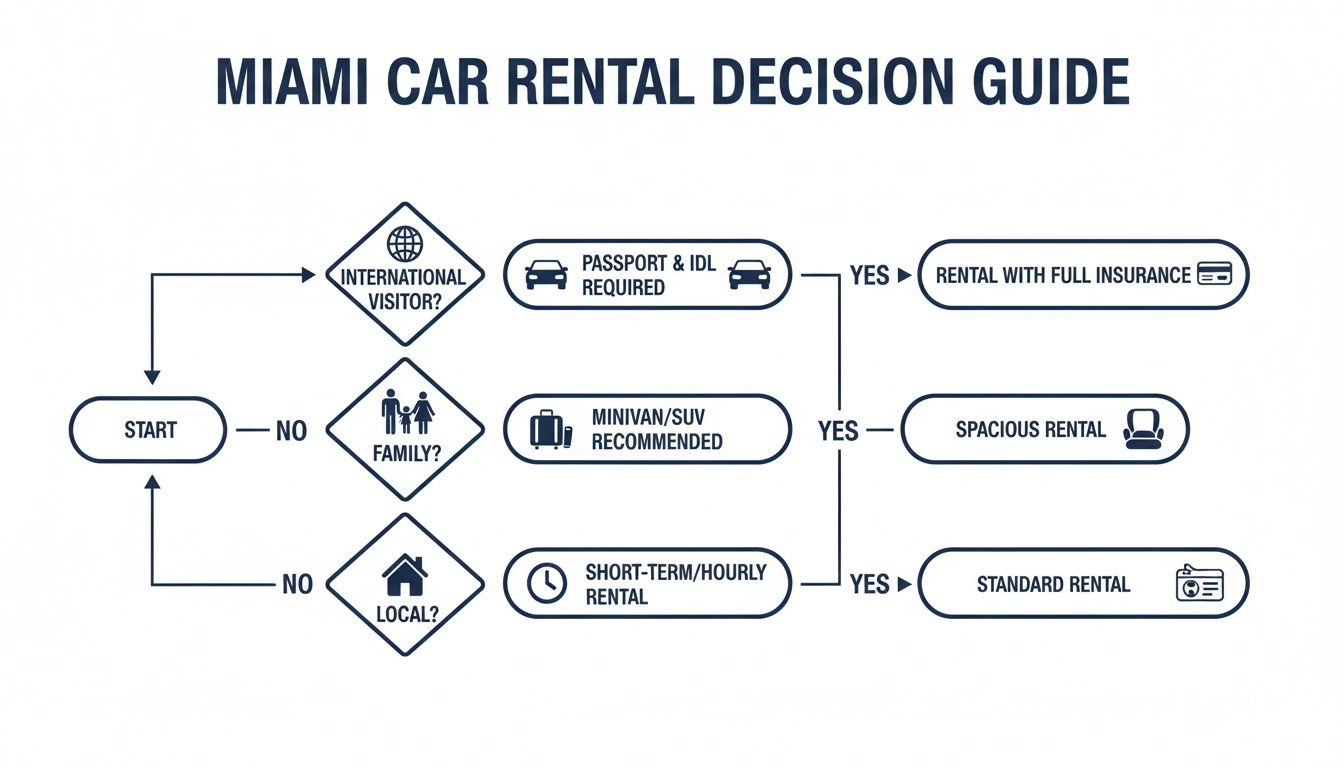

This simple decision tree can help you visualize the best approach based on your travel situation.

Running through this process helps you figure out exactly what you need, whether you're a local just grabbing a car for the weekend, a family on vacation, or a visitor from another country.

Once you know you've made the smartest insurance choice, you can confidently explore our current car rental deals and get on the road.

Your Top Rental Insurance Questions, Answered

Let's clear up a few common questions that pop up right at the rental counter. Knowing the answers ahead of time will help you feel confident no matter what comes up.

What Happens if I Decline Their Insurance and Have an Accident?

If you decide to pass on the rental company's insurance and end up in a fender-bender, you'll be leaning on your own coverage. That means you'll start the claims process with either your personal auto insurance provider or the benefits administrator for your credit card.

Should an accident happen, understanding how to file an auto insurance claim is your next critical step. Just keep in mind that you'll be on the hook for your personal policy's deductible and potentially other charges the rental company levies, like "loss of use" fees.

How Does Insurance Work for International Visitors?

This is a big one for travelers coming to the U.S. Your personal auto policy from your home country almost certainly won't cover you here. For most international visitors, the easiest and safest route is to buy liability coverage and a Collision Damage Waiver (CDW) directly from the rental agency.

It's really important for international travelers to get proper coverage at the counter. This protects you from major financial headaches while navigating different laws and driving conditions.

This ensures you're legally compliant with local state laws and you're covered if the rental car gets damaged.

At Cars4Go Rent A Car, we want this part of your trip to be simple and stress-free, so you can focus on the road ahead. https://www.cars4go.com

Comments