Car Rental Debit Card: A Complete Guide to Renting

- fantasma70

- Dec 29, 2025

- 12 min read

It’s a common question I hear all the time: "Can I actually rent a car without a credit card?" The answer is a resounding yes. Using a debit card to rent a car isn't just possible—it’s becoming a popular and smart way to travel, especially with customer-first companies leading the charge.

Let’s walk through how it works, so you can book your next ride with confidence.

Why Renting With a Debit Card Is a Smart Choice

The old myth that you absolutely need a credit card for a rental car is finally fading. The reality is, most major rental agencies have updated their policies. It's a welcome change that makes travel more accessible for everyone, whether you're an international visitor without a U.S. credit card or just someone who prefers not to use one.

Paying with a car rental debit card is simple and direct. The money comes right out of your bank account, which is a fantastic way to keep your travel budget in check and avoid any post-vacation debt surprises.

The Upside of Using Your Debit Card

While credit cards are still a go-to for many, paying with debit has some real perks that are perfect for today’s savvy travelers. Here’s why it might be the best move for your next trip to Miami.

You'll Stick to Your Budget: When the funds come directly from your checking account, there’s no temptation to overspend. It’s a great way to keep a close eye on your expenses in real-time.

No Credit History Needed: This is a huge advantage for students, young drivers, or anyone who simply chooses to live credit-free. You can secure a car without having to prove your creditworthiness.

Forget About Interest: By paying with your own money, you completely sidestep the risk of racking up interest charges that often come with carrying a balance on a credit card.

A Quick Heads-Up: Keep in mind that not all plastic is the same. Rental companies will almost always require a debit card with a Visa or Mastercard logo tied directly to a checking account. Prepaid debit cards or gift cards are typically a no-go for the initial security deposit.

Getting your rental sorted with a debit card is pretty straightforward once you know what to expect. At Cars4Go, we focus on making it a smooth process with clear, upfront policies.

Whether you need a zippy economy car for getting around the city or a roomy SUV for a family road trip, you can check out all the different car types available for rent to find what works for you. This guide is all about giving you the know-how to book your Miami rental without any of the usual stress.

Getting Your Paperwork in Order

Renting a car with a debit card? It's totally doable, but you've got to come prepared. The key is to have all your documents lined up before you even think about walking up to that rental counter. It’ll save you a world of hurt later.

While the requirements are a bit stricter than for credit card users, it's not personal. The rental company is handing over a car worth thousands of dollars, so they just need a little extra proof that you are who you say you are. Your driver's license alone often won't cut it.

What to Have Ready

So, what exactly do you need to bring? The list can change a bit from one rental agency to another, but a few items are almost always on the checklist when you pay with a debit card.

Proof of Travel: If you’re flying into a place like Miami International and renting from the airport, have your round-trip flight itinerary ready. It shows the company you plan on coming back.

Proof of Residence: This is a big one for local renters. You’ll likely need a recent utility bill or a bank statement with your name and address on it, and that address has to match what's on your driver's license.

Sufficient Funds: Make sure your debit card is a Visa or Mastercard tied to a checking account. You'll need enough in that account to cover the entire rental cost plus a hefty security deposit, which we'll get into shortly.

Don't be surprised by these extra steps. With credit card use in the car rental world dropping from 90% of bookings to 85% in a single year, companies are getting more used to debit card payments. It's just a different process.

Pro Tip: The best thing you can do is call the actual rental location you'll be using. Don't just rely on the national website. A quick chat with the local branch manager can clear up any specific rules they might have that differ from the corporate policy.

Keeping Your Records Straight

After you've paid and picked up the keys, don't just toss your paperwork. Good record-keeping is your best friend for a hassle-free return.

Understanding what goes into creating a perfect car rental receipt can help you spot-check every line item and make sure the charges and holds are all correct.

Hang onto your rental agreement and the final receipt until that security deposit is safely back in your bank account. It’s a simple step, but it’s your proof if any weird charges pop up later. Having those documents gives you all the power.

Understanding The Security Hold On Your Debit Card

The biggest "gotcha" moment for many people renting a car with a debit card is the security hold. It's that point at the counter when the agent mentions a surprisingly large chunk of money will be temporarily locked in your account. If you're not ready for it, a little bit of panic can definitely set in.

Let’s get one thing straight: a security hold isn't an actual charge. It’s more like a temporary freeze on funds in your bank account. Car rental companies do this as a form of insurance, making sure they can cover potential costs like late returns, refueling fees, unexpected tolls, or minor dings and scratches after you drive away.

Why Debit Card Holds Are Almost Always Higher

So, why is the hold for a debit card often so much steeper than for a credit card? It all boils down to risk.

When you hand over a credit card, you're giving the rental agency access to a line of credit they can tap into if needed. This gives them a strong safety net. A debit card, on the other hand, pulls directly from the cash you have in your account. Because that amount is finite, they see it as a bigger risk.

To balance that out, companies place a larger hold on debit card rentals. It's a standard industry practice that protects their vehicles and ensures they have a big enough buffer for any extra costs.

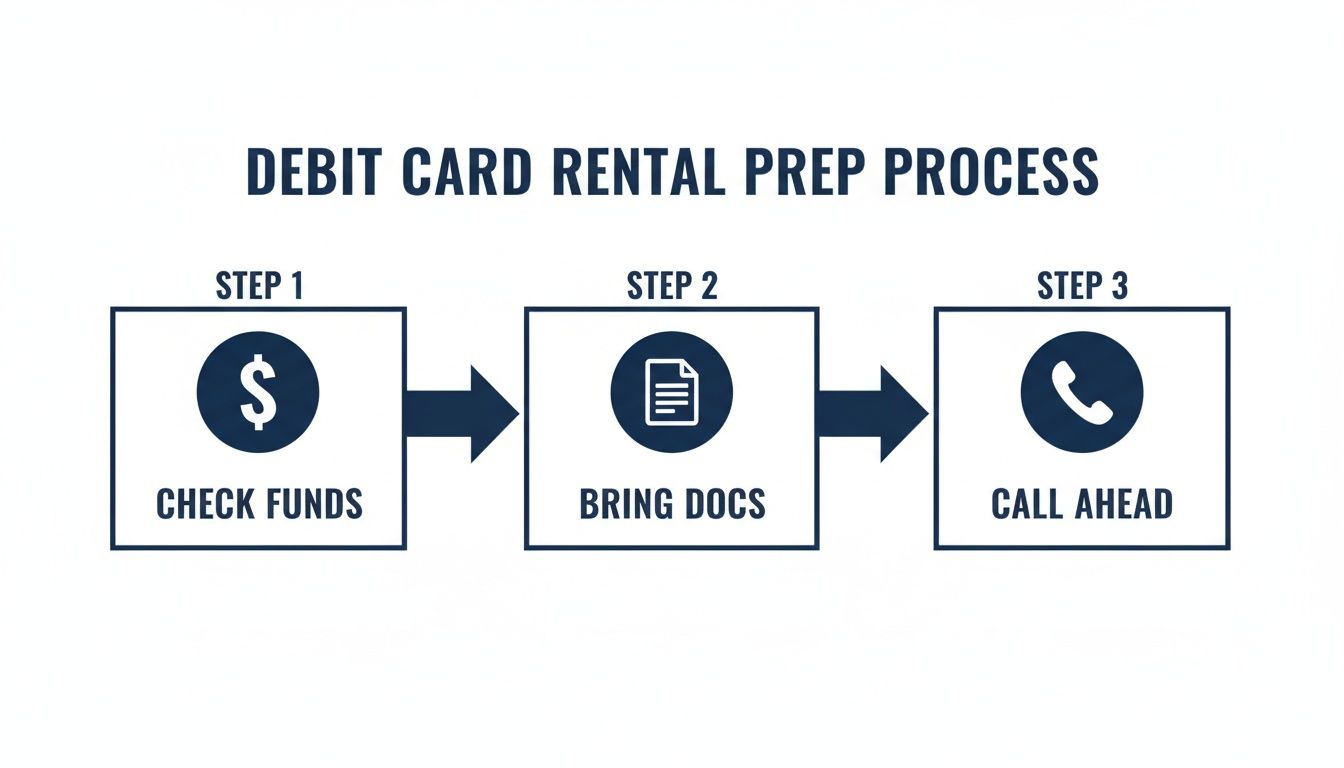

The image below breaks down the simple prep work you can do to avoid any unpleasant surprises at the rental desk.

Following these three steps—checking your funds, gathering your documents, and calling the branch beforehand—is the secret to a smooth, hassle-free rental.

How Much Cash Should You Expect To Be Held?

This is the million-dollar question, and the answer can vary wildly. The exact hold amount depends on the rental company, the specific location, the class of car you're renting, and how long you'll have it.

A typical security hold for a debit card user can run anywhere from $200 to over $500. The single most important thing you can do is call your specific rental branch and confirm the amount before you show up. This way, you can make sure your account can handle the hold on top of your other travel expenses.

This isn't a new trend; high deposits are a well-known hurdle for debit card users. For example, it’s not uncommon for major companies to slap a $500 hold on a debit card rental versus just $200 for a credit card. That’s a huge difference that can seriously impact your spending money. You can find more data on car rental market trends and deposit policies to see how these industry standards play out.

To put it in perspective, here's a quick look at what you might expect.

Comparing Potential Security Holds Debit vs Credit Card

This table gives a quick look at typical security hold amounts for different payment types, showing why debit card users should plan for potentially higher holds.

Payment Method | Typical Hold Amount (US) | Key Consideration |

|---|---|---|

Debit Card | $200 - $500+ | Funds are frozen directly in your checking account. |

Credit Card | $150 - $300 | Hold is placed against your credit limit, not your cash. |

As you can see, the direct impact on your available cash is the main reason you need to plan carefully when using a debit card.

So, When Do You Get Your Money Back?

Once you return the car safe and sound, the rental company will release the hold on their end. But don't expect the money to pop back into your account instantly.

It usually takes your bank 5-10 business days to process that release and make the funds available to you again. This delay is almost always on the bank's side, not the rental company's. Make sure you factor this timeline into your travel budget. Those funds will be out of commission for a week or two after your trip ends, so planning for that temporary cash freeze is the key to a stress-free rental.

How to Sidestep Common Fees and Hassles

Renting a car with a debit card is totally doable, but a little bit of smart planning can save you from a lot of potential headaches and surprise fees. The goal here is simple: drive off the lot with complete peace of mind, confident that the final bill will match what you were quoted.

A few proactive steps can make a world of difference. Your main focus should be on minimizing the security hold tied up on your card and ensuring there are no last-minute charges when you bring the car back.

Getting That Security Hold Down

Want to know a little trick that can sometimes lower the security hold? Ask about buying the rental company's own insurance coverage. Even if your personal auto insurance covers rentals, agencies often breathe a little easier—and lower the hold amount—when you opt into their Collision Damage Waiver (CDW) or Loss Damage Waiver (LDW).

It’s not a guaranteed trick, but it's always worth asking the agent if adding their insurance will reduce the hold. I've seen situations where a $500 hold drops to a much more manageable $250 just by adding their coverage. That can free up a nice chunk of cash for your actual trip.

Here’s the bottom line: the price you see online should be the price you pay. Stick with companies that are upfront about their costs, like Cars4Go, to make sure you aren't hit with hidden fees or surprise upcharges at the counter.

Document Everything Before You Drive Away

This is the single most important thing you can do, especially when a big chunk of your money is on the line with a debit card hold. Before you even think about putting the key in the ignition, channel your inner detective.

Grab your smartphone and take a detailed video and plenty of photos of the car, inside and out.

Do a full walk-around, capturing every single scratch, dent, or scuff you can find. Don't be shy.

Zoom in on the details. Get close-ups of the wheel rims, any windshield chips, and bumper scrapes.

Snap photos of the interior, looking for seat stains, tears in the upholstery, or any dashboard damage.

Get a clear shot of the instrument cluster to document the starting mileage and the fuel level.

This five-minute exercise is your best defense against being blamed (and charged) for damage you didn't cause. It’s a simple habit that can literally save you hundreds of dollars and a ton of stress.

If you’re looking for ways to save, check out these deals for a car rental in Miami to get an idea of what’s out there. And while you’re thinking about protecting your wallet, it’s also smart to know how a good car security system can help keep the vehicle itself safe during your rental.

How We Make Renting a Car in Miami Easy

Let's be honest: trying to figure out the rules for a car rental debit card can feel like a real headache, but it shouldn't derail your travel plans. The secret is to find a rental company that actually gets what modern travelers need—convenience over complicated rules. This is especially true in a place as busy as Miami.

Imagine this: you get to skip the endless lines and aggressive sales pitches at the airport counter completely. For anyone using a debit card, that’s a huge win, since you’re already under a bit more of a microscope. At Cars4Go, we’ve built our entire process to get rid of those common frustrations from the get-go.

A Clear and Simple Process

We've all been there. You get a great quote online, but by the time you're at the counter, the final price is way higher. Surprise insurance fees, location surcharges, and other hidden costs can blow up your budget. It's even more stressful when a big security hold is already tying up the cash in your checking account.

That’s why transparent pricing is so important. With us, the price you book is the price you pay. Period. This "no hidden fees" approach gives you the peace of mind to budget properly without worrying about nasty surprises when you pick up the car. We happily accept both debit and credit cards, making payment flexibility a core part of our service.

Honestly, the best perk for a debit card user is anything that cuts down on stress. When we bring the car right to you, you skip the entire counter experience—which is exactly where most of the hassle and upselling happens.

Unique Perks That Actually Make a Difference

Beyond straightforward pricing, a few key benefits can completely change your rental experience, especially if you're using a debit card. These aren't just frills; they’re practical extras designed to solve real problems and add genuine value.

Here are a few things we do to make your trip smoother:

Door-to-Door Delivery: Why fight the chaos at the airport rental center? We can bring the car directly to you, whether you're at Miami International Airport (MIA), your hotel, or an Airbnb. You get to start your trip your way.

A Free Second Driver: Most companies charge a daily fee to add another person to the rental. We include a second driver for free, so you can share the driving duties with your partner or a friend without the extra cost.

Free GPS and Car Seats: These essentials can add up fast, often costing $10-$15 per day each at other places. Getting them included for free is a serious budget-saver, particularly on longer rentals.

These benefits help take the sting out of a debit card security hold by lowering your total rental cost. You can check out all the different car rental locations in Miami where we offer these services. It’s this focus on making your life easier that turns a potentially frustrating process into a seamless part of your vacation.

Still Have Questions About Renting with Debit?

It's completely normal to have a few questions, even if you've done your homework. Renting a car with a debit card has its own set of rules, and it’s always better to clear things up before you're standing at the counter.

Let's walk through some of the most common things people ask.

Will They Really Run a Credit Check?

Yep, you should probably expect it. Most of the big rental companies will run a soft credit check when you hand over a debit card.

Don't let that scare you. This is just their standard procedure to make sure you're a low-risk renter before they give you the keys to a $30,000 asset. The good news is that these are "soft inquiries," which do not affect your credit score. Policies can differ from one location to the next, so a quick call ahead to confirm is always a smart move.

What if My Debit Card Gets Declined?

That's a moment of pure panic, right? But stay calm. If your card is declined, it's almost always for one of two reasons: not enough money in the account for the rental and the hefty security hold, or you missed one of the company's specific rules.

Your first step is to politely ask the agent why it was declined. If it's an issue with your balance, you might be able to fix it right there by transferring funds. If it's a policy issue (like you're a local renter or don't meet an age requirement), ask about your options. Can a friend with a credit card take over the rental? Is there any other proof of ID or residency you can provide?

Honestly, the best defense here is a good offense. Before you even head out the door, log into your banking app. Check your balance against the total estimated cost plus the security deposit. A quick review of the policy on their website can save you a world of headache.

Can I Use a Prepaid Debit Card?

I'll make this one short and sweet: almost certainly not. Prepaid cards from places like Visa or Green Dot are a no-go at virtually every rental agency for the security deposit.

Why? Rental companies need a direct line to a real bank account. This gives them a way to charge you for things that might pop up later, like unpaid tolls, parking tickets, or damage to the vehicle. A prepaid card just doesn't offer them that security. They'll need a debit card linked to a checking account with your name on it.

How Do I Get My Security Deposit Back Faster?

This is the frustrating part—you can't really speed it up. Once you return the car, the rental company releases the hold on their end pretty quickly, usually within 24 hours.

After that, it's all up to your bank. The ball is in their court, and it can take anywhere from 5 to 10 business days for the money to actually reappear in your available balance. To avoid any delays from the rental company's side, make sure you bring the car back on time, clean, and with a full tank of gas. If it feels like it's taking forever, your best bet is to call your bank directly and ask about the status of the pending transaction.

Ready to book your Miami trip without the usual rental hassles? At Cars4Go Rent A Car, we make renting with a debit card simple and transparent. Get a clear, upfront quote and enjoy perks like door-to-door delivery. Book your car today!

Comments