Car Rental After Accident: Essential Guide for Quick Help

- fantasma70

- Oct 7, 2025

- 12 min read

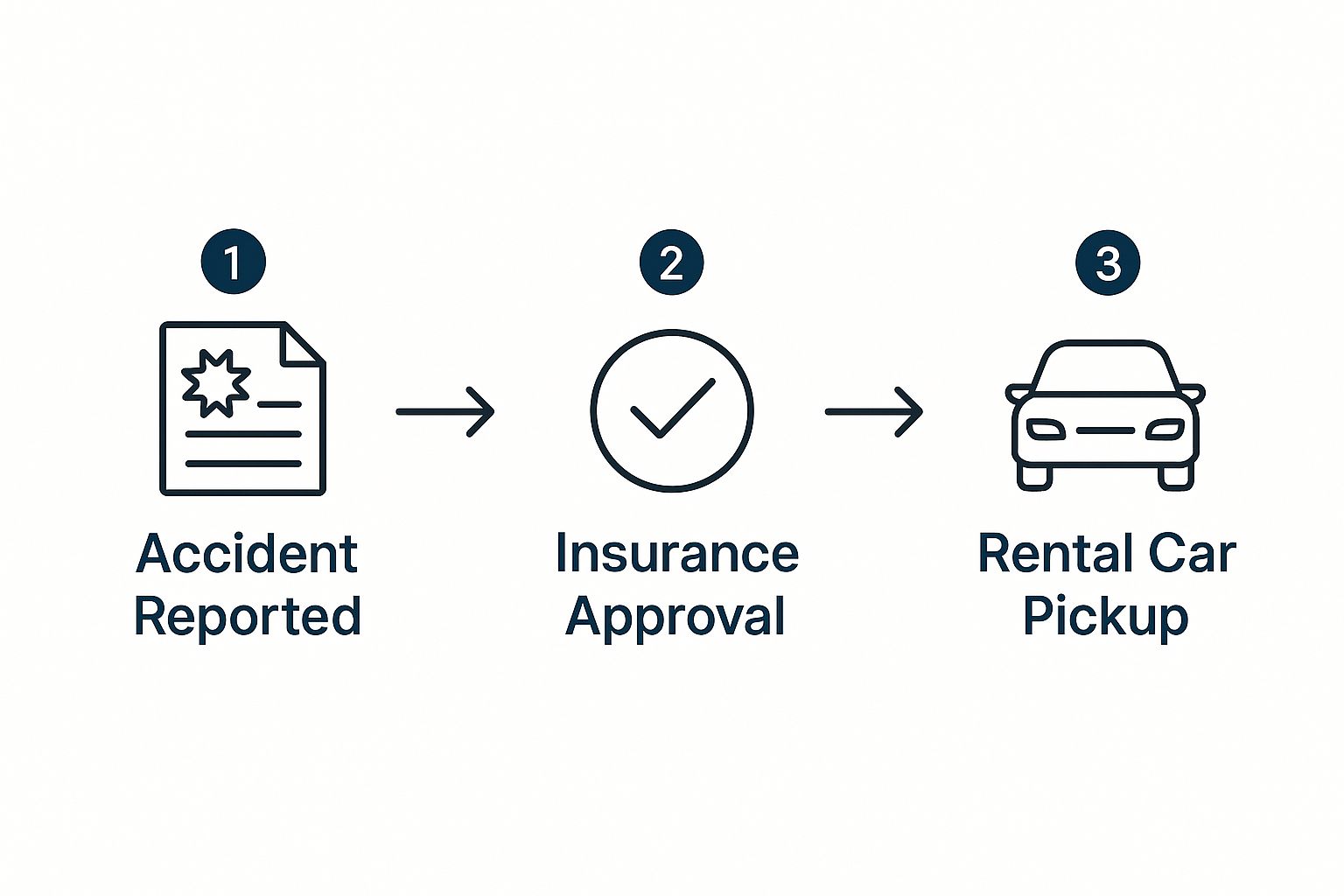

The quickest way to get a car rental after an accident is to ring up your insurance agent and get your rental reimbursement coverage rolling. This one call gets you a claim number and confirms your daily spending limit—the two most important details you need to book a replacement car right away. Honestly, everything else depends on getting this done first.

Your First Moves to Secure a Rental Car

In the chaos that follows a car accident, figuring out a rental can feel like just another massive headache. But it doesn't have to be. A few quick, smart moves can make all the difference.

Your absolute first priority? Call your insurance company. Report what happened and open a claim. This single phone call is what kicks the whole process into gear.

When you're on the phone with your agent, you need to walk away with three specific things:

Your Claim Number: This is the magic number. The repair shop will need it, and so will the rental car company.

Your Daily Rental Limit: This is the most your insurance will pay per day for the rental. It might be something like $40 per day.

The Total Coverage Duration: This is the maximum number of days your policy covers, which is often around 30 days or until your car is fixed—whichever comes first.

Gathering Your Essential Paperwork

Once you have that claim number, it's time to pull together the documents you'll need at the rental counter. Getting this done ahead of time saves you from a lot of frustration later.

To make this super simple, here's a checklist of everything you should have ready. Gathering these items will speed things up and help you avoid any last-minute scrambles.

Your Post-Accident Rental Car Checklist

Document or Info | Why It's Essential | Where to Find It |

|---|---|---|

Valid Driver's License | Required by law and the rental agency to drive. | Your wallet or purse. |

Proof of Insurance | Confirms you have active coverage. | Your glove compartment or a digital version on your phone. |

Insurance Claim Number | The key that links the rental directly to your claim. | From your insurance agent during your first call. |

Credit/Debit Card | Most agencies require a card on file for a security deposit. | Your wallet or purse. |

Having these four things ready to go when you head to the rental office will make the whole experience a lot smoother.

As you can see, that first call to your insurer really is the trigger for everything that follows. It's the most important step you can take.

Pro Tip: When you talk to your insurance agent, ask if they partner with specific rental companies. Many have direct billing arrangements, which is a lifesaver. It means the rental company bills the insurer directly, so you don't have to pay out of pocket and wait to get your money back.

Of course, getting your rental car is just one part of the puzzle. To make sure your entire claim goes smoothly, it helps to know the essential steps to take after a car accident. When you handle the incident correctly from the very beginning, every other step becomes simpler.

Once you have that approval from your insurer, you can find one of our convenient Cars4Go rental locations and book your temporary ride without any more hassle.

Getting to Grips With Rental Car Insurance

Figuring out who's going to pay for your car rental after an accident can feel like a headache you don't need. It really comes down to two options: you can either use your own insurance or go after the at-fault driver's policy.

Going through your own insurance is almost always the faster, smoother path. Your company covers the rental cost upfront and then deals with the other driver's insurer to get their money back. If you try to file directly with the other person’s insurance, you’re stuck waiting for them to officially accept fault, which can drag on for days or even weeks.

What to Do About Coverage Limits and Extra Costs

Most policies put a cap on how much they'll pay per day for a rental. A very common limit is around $35 per day. That's usually enough for a basic sedan, but what if your family car is an SUV and you need something similar?

Let’s imagine your policy maxes out at $35/day, but the only suitable minivan costs $55/day. That $20 daily difference (plus taxes) is on you. You'll settle that extra amount directly with the rental company when you return the car.

Real-World Tip: Before you even think about booking, call your insurance agent. Ask them point-blank about your daily limit and the total number of days covered. A two-minute phone call can save you from a nasty surprise bill later on.

Managing these details is key to keeping your own expenses down. It also helps to learn some effective strategies for dealing with insurance adjusters, since they're the ones who give the final approval on these costs.

Who Actually Insures the Rental Car?

So, you've figured out who's footing the bill. The next big question is, who insures the rental car itself while you're driving it? This is where a lot of people get confused at the rental desk.

More often than not, your personal auto insurance policy’s coverage—liability, comprehensive, and collision—extends to a temporary rental. Basically, if you have full coverage on your own car, the rental is usually protected in the same way.

The best thing you can do is call your agent before you leave home and ask, "Does my personal policy cover a temporary replacement rental?" Their answer will tell you exactly what you need to do next.

Some credit cards also offer rental car insurance, but this is almost always secondary coverage. It’s designed to fill in the gaps, like covering your deductible, after your primary auto insurance has paid out.

Here’s a quick look at your main options:

Your Personal Auto Policy: This is typically your primary source of coverage and mirrors the protection you have for your own vehicle.

Credit Card Benefits: Think of this as a backup plan. It’s great for covering deductibles but won't replace a primary policy.

Collision Damage Waiver (CDW): This is the expensive insurance the rental company pushes at the counter. If your personal policy already covers the rental, paying for a CDW is often just throwing money away.

Knowing your coverage ahead of time gives you the confidence to politely decline the costly daily insurance at the rental counter. It’s one less thing to worry about, and it keeps more money in your pocket.

Choosing the Right Rental Car and Company

Not all rental agencies are the same, and this becomes glaringly obvious when you're dealing with an insurance claim. Picking the right company for your car rental after an accident is the single most important step to avoid headaches, delays, and surprise bills. You need a partner that knows how the insurance system works.

The absolute golden ticket here is direct billing. This is a non-negotiable for me. When a rental company direct-bills, they send the invoice straight to the insurance company. This means you aren’t fronting hundreds of dollars out-of-pocket for the daily rental cost and then crossing your fingers for a reimbursement check. It takes a huge financial weight off your shoulders.

Select a Comparable Vehicle

Here’s a common pitfall: your insurance company will only cover a rental that's "comparable" to your car in the shop. If you drive a Toyota Corolla, they aren't going to spring for a full-size SUV. The smartest move is to stick to a vehicle in the same size and class as your own to stay within your daily coverage limit.

When you call to book, be specific. Don't just ask for a "mid-size." Instead, say, "I need something comparable to my Honda CR-V." This simple phrase sets clear expectations and makes sure the car you get is what your insurer has already approved. To get a feel for what's available, you can check out a full list of available car types from Cars4Go and find a good match.

How to Spot and Avoid Hidden Fees

Even when insurance is paying the bulk of the bill, rental companies have a knack for adding extra charges that can sneak up on you. Knowing what to look for is the best way to protect your wallet.

Be on the lookout for these common culprits:

Airport Surcharges: Renting from an airport location is convenient, but it almost always comes with a stack of extra fees and taxes.

Mileage Limits: Most rentals come with unlimited mileage, but some don't, especially for longer-term or out-of-state rentals. Always confirm.

Fuel Prepayment Plans: This is almost never a good deal. It’s a convenience charge. You'll save money by simply filling up the tank yourself right before you return the car.

Young Driver Fees: If you're under 25, get ready for a hefty daily surcharge. It's an unfortunate industry standard.

Insider Tip: Before you sign anything, look the agent in the eye and ask for a complete breakdown of the estimated charges. A great question is, "Can you confirm which charges, if any—like airport fees or local taxes—are not covered by my insurance?" This puts them on the spot and forces transparency.

One last piece of advice: do a quick Google search for the company's name plus terms like "insurance claim" or "accident rental." You'll quickly see if they have a smooth process or if they're known for creating nightmares for people in your exact situation. A little homework now can save you a world of frustration later.

The Pre-Drive Inspection: Your 10-Minute Shield

Those first ten minutes on the rental lot are easily the most important. Don't be in a rush to just grab the keys and hit the road. This is your one and only chance to document the car's existing condition, and believe me, it can save you hundreds of dollars in bogus damage claims down the line.

Before you even think about putting your bags in the trunk, pull out your smartphone. Fire up the video recorder and take a slow, deliberate walk around the entire car. Get up close and personal with any scratches, dings, or scuffs you see—no matter how tiny they seem.

Here's what I always focus on during my walk-around:

Bumpers and Fenders: These areas are ding magnets. Pay extra attention to the corners.

Door Panels: Look for those classic parking lot dings and scrapes from people opening their doors too wide.

Windshield and Windows: Scan carefully for any chips or cracks. A tiny starburst fracture in the glass is easy to miss but expensive to fix.

Wheels and Rims: Note any curb rash. Scraped-up rims are one of the most common charges.

Once you have your video evidence, head back to the rental agent. Show them every single mark you found and insist that they note it on the official checkout form. Do not drive off that lot until every last scratch is documented in writing. That piece of paper is your get-out-of-jail-free card.

Don't Forget the Basics

While you're hunting for cosmetic flaws, it's easy to forget about the stuff that actually keeps you safe. A proper inspection for your car rental after an accident isn't just about avoiding fees; it’s about making sure the car is roadworthy.

You don't need to be a mechanic. This is just a quick check for obvious problems that could put you in a dangerous situation. It takes two minutes, tops.

Your goal is simple: return the car in the exact same condition you got it. A timestamped video and a checkout form with every pre-existing ding noted are your best defense against any arguments at drop-off.

Quick Safety and Functionality Tests

Run through this quick-fire list before you leave the parking spot.

Eyeball the Tires: Do any of them look low? A quick visual is usually enough to spot a tire that's losing air.

Test the Wipers: Flip them on. You don't want to find out they're shot in the middle of a surprise rainstorm.

Check All the Lights: Turn on the headlights and test your turn signals. You can usually see the reflection of the brake lights in a window or another car, but don't be shy about asking the agent to help you check them.

Taking these steps is more critical than ever. The rental industry is seeing a spike in damage claims, often because modern cars have complex sensors and cameras that make even minor bumps incredibly expensive to fix. If you want to dive deeper, you can read about the latest trends in rental car damage claims to see why this inspection is so important.

A few minutes of diligence here ensures your temporary ride is safe and that you're completely covered financially.

Keeping Your Rental on Track and Returning It Hassle-Free

You’ve got the keys to your rental, and it feels like the biggest hurdle is behind you. But staying on top of the rental period is just as important to avoid surprise bills when it's all over. The single most unpredictable part of this process is your car's repair timeline, which makes communication your best friend.

Make it a habit to check in with your insurance adjuster and the body shop regularly. If the shop discovers more damage and tells you they’ll need another week, your next call should be to your adjuster. Don't wait until your rental is due back to ask for more time.

Know the Rules of the Road (in Your Rental Agreement)

Before you get too comfortable, take a few minutes to actually read the rental agreement. I know, it's boring, but these contracts have specific rules that can come back to bite you if you aren't paying attention. Breaking them can lead to extra fees or even void your insurance coverage.

Here are a couple of common gotchas to look out for:

Additional Drivers: Thinking of letting your partner or a friend drive? Make sure they are officially listed on the rental contract. If an unlisted driver gets into an accident, you could be on the hook for everything.

Geographical Limits: Don't assume you can take the car anywhere. If you’re planning a trip, double-check if the agreement allows you to drive out of state. Some policies have strict boundaries or mileage caps that can trip you up.

Key Takeaway: The second you hear about a repair delay, call your insurance adjuster. Being proactive is the best way to get your rental extension approved and avoid paying for extra days yourself.

Ignoring these rules isn't worth the risk. Imagine an unlisted friend has a minor fender bender—suddenly, you could be personally liable for all the damages because both your personal insurance and the rental company’s protection might refuse to cover it.

Your Checklist for a Smooth Return

Returning the car should be a simple sign-off, not a debate over unexpected charges. A little bit of prep work can save you a massive headache and ensure the rental experience ends cleanly.

Your main goal is to hand the keys back with no loose ends. A few simple steps will protect you from those frustrating charges that show up on your credit card statement weeks later.

Here’s what I always do before returning a rental:

Fill Up the Tank: Most policies require you to return the car with the same fuel level you started with. Find a gas station close to the rental office, top it off, and hang on to that receipt. It’s your proof.

Do a Final Sweep: Seriously, check everywhere for your stuff. Glove box, center console, door pockets, under the seats, and especially the trunk. Phone chargers and sunglasses are the usual suspects.

Get a Signed Receipt: This is the most important step. Don't just drop the keys and run. Ask an employee to inspect the vehicle with you present and sign a final receipt confirming it was returned damage-free and with the right amount of fuel. This piece of paper is your ultimate defense against any future claims.

Got Questions About Your Post-Accident Rental? We've Got Answers

Even with a perfect game plan, a few curveballs are almost guaranteed when you're trying to get a rental car after an accident. Getting ahead of these common questions can save you a ton of headaches and keep things moving smoothly.

Let's dive into some of the most frequent concerns drivers have and give you the straightforward answers you need.

What if My Car Repairs Take Longer Than My Insurance Covers?

This is a big one, and it causes a lot of stress. Most insurance policies cap rental reimbursement at around 30 days. If the body shop is still working on your car after that, the daily rental cost usually lands back on your shoulders.

As soon as you hear about a repair delay, get on the phone with your insurance adjuster. Don't wait. If the delay is something you can't control—like a part on backorder—they might be willing to approve an extension. If not, your next best move is to ask the rental company about swapping into a more budget-friendly car to cut down on what you'll owe.

Expert Tip: Stay ahead of the problem. If you wait until your last day of coverage to call your adjuster about a delay, you'll have a much harder time getting an extension. Early communication is everything.

Can I Upgrade My Rental to a Nicer Car?

Absolutely! Just know that you'll be footing the bill for the difference. Your insurance company’s job is to cover a "comparable" vehicle to yours, and only up to your daily policy limit.

Let's say your policy covers $40 per day for a mid-size sedan, but you've got your eye on a luxury SUV that runs $70 per day. You’ll be responsible for that extra $30 per day, plus taxes. You'll typically settle this extra cost directly with the rental agency when you return the car.

What if the At-Fault Driver's Insurance Is Dragging Its Feet?

This is easily one of the most frustrating parts of the whole process. The other driver’s insurance company won't approve a rental for you until they've finished their investigation and officially accepted liability. This can take time.

Your best option here is to use your own collision policy's rental coverage if you have it. Your insurance company will pay for the rental and then go after the at-fault party’s insurer to get their money back (a process called subrogation). If you don't have that coverage, you might have to pay out-of-pocket and fight for reimbursement later, which can be a long and challenging battle.

Does My Personal Car Insurance Cover Me When I Rent a Car Abroad?

Planning an international trip? This is a crucial detail to check. The short answer is almost always no. A standard auto policy from the U.S. or Canada typically won't cover you in a rental car in Mexico, Europe, or most other countries.

Your game plan should be to purchase insurance directly from the rental company overseas. It’s always smart to call your agent and confirm your policy's geographical limits before you travel to avoid any nasty surprises. For more insider tips, check out some of our other Cars4Go blog articles—being prepared is your best defense.

When you need a simple, reliable car rental after an accident, Cars4Go Rent A Car is here to get you back on the road. We work with many insurance companies on direct billing and have a great selection of vehicles ready to go. Book your car without the hassle at https://www.cars4go.com.

Comments