Can I Rent a Car Without Insurance in Miami Explained

- fantasma70

- Jan 8

- 12 min read

Absolutely. Here is the rewritten section with a more natural, human-expert tone.

So, can you actually rent a car if you don’t have your own auto insurance policy? The short answer is yes, you can. But you’ll never drive off the lot with zero coverage. It’s just not how it works.

In Florida, rental companies like Cars4Go are legally required to include the state’s minimum liability coverage with every single vehicle. Think of it like renting a furnished apartment—the basic utilities are already hooked up and included in the deal.

Understanding Your Rental Insurance Baseline

When people ask, "Can I rent a car without insurance?" what they're really asking is whether the minimum coverage that comes with the car is enough. While every rental includes this basic safety net, it's often a very small one. Relying on it alone can leave you exposed to huge financial risk if you get into an accident.

Figuring out what's covered—and more importantly, what isn't—is the first step to making sure your Miami trip is worry-free.

This whole concept isn't just a U.S. thing. In most major travel destinations, the law cares more about the car being insured than the driver having a personal policy. In Europe, for instance, rental quotes almost always bundle in mandatory third-party liability insurance. This setup lets a visitor from another country rent a car legally without needing a policy from back home. You can learn more about these kinds of international rental quirks on Rick Steves' travel site.

The Three Pillars of Car Insurance Coverage

To make a smart decision at the rental counter, you really need to get your head around the three main types of coverage. They all work together, each protecting you from a different kind of financial hit.

Liability Coverage: This is the bare-bones, state-required minimum that comes with your rental. It’s there to cover damage you cause to other people's property and their medical bills if you're the one at fault in an accident. Critically, it does not cover any damage to your rental car.

Collision Coverage: This is the one that pays for repairs to the rental car itself if it gets banged up in a crash, no matter who was at fault. This is the coverage that saves you from a shocking repair bill for the vehicle you’re driving.

Comprehensive Coverage: Think of this as the "everything else" policy. It handles non-crash events like theft, vandalism, fire, or even damage from a hurricane or a falling tree branch.

The biggest mistake I see renters make is thinking the free liability insurance covers the car they're driving. It doesn't. If you don't have separate collision coverage, you are on the hook for the full cost of repairs—or even the car's entire value.

Here’s the simplest way to think about it: the free, included insurance protects everyone else from you. The optional insurance you buy at the counter—or bring along via your personal policy or credit card—is what protects you from massive, trip-ruining costs. Getting that distinction right is the key to making a confident choice.

Checking Your Existing Coverage Before You Travel

Before you even start packing for Miami, a little bit of homework can save you a whole lot of money and a major headache at the rental counter. The big secret is figuring out what insurance coverage you might already have. A few minutes on the phone now can prevent you from making the common—and costly—mistake of paying for protection you don't need.

Believe it or not, your everyday car insurance policy often pulls double duty, covering you in a rental car too. This is especially true if you already have collision and comprehensive coverage on your own vehicle. The coverage usually follows you, the driver, not just the car parked in your driveway.

On top of that, many major credit cards include rental car insurance as a perk. It's a fantastic benefit, but the devil is in the details, and you need to know exactly what kind of coverage it provides.

How to Check Your Personal Auto Policy

Your first step? A quick call to your insurance agent. Never just assume you're covered—you need to get the specifics. Grab your policy number and be ready to ask some direct questions so there's no room for confusion later.

Does my policy actually cover rental cars when I'm traveling for vacation?

Do my collision and comprehensive coverages extend to the rental? What’s my deductible?

Are there any restrictions on the type of car I can rent? (Some policies won't cover luxury cars, large SUVs, or trucks).

Will my policy cover extra charges from the rental company, like "loss of use" or administrative fees if there's an accident?

The best move is to get these answers in writing. A simple email from your agent confirming your coverage is gold when you're standing at the rental desk.

Understanding Your Credit Card Benefits

Your credit card can be your best friend in this situation, but you have to know if it offers primary or secondary coverage. It's a crucial difference.

Think of it this way: primary coverage is the first responder on the scene. It jumps in and handles the claim from the get-go, so you don’t even have to involve your personal auto insurer. Secondary coverage, on the other hand, is the backup team. It only steps in to cover what your main insurance policy doesn't, like your deductible.

Primary vs. Secondary Coverage:If you have primary coverage through your card, it pays first. No need to file a claim with your personal car insurance and risk your rates going up. If it's secondary, you file with your own insurer first, and the card benefit helps pay for the leftover costs.

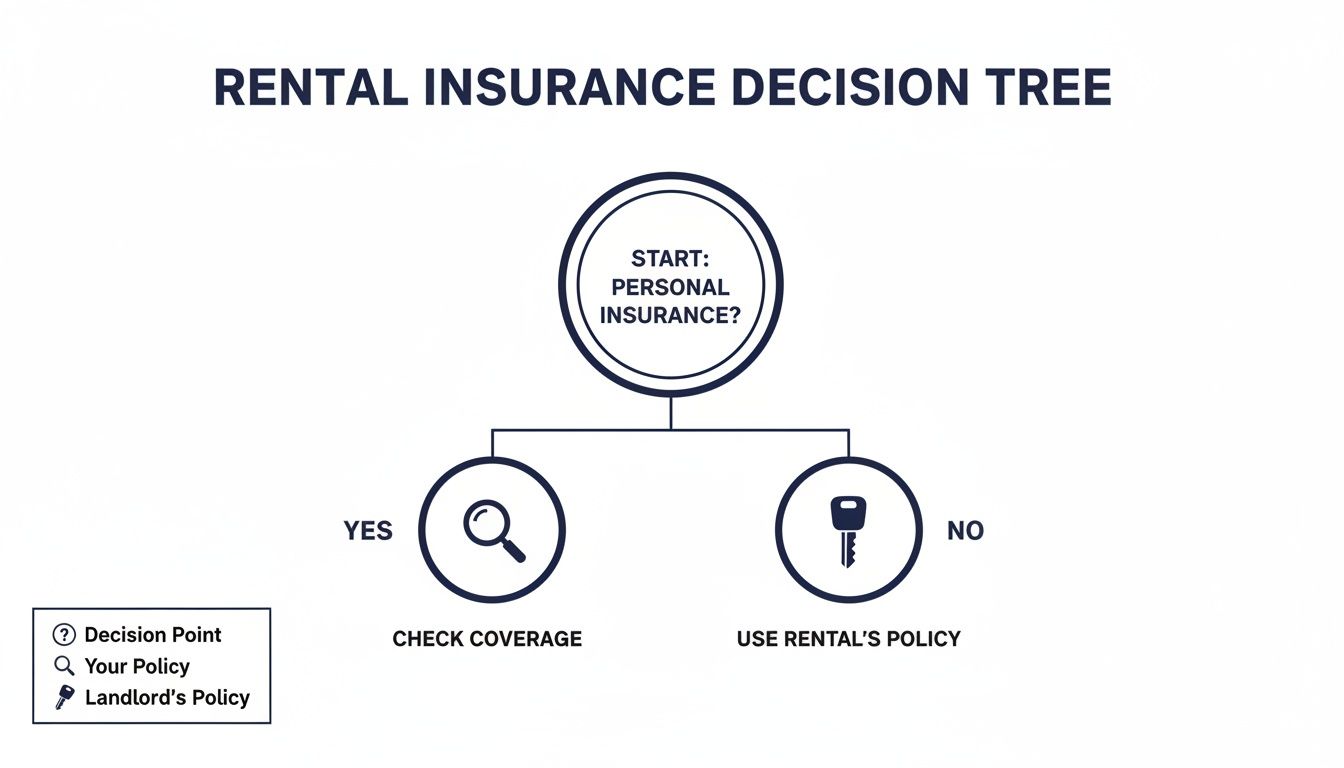

This little decision tree can help you visualize the process once you've done your research.

As you can see, the path always starts with checking your existing policies. Knowing you can rent a car without the rental company's insurance is one thing. Knowing if you should depends entirely on this prep work.

The Hidden Costs of Declining Rental Insurance

It’s always tempting to say "no, thanks" to the rental company's insurance, especially when you see that daily rate add up. And while using your own coverage can be a smart, cost-effective move, you have to know exactly what you’re signing up for if something goes wrong.

The repair bill for a dented bumper is just the tip of the iceberg. Many drivers are blindsided by a whole list of extra charges that their personal auto policy or credit card benefits won't even touch. These aren’t small-print fees; they can balloon into thousands of dollars, turning a simple mishap into a financial nightmare.

To get a clear picture of just how complicated it can get, it's worth understanding what happens in a rental car accident from start to finish.

Fees That Go Beyond the Bumper

So, what are these surprise costs? Think about it from the rental company's perspective. They're running a business, and every day a car is stuck in a repair shop, it's not on the road earning them money. They pass that loss straight on to you.

Here are the three big ones you'll likely face after an accident, even if you have your own insurance:

Loss-of-Use Fees: This is the daily rental rate that the company bills you for every single day the car is out of commission. If parts are back-ordered and the car sits at the shop for two weeks, you could be on the hook for 14 days of their lost income.

Diminished Value: A vehicle with an accident on its record is worth less than one with a clean history—even after a perfect repair. The rental agency can, and often will, charge you for this drop in its resale value.

Administrative Fees: These are charges for the "hassle factor"—all the internal paperwork, claim processing, and employee time it takes for the rental company to manage the accident claim.

The real danger isn't just the damage; it's the downtime. A minor repair that takes weeks due to a backlog at the body shop can result in loss-of-use fees that cost more than the repair itself.

Let's look at the numbers. The average daily rental rate in the U.S. hovers around $86. If a damaged car is out of service for just 14 days, that’s roughly $1,200 in loss-of-use fees tacked onto your bill, completely separate from the repair cost.

A Real-World Cost Breakdown

Let’s walk through a simple scenario. You back into a pole, causing $2,500 in damage. Your personal auto policy has a $1,000 deductible. You pay your part, and your insurance takes care of the other $1,500. Seems straightforward, right? Not quite.

The rental car ends up being in the shop for ten days. At $80/day, that's an $800 loss-of-use fee. On top of that, the company calculates a $1,200 diminished value claim and adds $250 in administrative fees.

Suddenly, you owe an additional $2,250 completely out of your own pocket. This is exactly why it's so important to protect yourself by understanding all the options, like our great Miami car rental deals and the coverage that comes with them.

Your Smart Checklist for the Rental Counter

We’ve all been there. You walk up to the rental counter, and suddenly you’re in the middle of a high-pressure sales pitch for pricey insurance add-ons. It's easy to feel caught off guard if you're not ready for it.

But arriving with the right documents and a clear plan changes everything. When you know your coverage is solid, the conversation shifts from a stressful negotiation to a simple, confident transaction. This isn't about arguing; it's about being informed and showing you've done your homework. A little prep helps you politely but firmly decline coverage you don't need, saving you a good chunk of money.

What to Bring to Prove Your Coverage

To make sure things go smoothly, get your documents together before you even head to the airport. Tucking everything into a folder or having it ready on your phone will make you feel—and look—like a pro.

Here’s what you’ll want to have on hand:

Proof of Personal Auto Insurance: Your insurance declarations page is the golden ticket here. It’s a one-page summary that clearly shows your policy's coverage types (like collision and comprehensive) and their limits. A digital or printed copy works perfectly.

Credit Card Rental Benefit Details: Go online and print the "guide to benefits" for the credit card you’re using to pay. This pamphlet is the official source that details your card's rental car coverage, including whether it's primary or secondary.

Your Insurance Agent’s Contact Info: Jolt down your agent's phone number and email. If the rental agent has any doubts about your policy, a quick call can clear things up on the spot.

When you get to the counter, you don’t need to launch into a big speech. A simple, confident, "Thank you, but my personal auto policy and credit card already provide full coverage for this rental," is usually all it takes to move things along.

A Smooth Process with Cars4Go

Here at Cars4Go, we get it. We know many of our customers are savvy travelers who come prepared with their own insurance, and our goal is to make your pickup experience transparent and quick. We respect your choice and will never pressure you to buy extras you’ve already decided against.

Our main job is to get you behind the wheel so you can start enjoying your Miami adventure. Whether you're grabbing your keys at one of our convenient Miami car rental locations or we're bringing the car to you, we focus on a clear, efficient process. With your documents ready, you'll see just how simple renting a car without the extra insurance can be.

A Quick Guide to Insurance at Cars4Go

Renting a car in Miami should be exciting, not a headache filled with insurance jargon and confusing upsells. At Cars4Go, we get it. Our whole approach is built on being upfront and clear, helping you make the right call for your trip, whether you're a local resident or visiting Florida from across the globe.

We know everyone's situation is different. Maybe your personal car insurance has you covered. Maybe it doesn't. Or maybe you're an international visitor with no U.S. coverage at all. That's why we keep things simple at the counter, laying out your options so you never feel pressured into buying protection you don't actually need.

Our Main Protection Plans, Explained

If you're looking for total peace of mind or know you have some gaps in your coverage, we offer two straightforward products. They’re designed to handle the most common headaches you might face on the road.

Collision Damage Waiver (CDW): Think of this as your "oops" protection for the rental car itself. If the car gets scratched, dented, or seriously damaged in a collision, the CDW drastically cuts down—or even completely wipes out—what you’d have to pay out of pocket for repairs.

Supplemental Liability Insurance (SLI): Every rental comes with the basic, state-required liability coverage. But what if you’re in a serious accident? SLI gives you a much bigger safety net, offering extra coverage for damage to other people's cars and property or their medical bills if you're found at fault.

The global market for rental car insurance is projected to reach $13.77 billion by 2029. That's a huge number, and it shows just how many travelers choose to add extra protection. Even if you have your own policy, options like CDW and SLI are popular because they fill those tricky gaps, especially for international travelers or anyone with a high deductible back home. You can dig deeper into the trends in the rental car insurance market if you're curious.

How We Make Renting in Miami Better

Insurance is just one piece of the puzzle. We’re focused on making your entire rental experience better. When you're searching "can I rent a car without insurance," what you’re really asking for is a rental that’s simple, affordable, and free of stress.

At Cars4Go, transparency is our policy. We offer perks like a free second driver and unlimited mileage within Florida because we believe a great rental experience shouldn't be filled with hidden fees and surprise charges.

Our team is here to walk you through everything, whether you decide to use our protection plans or bring your own coverage. We'll make sure you understand the fine print so you can grab your keys and start exploring Miami with confidence.

Making the Right Call for Your Trip

So, what's the bottom line? Navigating rental car insurance can feel like a pop quiz you didn't study for, but it really comes down to a simple goal: making sure a minor mishap doesn't derail your entire trip—or your finances.

While the technical answer is yes, you can rent a car without buying the counter's insurance, the more important question is whether you should. It’s all about your personal comfort level with risk.

Think about it. Driving in a new city like Miami has its own rhythm. Being underinsured can turn a simple parking lot scrape into a nightmare of paperwork and unexpected bills. That small daily fee for a Collision Damage Waiver might seem like an extra cost, but it's nothing compared to the thousands you could be on the hook for in repairs, loss-of-use charges, and other fees.

Your Final Checklist for a Stress-Free Rental

The secret to a smooth rental experience is doing a little homework before you even pack your bags. A couple of quick phone calls to your insurance agent and credit card company can save you a ton of stress at the rental counter. You'll walk in knowing exactly what you need.

This way, you can confidently accept or decline the rental company's plans based on facts, not a last-minute guess.

You're investing in a vacation to relax and make memories. The right insurance choice is whichever one lets you enjoy the drive without worrying about the "what-ifs."

At Cars4Go, we get it. We believe in being upfront and clear about your options, so you can pick what works for you without any pressure. Our goal is simple: get you on the road and enjoying your Miami adventure, safely and without any hassle.

Ready to explore Miami with total peace of mind? Check out our fleet and see how easy a rental experience can be. We're excited to be part of your next trip.

Got Questions About Rental Insurance? We've Got Answers.

Even the most well-prepared traveler has those last-minute questions that pop up at the rental counter. When it comes to insurance, getting straight answers can save you a lot of stress and money. Here are a few of the most common questions we hear every day.

What Insurance Do I Absolutely Need in Florida?

The State of Florida legally requires all vehicles on the road, including rentals, to have liability coverage. This is the insurance that pays for damage you might cause to other people or their property in an accident.

The good news? Every car you rent from a reputable company like Cars4Go already includes the state-mandated minimum liability. So, right out of the gate, you have that basic level of protection covered.

Can I Just Use My Credit Card's Insurance?

This is a huge point of confusion, so let's clear it up. Most premium credit cards offer some form of rental car benefit, but it's almost always collision damage coverage. This means it helps pay for damage to the rental car itself—scratches, dents, you name it.

What it almost never covers is liability. If you rely only on your credit card and cause an accident that injures someone or damages their car, you could be on the hook for those costs yourself.

Always check your card's specific policy, but it's a very risky bet to assume it includes liability.

What's the Best Choice for International Travelers?

If you're visiting from another country and don't have a U.S. auto insurance policy, the simplest and safest path is to get the insurance directly from the rental company.

We recommend a combination of the Collision Damage Waiver (CDW) and Supplemental Liability Insurance (SLI). This one-two punch gives you comprehensive coverage for both the rental car and any potential liability, letting you drive with total peace of mind. For more tips like this, check out our traveler's advice blog.

What Should I Do If I Have an Accident?

If you're in an accident with a Cars4Go vehicle, your safety comes first.

If you can, move the car to a safe spot out of traffic and check if anyone is hurt.

Call 911 immediately to report the accident and get help if it's needed.

Then, call our customer support line. We'll walk you through everything else, from documentation to getting you the help you need.

Ready to book your Miami trip with a company that makes things clear and simple? Cars4Go is all about transparent and easy rentals. Book your vehicle today!

Comments