Bad Credit Car Rental: Tips to Get Approved & Drive Today

- fantasma70

- Oct 5, 2025

- 14 min read

Having a low credit score can feel like a major roadblock when you need to rent a car, but it's far from a dead end. I've seen countless people in this situation get behind the wheel. The secret isn't some magic trick; it's about knowing the right approach. Forget the standard credit card process—we're talking about using a debit card, finding the right companies, and being prepared.

Why Your Credit Score Can Be a Hurdle

It catches a lot of folks off guard. Why does a car rental company care about your credit history? From their perspective, a low score signals risk. They're worried about getting paid, potential damage to the car, or even theft. It’s their way of gauging if you’re a reliable customer.

To protect their assets, many agencies will run a credit inquiry, which can be a huge barrier for a surprising number of people. In fact, about 20% of U.S. consumers run into trouble renting a car simply because their score is below 600. For them, the result is often a demand for a massive security deposit or an outright rejection. You can dig into some of the industry statistics to see just how common this is.

Understanding the Credit Check Process

When you try to rent, particularly with a debit card, the company often runs a "soft" credit check. The good news is this type of inquiry doesn't ding your credit score. It just gives them a quick look at your financial standing. If they see a pattern of late payments or a lot of debt, it can make them nervous.

At the end of the day, all they want is to know you can cover the rental and any other potential charges—like an extra day, a tank of gas, or a traffic ticket. That's why they strongly prefer credit cards; it gives them an easy way to charge you for any extras that might pop up.

Your Rental Options with a Low Credit Score

Even if your credit isn't stellar, you absolutely have options. The game plan is to pivot from relying on your credit score to offering a different kind of financial assurance.

To make things simpler, here’s a quick look at the most common ways to get a rental with less-than-perfect credit.

Your Rental Options with a Low Credit Score

Rental Method | Primary Requirement | Common Challenge |

|---|---|---|

Using a Debit Card | Enough cash for the rental + a sizable security deposit | Bigger security holds and more rigorous ID verification |

Prepaid Car Rental | Paying for the entire rental in advance | Less flexible if plans change; you might still need a deposit |

Finding No-Credit-Check Agencies | Seeking out smaller, local, or specialized rental outfits | The car selection might be older and they have fewer locations |

Using a Co-signer | Finding someone with good credit to rent in their name | They must be present at pickup and are fully responsible |

The most important thing to remember is that preparation is everything. Knowing a company's policies on debit cards, security deposits, and identification before you even walk in the door can turn a potential 'no' into a 'yes'.

Walking up to the counter with this knowledge changes the whole dynamic. You're no longer just hoping they'll approve you based on your credit. Instead, you're focused on meeting their other requirements, showing the rental agent that you're a responsible and well-prepared customer. That confidence can make all the difference.

Get Your Paperwork in Order to Avoid Rejection

Walking into a rental agency unprepared is one of the quickest ways to get turned away, especially when you're trying to rent a car with bad credit. Your best tool in this situation isn't a high credit score—it's having all your paperwork perfectly organized and ready to go. This preparation shows you're reliable and serious.

Think of it like building a case for yourself. You're presenting undeniable proof that you are who you say you are and can be trusted with their vehicle. Your goal is to make it as easy as possible for the agent to say "yes" by leaving no room for doubt.

Your Essential Document Checklist

Besides your driver's license and a way to pay, a few other documents can make all the difference. Having these in hand can easily turn a potential "no" into a "yes."

Valid Driver's License: This one is absolutely non-negotiable. Make sure your license isn't expired, damaged, or suspended. It's a good idea to confirm your driving privileges are in good standing by reviewing resources on understanding the basics of license suspension.

Proof of Address: Grab a recent utility bill (like gas, electric, or water) or a bank statement from the last 30-60 days. It needs to clearly show your name and current address. This simple piece of paper confirms where you live and adds a layer of stability to your application.

Proof of Income: A recent pay stub can be a real game-changer. It shows the rental company you have a steady income and can actually cover the costs. This can be especially persuasive if a manager is on the fence about approving your rental.

Personal Auto Insurance: If you have your own car, bring your insurance card or the policy's declaration page. Showing you already have coverage significantly lowers the rental company's risk, and sometimes, it can even help you get a lower security deposit.

Having these documents ready shows you're organized and proactive. It signals to the rental agent that you've thought ahead and are prepared to address their concerns, which can heavily influence their decision.

Why This Extra Effort Matters

With a high-limit credit card and a good score, a license and the card are usually all you need. But when you're renting with bad credit or using a debit card, the agency automatically views the transaction as higher risk. Each extra document you provide helps chip away at that perception.

A utility bill proves you have roots in the local area. A pay stub shows you have the money to pay your bills. Your own insurance policy demonstrates financial responsibility. All together, these documents paint a picture of a trustworthy customer, no matter what a credit report might say.

For more helpful guides on navigating these kinds of situations, feel free to check out our other posts on the Cars4Go blog. Taking these extra steps is your best bet for driving off the lot with the keys in your hand.

Navigating Debit Card Holds and Deposits

For a lot of people trying to rent a car with bad credit, the biggest roadblock is often the payment method. While credit cards are the gold standard for rental companies, they're not the only game in town. Using a debit card is a totally possible alternative, but it comes with its own set of rules you'll want to know about before you get to the counter.

The first thing to get straight is the debit card hold. This isn't like a hold on a credit card. When a rental agency puts a hold on your debit card, they are literally freezing that money right out of your checking account. You can't touch it until they release the hold, which can take several days—sometimes even a week—after you've already brought the car back.

Understanding the Security Deposit

So, why the hold? From the rental company's point of view, someone using a debit card is a slightly bigger risk. Without a credit line to cover potential issues, they use this hold as a security deposit for things like a late return, forgetting to fill up the gas tank, or any dings and scratches.

Because of this, you should be prepared for a much higher security deposit than you'd see with a credit card. A typical hold might be the total estimated rental cost plus an extra $200 to $500. Let that sink in: if your rental costs $300, you might need to have $800 or more of available cash in your account just to pick up the keys.

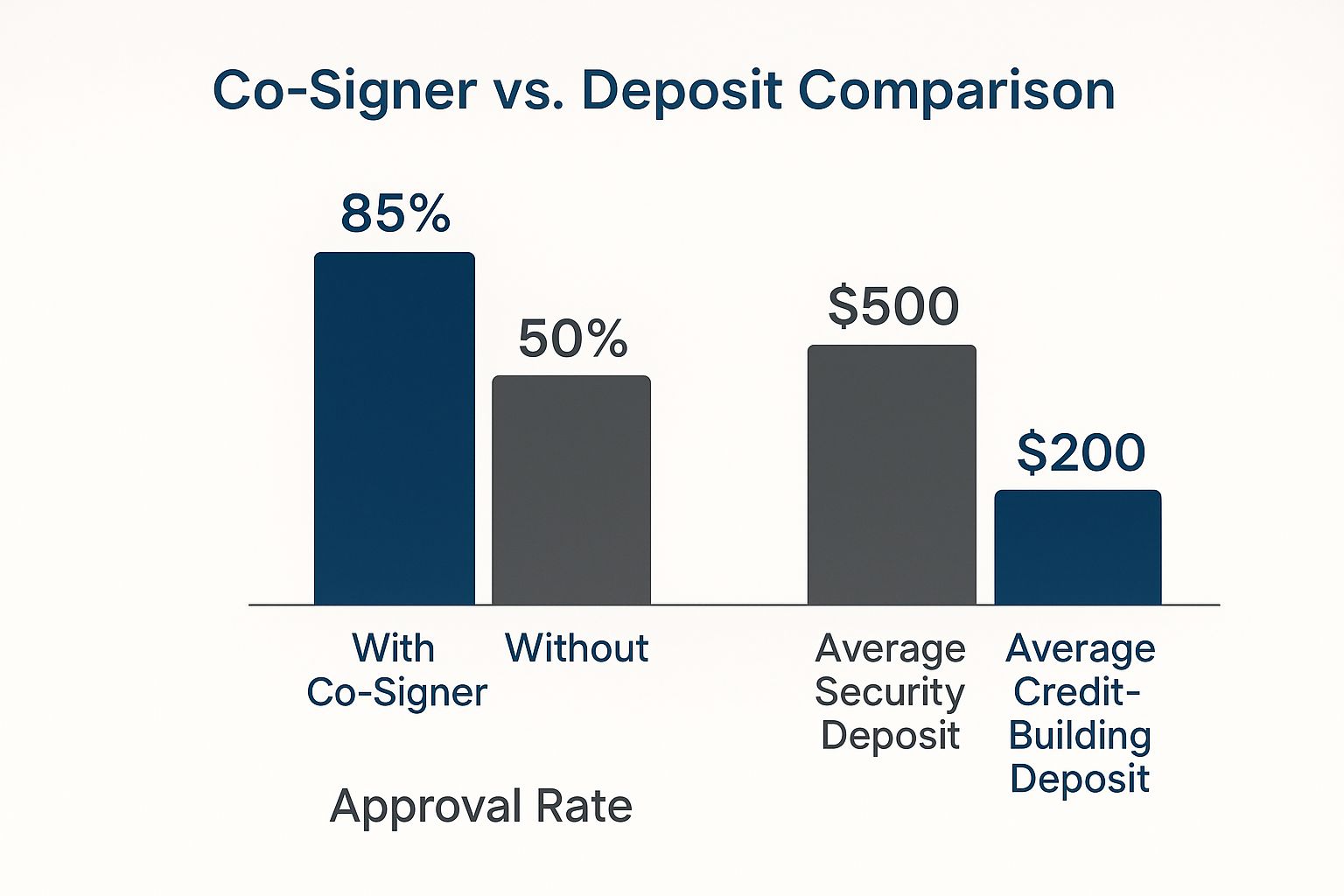

This is where having a plan B, like a credit-building program or a co-signer, can make a huge difference.

As you can see, renting with a debit card is doable, but it requires having more cash on hand. Options like bringing a co-signer can dramatically improve your chances of getting approved without tying up so much of your money.

How Rental Market Trends Affect You

This cash crunch is only made tougher by the rising costs of renting a car. In the U.S., the average daily rental rate shot up from $76 in 2019 to around $90 in 2022—that's an 18.4% jump. If you're using a debit card, that means the rental itself costs more, and the security hold tied to that cost also gets bigger. It can really stretch a tight budget. You can dig into more of these market trends and their impact on consumers to see the bigger picture.

Pro Tip: Always call the specific rental location you plan to use and ask what their exact debit card hold amount is. Don't just trust the website. Policies can and do change from one branch to another, and you don't want any surprises.

Finding Companies That Work With Debit Cards

Not every rental company treats debit cards the same. Some are more flexible than others, but even the friendly ones will have some pretty firm rules you'll need to follow.

To give you an idea of the landscape, here’s a quick look at what the major players generally require for debit card rentals.

Debit Card Policies at Major Rental Companies

Rental Company | Accepts Debit Cards? | Common Requirements |

|---|---|---|

Enterprise | Yes, at most locations | Often requires a recent utility bill and paystub. Non-airport locations are typically more flexible. |

Hertz | Yes, with restrictions | Requires a credit check at the counter. Must be at least 25. May require proof of a round-trip flight. |

Avis | Yes, with restrictions | Usually requires a credit check. Limited to certain car classes. Proof of return travel often needed at airport locations. |

Budget | Yes, with restrictions | Similar to Avis, a credit check is common. Additional ID like a utility bill may be requested. |

Thrifty | Yes, with restrictions | Strict requirements, often including proof of a return ticket and a credit check at the counter. |

These policies are a good starting point, but they can vary. The key is always to call ahead and confirm.

Beyond the credit checks, you'll often run into other hoops to jump through. Common ones include:

Proof of Travel: If you’re renting from an airport, they'll almost always ask to see your return flight itinerary.

Age Restrictions: Most major brands will not rent to anyone under 25 with a debit card. Exceptions are extremely rare.

Extra ID: Be ready with more than just your driver's license. They'll often ask for a recent utility bill or bank statement with an address that matches your license.

The secret to successfully renting with a debit card is just being prepared. Know the rules, have your documents ready, and most importantly, make sure you have enough money in your account to cover both the rental and that hefty security hold.

How to Find a Car Rental That Works With Bad Credit

When you're trying to rent a car with a less-than-perfect credit score, the rules of the game change. Not every rental agency plays by the same book. The real trick is knowing exactly where to look and what to ask. Forget the big-name airport counters for a moment; your best bet is often found in more flexible, local spots.

The massive national chains are usually locked into rigid corporate policies. To them, your credit history is just a data point. What you need is a place where a real conversation can actually make a difference.

Look Beyond the Airport

Here’s a pro tip: start by looking away from the airport. Those airport rental locations are a whole different world. They’re built for business travelers and vacationers who flash corporate cards or have stellar credit, and their policies reflect that. There’s really no incentive for them to bend the rules.

Off-airport branches, on the other hand, are a much better bet. They typically serve the local community—people whose cars are in the shop or who just need a vehicle for a weekend trip. I've found these neighborhood spots are often far more willing to work with customers using debit cards or those with shaky credit. Take some time to explore different off-airport car rental locations and see what's available near you.

Embrace Smaller, Local Agencies

Never underestimate the small, independent rental agencies in your town. Unlike the corporate giants, these local businesses have more wiggle room. A manager at a neighborhood shop often has the authority to make a judgment call based on your paperwork and a simple chat, not just a cold credit score.

These smaller outfits thrive on their local reputation and repeat customers. They're usually more concerned with your current ability to pay than what happened with your finances a few years ago. You’d be surprised how far a friendly phone call to explain your situation can get you.

Don't be afraid to pick up the phone. A five-minute call can save you hours of online searching and frustration. Ask directly, "What's your policy for renting with a debit card?" or "Do you run a credit check on every renter?" Getting a straight answer upfront is everything.

Check Out Long-Term Rental Specialists

Another great option is to look into companies that specialize in long-term or monthly rentals. Their business is designed for people who don't fit the typical rental mold, like someone relocating for a new job or waiting for a car repair.

Because you’re renting for a longer period, their approval process often focuses more on things like proof of steady income and where you live, rather than just pulling your credit. They're just more accustomed to handling diverse financial situations.

Questions to Ask Before You Book

When you call a potential rental company, having a few key questions ready shows them you’re serious and helps you avoid any nasty surprises at the counter.

Here's what you should ask:

Debit Card Policy: "Do you accept debit cards, and what are the specific requirements if I use one?"

Security Deposit: "How much is the security hold for a debit card rental, and how long does it take to get it back?"

Credit Check: "I'm curious about your process—will you perform a soft or a hard credit check?"

Required Documents: "Other than my driver's license, what else should I bring? A utility bill? A recent pay stub?"

By targeting the right kind of agencies and knowing what to ask, you instantly boost your chances. You stop being just another application and become a prepared customer they want to work with.

Creative Alternatives When Traditional Car Rentals Say No

If you’re tired of hitting a brick wall with the big rental agencies, it’s probably time to think outside the box. A low credit score can feel like a roadblock, but thankfully, the traditional rental counter isn't the only game in town. There are plenty of other services with different rules that don't hinge everything on your credit history.

One of the best options out there is a peer-to-peer (P2P) car-sharing platform. You've probably heard of services like Turo—they're basically the Airbnb for cars. Instead of dealing with a huge corporation, you're just renting a car from a local person. This completely sidesteps the usual approval headaches.

Why Peer-to-Peer Car Sharing is a Game Changer

P2P platforms generally don't bother with old-school credit checks. Their main concern is verifying your identity, making sure you have a valid driver's license, and checking that you have a decent driving record. They use their own methods to figure out risk, which is great news if you're looking for a bad credit car rental.

No Hard Credit Pulls: Most of these services skip the credit check entirely. They care more about who you are and how you drive.

More Interesting Cars: You can find anything from a simple commuter car to a fun convertible, often for less than you'd pay at a big agency. Check out the different types of cars available to get an idea of what's out there.

No Hidden Fees: What you see is usually what you get. The pricing is upfront, and insurance options are explained clearly when you book.

This puts you in a much better position. You can get a car based on your merits as a driver, not on financial mistakes you might have made years ago.

What About Car Subscription Services?

Here's another great option, especially if you need a vehicle for more than just a few days. Car subscription services are becoming more popular, offering an all-in-one monthly package that covers the car, insurance, and even maintenance. It’s like a super-flexible lease without the scary long-term contract and tough credit requirements.

Car subscription services are all about convenience and flexibility. They're usually more interested in your current income and ability to make the monthly payment than in your FICO score.

Your Local Car Dealership Might Surprise You

Last but not least, don't write off your local car dealerships. It's not something they all advertise, but some dealerships have their own rental or loaner car programs. Because these are often handled right there at the dealership, the manager has more leeway. They might be more willing to work with a local resident who can show a steady job and a local address. It's a long shot sometimes, but it can be a real hidden gem when you've run out of other options.

Frequently Asked Questions About Renting a Car with Bad Credit

Trying to rent a car when your credit isn't perfect can feel like navigating a minefield of questions. Getting straight answers is the best way to feel confident and avoid surprises at the rental counter. Let's break down some of the most common things people worry about when looking for a bad credit car rental.

A big one that comes up all the time is whether a credit check is an absolute must. The short answer is no, but it’s definitely common.

Do All Car Rental Companies Run a Credit Check?

Not every single one does, but it's pretty standard practice for the big players, especially at airport locations or if you're paying with a debit card. You'll find that major brands like Hertz and Avis often run a soft credit inquiry. It won't ding your credit score, but it does give them a quick snapshot of your financial responsibility.

So, how do you get around it? Your best bet is to steer clear of the airport counters and look for off-airport branches or smaller, independent rental agencies. These places are often much more flexible and may skip the credit check altogether.

The smartest thing you can do is simply call the specific location you plan to rent from ahead of time. Ask them directly what their policy is for customers using a debit card. This one phone call can save you a world of headache and last-minute panic.

Can I Rent a Car Under 25 with a Debit Card?

This is a tough spot to be in, but it's not always a dead end. Renting a car when you’re under 25 already involves extra fees and hoops to jump through. When you add a debit card into the equation, your options get even slimmer.

Most of the major rental companies have a strict policy against renting to drivers under 25 with a debit card. For the few that might be willing to bend the rules, you'll need to come prepared with extra documentation, like:

Proof of your own full-coverage car insurance that extends to rentals.

A verified return travel itinerary, such as a round-trip plane ticket.

Your options will be seriously limited here, so it's absolutely crucial to call around to different locations and confirm their policies before you book.

How Much Is the Security Hold on a Debit Card?

Plan for the security hold on a debit card to be significantly higher than what they'd ask for with a credit card. This isn't just a small fee; it's a hefty chunk of money that will be frozen in your bank account.

Expect the hold to be the total estimated cost of the rental plus an extra security deposit, which usually falls somewhere between $200 and $500. Remember, you won't be able to access this money for your entire rental period, and it can take several business days after you return the car for the hold to be released.

Are There Companies That Guarantee No Credit Check?

You won't find a major national brand that can "guarantee" a no-credit-check rental across the board. Company policies can change and often vary from one franchise to the next. However, some companies are known for being more lenient.

Your best shot at avoiding a credit check is to look into local, independent rental businesses or franchises like Rent-A-Wreck, which built their business model on being more flexible.

Another fantastic route to explore is peer-to-peer car-sharing platforms like Turo. They skip traditional credit checks completely, using their own internal systems to verify your identity and risk level. This makes them a really solid alternative for a lot of renters.

No matter your credit situation, Cars4Go Rent A Car believes in providing clear, upfront service without the hassle. We offer flexible payment options and transparent pricing to get you on the road in Miami. Book your next rental with us at https://www.cars4go.com.

Comments