A Simple Guide to Auto Rental Insurance

- fantasma70

- Jan 16

- 13 min read

Think of rental car insurance as a temporary safety net. It's a suite of optional coverages offered at the rental counter, designed to protect you from the financial fallout of everything from a small ding to a major accident.

Getting a handle on these options before you're standing at the counter can save you a ton of money and stress.

Understanding Your Rental Insurance Options

The rental counter can feel like a high-pressure sales environment, especially when they start throwing around acronyms. But let's demystify it. These aren't just confusing upsells; they're specific tools for managing different kinds of risk.

Let's break down the four main types you’ll almost always be offered.

Collision and Loss Damage Waivers (CDW/LDW)

First up is the most common one: the Collision Damage Waiver (CDW), which is often bundled into a broader Loss Damage Waiver (LDW). This isn't technically "insurance" in the traditional sense. It's simpler than that.

It's an agreement where the rental company promises not to come after you for the cost if their car is damaged or stolen while you have it.

Imagine you return the car and there's a new dent in the bumper. Without an LDW, you could be on the hook for the full repair cost, plus administrative fees and even the revenue the company loses while the car is in the shop. With an LDW, you walk away clean.

The LDW is your primary shield against a massive repair bill for a car you don't even own. It shifts the financial risk for the vehicle itself from you back to the rental company.

To help you get a quick overview, here’s a simple table summarizing the main types of rental coverage.

Rental Insurance Coverage at a Glance

Coverage Type | What It Covers | Primary Use Case |

|---|---|---|

CDW / LDW | Damage to or theft of the rental car itself. | To avoid paying for repairs or replacement of the rental vehicle. |

Liability | Damage to other people's property and their medical bills. | To protect you financially if you cause an accident injuring others. |

Personal Accident | Medical expenses for you and your passengers after an accident. | To supplement your existing health insurance or cover out-of-pocket costs. |

Personal Effects | Theft of your personal belongings from the rental car. | To cover the loss of items like laptops, luggage, or cameras. |

This table gives you the basics, but let's dive a little deeper into the other three common options.

Liability Insurance

Okay, so the LDW covers the rental car. But what about the other car? Or other people's property? Or, most importantly, other people? That’s where liability insurance steps in.

This protects you from claims if you’re at fault for an accident that damages property or injures someone. To get a real sense of its importance, it's helpful to understand liability insurance coverage and the protection it offers.

Most states legally require a minimum amount of liability coverage, which rental companies usually include. However, the supplemental policies they sell offer much, much higher protection limits, which can be critical in a serious accident.

Personal Accident and Effects Coverage

These last two options are all about protecting you, your passengers, and your stuff.

Personal Accident Insurance (PAI): This provides medical, ambulance, and death benefits for you and your passengers if you're in an accident. It's designed to fill the gaps your personal health insurance might have, like high deductibles or copays.

Personal Effects Coverage (PEC): This insures your personal belongings if they are stolen from the rental car. If a thief breaks in and snags your laptop or luggage, PEC helps you cover the cost of replacing them, up to a certain limit.

Checking Your Existing Coverage Before You Rent

Ever feel that pressure at the rental counter? The agent slides a form over, asking you to accept or decline their insurance, and you have no idea what to do. You’re not alone. Many people end up paying for coverage they don't actually need, just because they haven't checked the policies they already have.

A few minutes of homework before your trip can save you a surprising amount of money and give you real peace of mind.

The first place to look is your own personal auto insurance. For most standard U.S. policies, the coverage you have for your own car—liability, collision, the works—often extends to a rental car. Your insurer usually sees the rental as a temporary substitute for your daily driver, so they cover it the same way.

But—and this is a big but—there are always exceptions. This courtesy typically doesn't apply to business travel, renting a car in another country, or certain vehicles like big cargo vans or that flashy luxury sports car. It pays to know for sure.

Taking a Look at Your Personal Auto Policy

Insurance documents can be a bit of a snoozefest, but you only need to look for a couple of key phrases. Scan your policy for terms like "substitute vehicle" or "temporary vehicle" to see how—or if—your coverage transfers over. Keep an eye out for any exclusions that could leave you exposed.

Honestly, the fastest way to get a straight answer is to just call your insurance agent. Ask them point-blank: "Does my policy cover rental cars, and what are my limits and deductibles?" That one quick call can clear up all the confusion.

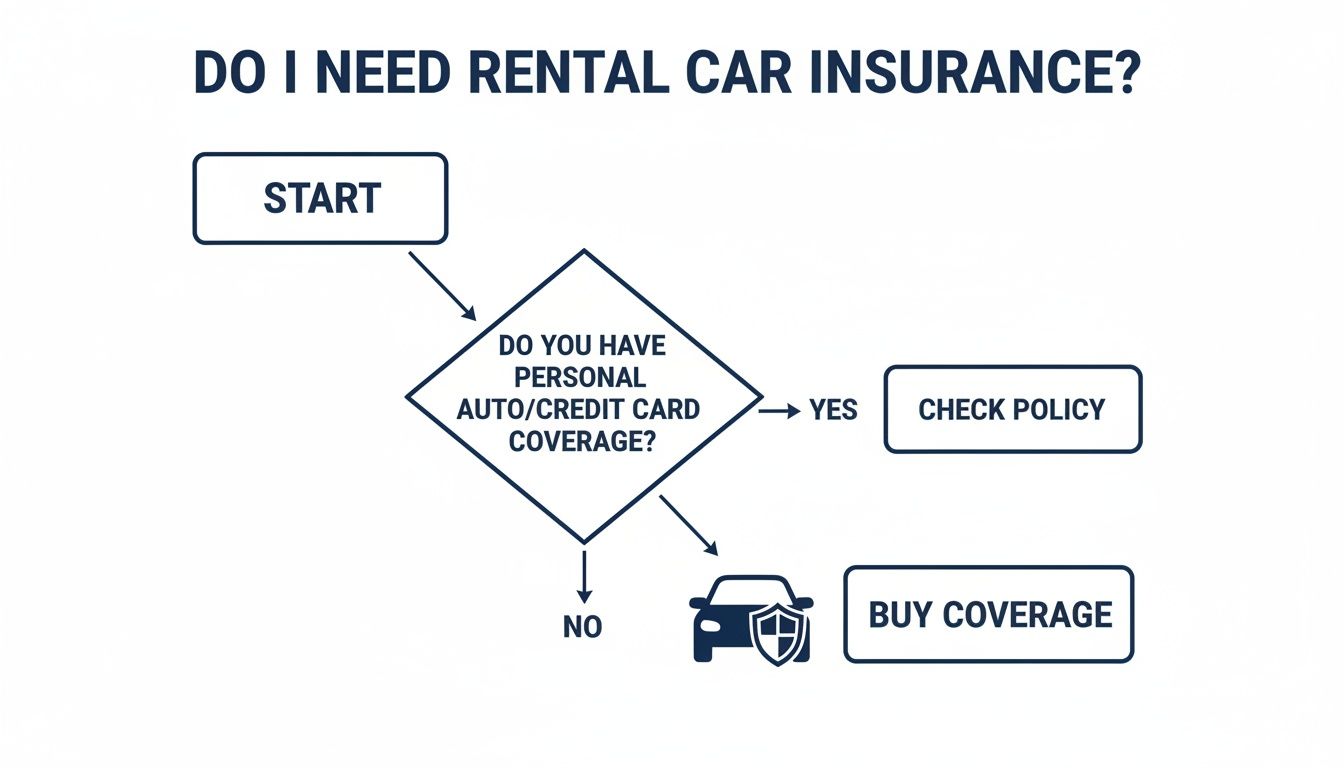

This simple decision tree can help you map out your thought process.

As you can see, the first move is always to figure out what you're already working with before you buy anything extra.

Uncovering Your Credit Card Benefits

You might be holding another key to rental car coverage right in your wallet. Many major credit cards offer rental car insurance as a built-in perk, but you have to understand the fine print to use it correctly.

The most important thing to know is whether the coverage is primary or secondary.

Primary Coverage: This is the best-case scenario. It acts as your first line of defense, kicking in before your personal auto insurance. That means you likely won't have to file a claim with your own insurer or pay your personal deductible if something happens.

Secondary Coverage: This is more of a backup plan. It only covers costs after your personal auto policy has paid out. It’s great for things like covering your deductible, but it still means you have to go through your own insurance company first.

To activate this benefit, you absolutely must use that specific credit card to book and pay for the entire rental. Don't just assume you're covered. Call the number on the back of your card and get answers to these crucial questions:

Is the coverage primary or secondary? This is the most important question.

What's the maximum coverage amount? Make sure it's high enough to cover the full value of the car you're renting.

Are any vehicles excluded? Most cards won't cover exotic cars, large passenger vans, or moving trucks.

Are there any location restrictions? Some cards exclude coverage in countries like Ireland, Israel, or Jamaica.

What's the time limit? Coverage often caps out for rentals lasting more than 15 to 30 consecutive days.

By checking these two sources—your auto policy and your credit card—you can walk up to that rental counter with confidence. You'll know exactly what protection you have, where the gaps are, and whether you truly need to buy anything extra.

How to Choose the Right Coverage for Your Trip

Figuring out the right rental insurance isn’t about finding a single "best" option—it's about finding the best option for you. The right coverage depends entirely on your specific trip. Think of it like packing for a vacation; you wouldn't pack the same things for a business conference as you would for a week at the beach.

By understanding your travel style, you can pick the protection that makes sense without paying for things you don't need. Let’s walk through a few common scenarios to see what this looks like in the real world.

The Leisure Traveler

Let's say you're heading to Miami for a week of sun. Your plans involve hitting South Beach, checking out the Art Deco architecture, and maybe a road trip down to the Keys. When you’re on vacation, the last thing you want is stress.

You’ll be driving in an unfamiliar city, navigating different traffic patterns and tight parking spots. A solid plan that includes a Loss Damage Waiver (LDW) and strong liability coverage is usually the way to go. This combo covers you for damage to the rental car and for any costs if you’re at fault in an accident. With leisure travelers driving the market—which was valued at USD 141.6 billion and is still growing—it's clear that peace of mind is a top priority. You can dig into the growth of the car rental industry on gminsights.com for more details.

Leisure Traveler Tip: Don't let a simple fender bender derail your whole vacation. Choosing the rental company's primary coverage often means you have a zero deductible and don't have to get your personal insurance involved. It keeps things simple and stress-free.

The Business Traveler

Now, imagine you're flying into that same city for a few days of client meetings. Your company might have a corporate policy that covers rental cars, but you absolutely have to check first. It's common for personal auto policies and credit cards to have exclusions for business-related travel.

For anyone traveling for work, liability insurance is the most critical piece of the puzzle. If you're in an accident on company time, the potential financial fallout is significantly higher. Make sure your liability limits are high enough to protect both you and your employer. You might be able to decline the LDW if your corporate credit card provides primary coverage, but always, always verify the fine print before you get to the counter.

The International Visitor

If you’re visiting the United States from another country, rental insurance can feel like a whole different language. Your car insurance from back home almost certainly won't cover you here, and you probably don't have a U.S.-based credit card with rental perks.

For international visitors, the simplest and safest route is almost always to buy a full insurance package directly from the rental company. It’s the most straightforward way to make sure you’re meeting all the legal driving requirements and are completely protected without any confusion over jurisdiction. You'll get a bundle with the LDW, liability, and other key protections all in one clear plan.

The Family Vacation

When you’re traveling with kids, you’ve got more to think about than just the car. You're protecting your family. The vehicle you pick from our lineup of family-friendly vehicle types will probably be loaded with luggage, car seats, and all the gear that comes with a family trip.

This is where those extra coverages really start to make sense:

Personal Accident Insurance (PAI): This is a great supplement to your regular health insurance, helping cover medical bills for everyone in the car if there's an accident.

Personal Effects Coverage (PEC): This covers your stuff—laptops, tablets, luggage—if it gets stolen from the car. It’s a very real risk when you’re parked at a tourist spot.

For a family, the small extra cost for PAI and PEC adds a huge layer of security. It’s about making sure your whole family, and your valuables, are covered.

Navigating the Rental Counter with Confidence

We’ve all been there. You get to the rental counter, tired from your flight, and suddenly you’re in a high-pressure sales pitch. It’s easy to feel flustered and second-guess your insurance decisions. But a little bit of prep work can transform this moment from stressful to straightforward. The trick is to walk in with a plan and your paperwork ready to go.

Before you even head to one of our convenient car rental locations, do yourself a favor: print out proof of your coverage. If you’re using your personal auto policy, have a copy of the declarations page. If it’s your credit card, print the benefits guide. Showing up with these documents instantly signals to the agent that you've done your research.

Your Script for Declining Unnecessary Coverage

When the agent starts explaining the insurance options, you don't need to give a long, detailed reason for declining. A simple, polite, and firm response is all it takes.

Try one of these:

"Thank you, but my personal auto policy already has me covered."

"I appreciate the offer, but my credit card provides the primary coverage I need."

"No thanks, I'll be declining all the optional insurance today."

On the flip side, if you do decide to accept a specific auto rental insurance like the Loss Damage Waiver, it’s just as important to ask a couple of key questions. This helps avoid any nasty surprises down the road.

Always ask the agent to confirm the total daily rate with your chosen insurance before you sign anything. A simple question like, "Okay, so what will my total charge per day be, including this waiver and all taxes and fees?" clears up any confusion.

Another smart question to ask is, "What is the deductible for this coverage?" Just because you buy their insurance doesn't always mean you're 100% off the hook. Some rental company policies still have a deductible, and you need to know exactly what you’d be responsible for if something happens.

Performing a Thorough Vehicle Inspection

This is the last, and arguably most important, step before you drive away. A thorough vehicle inspection is your best defense against being blamed (and charged) for damage you didn't cause. Your smartphone is your best friend here.

Do a slow walk-around. Look at every panel, bumper, and mirror for scratches, dings, or dents. Take your time.

Photograph any damage. Get a close-up of the scuff or dent, then take a wider shot to show its location on the car.

Check the windshield. Look closely for any chips or cracks. Even a tiny star can spread quickly.

Inspect the interior. Note any burns, tears in the upholstery, or major stains.

Get it in writing. Before you leave the lot, make sure a rental agent has noted every single thing you found on the official rental agreement. Don’t drive off until it's documented.

Following this simple playbook puts you in the driver's seat, both literally and figuratively. You’ll leave the rental counter feeling confident and in control, free to focus on the trip ahead instead of worrying about surprise charges later.

Making Rental Insurance Easy

Let's be honest: rental car insurance can feel like a pop quiz you didn't study for. But it absolutely doesn't have to be a source of stress or confusion. A good rental experience starts with putting you, the customer, first—and that means clarity, not complexity.

It all boils down to transparent pricing. You shouldn't have to deal with aggressive upselling or confusing jargon at the rental counter. The goal is to feel informed and in control of your decisions, not pressured into buying something you don't understand or need.

Finding a Partner, Not a Salesperson

Imagine having your rental car delivered right to your hotel or airport terminal. This gives you a calm, relaxed space to look over the paperwork and make insurance choices at your own pace, without a queue of people tapping their feet behind you. That's the kind of service that puts you in the driver's seat.

A rental company that genuinely cares will take the time to walk you through your options. They'll have staff who can patiently explain the different types of coverage, helping you match the right protection to your specific travel plans. It's about education, not just a transaction.

This customer-first approach is more important than ever. The global rental car insurance market was valued at USD 10.59 billion and is expected to reach USD 13.77 billion by 2029. As the market grows, you have more choices, so it pays to find a company committed to clear communication. You can discover more insights about the rental insurance market on researchandmarkets.com.

Think of the right rental partner as a helpful guide, not a high-pressure salesperson. Their only goal should be to help you feel confident that you're properly protected without spending a penny more than you need to.

When you choose a company that prioritizes your peace of mind, the whole insurance conversation becomes a simple, hassle-free step. It lets you focus on the real reason you're renting a car: to get out and enjoy your trip.

You'll see this commitment to clarity firsthand when you explore our current rental deals. We build transparent pricing into every single offer, ensuring your experience is smooth from the moment you book to the moment you hand back the keys.

Common Questions About Auto Rental Insurance

Even after you've done all your homework, a few questions always seem to pop up right at the rental counter. Let’s tackle some of the most common ones head-on, so you can feel completely confident in your choices.

Think of this as the final checklist before you grab the keys. Getting these answers straight can be the difference between a great trip and a really stressful one.

What Happens If I Have an Accident After Declining Insurance?

This is the big one. If you say "no" to the rental company's coverage and don't have another solid plan, you're on the hook for the car's full value.

That means paying for repairs, administrative fees, and even "loss-of-use" charges—money the company loses while the car is in the shop. You’re also liable for any damage you cause to other cars or property.

Your personal auto policy might step in, but you'll still have to cough up your deductible and deal with filing a claim. If you were banking on your credit card, get ready for a detailed and often slow claims process.

Declining coverage without a confirmed backup is a major financial gamble. And beyond insurance, it's smart to know the essential steps and legal guidance after an accident to make sure you handle everything correctly.

Are LDW and CDW the Same Thing?

You'll hear these terms thrown around a lot, and while they sound similar, there’s a small but important difference.

A Collision Damage Waiver (CDW) typically covers just that—damage to your rental car from a collision.

A Loss Damage Waiver (LDW) is the more comprehensive option. It includes everything the CDW covers but also protects you if the car is stolen, vandalized, or damaged in a non-collision event (like a hailstorm).

These days, most rental companies offer the broader LDW. Just to be safe, always ask the agent to clarify exactly what their waiver includes before you sign anything.

Does My Health Insurance Cover Accident Injuries?

Yes, your personal health insurance is usually your primary medical coverage after an accident, but it works the same way it always does. You’re still responsible for your deductibles, co-pays, and any other out-of-pocket costs.

This is where Personal Accident Insurance (PAI) from the rental company comes in. It’s designed to fill in the gaps left by your health plan.

Here’s how PAI helps:

Covers Your Deductible: It can pay for the out-of-pocket costs your own health insurance requires you to cover first.

Protects Your Passengers: It provides benefits for passengers in your rental car, who might not be covered under your policy.

Pays for the Ambulance: PAI often includes coverage for ambulance fees, which can get surprisingly expensive.

This makes PAI a really good idea for anyone with a high-deductible health plan or for international travelers whose home insurance might not cover them in the U.S.

Think of PAI as a financial cushion for medical costs. It’s designed to minimize the immediate financial impact of an accident, letting you focus on recovery instead of worrying about unexpected medical bills.

Can I Use a Debit Card for Rental Insurance?

While you can often rent a car with a debit card, it comes with a big catch: you’ll almost certainly lose any auto rental insurance benefits offered by your credit card. One of the main rules for credit card coverage is that the entire rental has to be paid for with that specific credit card.

If you opt for a debit card, that credit card safety net vanishes. In that situation, it's strongly recommended that you buy the Loss Damage Waiver (LDW) directly from the rental company to make sure you’re not left exposed.

At Cars4Go Rent A Car, our goal is to make every part of your rental, including the insurance, straightforward and stress-free. Our team is always ready to walk you through your options so you can drive off with complete peace of mind. Check out our great rates and book your Miami rental today at https://www.cars4go.com.

Comments